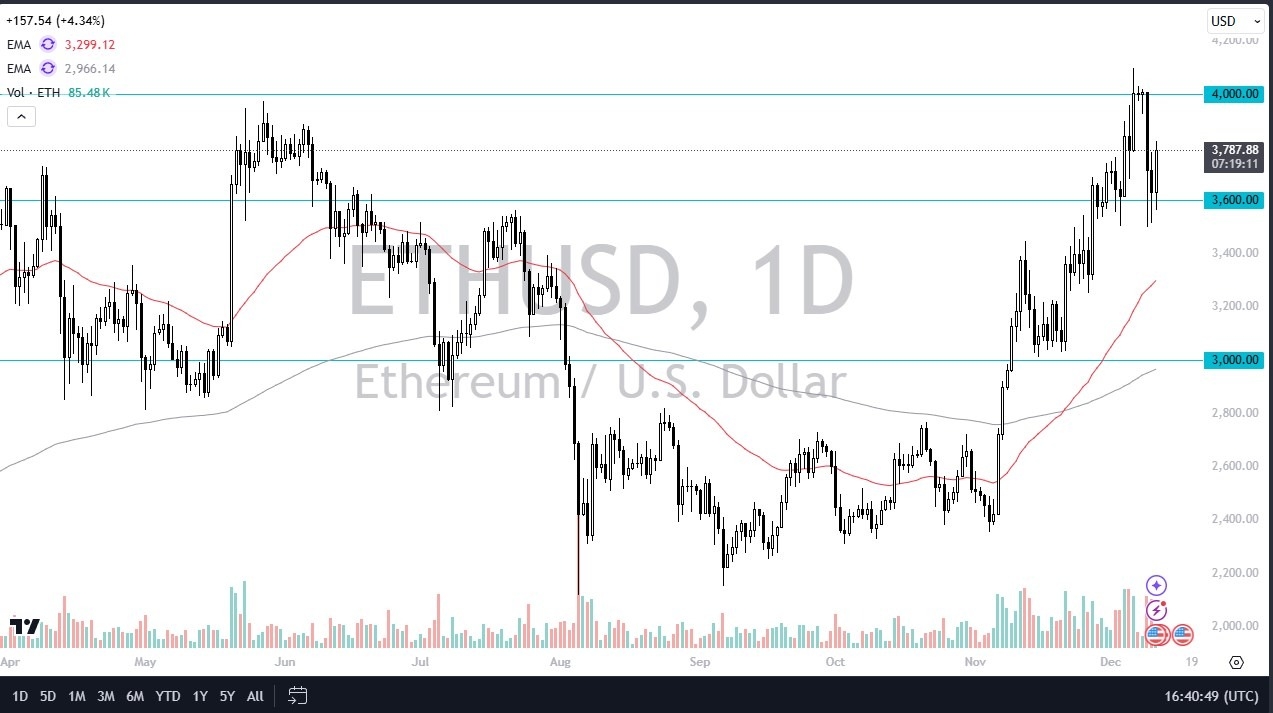

- During my daily analysis of the crypto markets, the Ethereum market has captured my attention because we have bounced from a very obvious support level that will have almost certainly attracted a lot of attention from other traders around the world.

- Furthermore, we also need to keep in mind that the Bitcoin market has rallied, so I think you’ve got a situation where Ethereum is just simply following.

- This is the typical correlation that we see over time, so it’s not a huge surprise.

Much like Bitcoin, Ethereum is in an uptrend, but it’s also in a short-term consolidation phase after rallying quite viciously. Also, like Bitcoin, there is a very significant and obvious resistance barrier above that is acting like a ceiling for the market. In this case, it’s the $4000 level, but in the case of Bitcoin it’s the $100,000 level. If Bitcoin can break to the upside for a longer-term move, then Ethereum will almost certainly follow right along.

Top Forex Brokers

Goal Analysis

The technical analysis for Ethereum is very positive, but I also anticipate that we will probably bounce around between the $3600 level, and the $4000 level above. If we were to break down below the $3500 level, then we probably will pull back to test the 50 Day EMA. On the other hand, if we can break above the $4100 level, then I suspect that Ethereum will continue to go much higher, perhaps trying to reach the $4400 level before it is all said and done, based upon the “measured move” of the consolidation that we are currently experiencing.

Nonetheless, it’s very important pay attention to Bitcoin, because as Bitcoin goes, so goes the rest of the digital coin markets. While Ethereum is extraordinarily important, the reality is that everybody pays close attention to Bitcoin for their cues. That being said, there’s also something else that can have a major influence on Ethereum is the fact that many of the so-called “altcoins” out there operate on top of the Ethereum ecosystem, so if we start to see a lot of those rally again, that will drive up the momentum for Ethereum itself.

Ready to trade our Ethereum forecast? We’ve shortlisted the best MT4 crypto brokers in the industry for you.