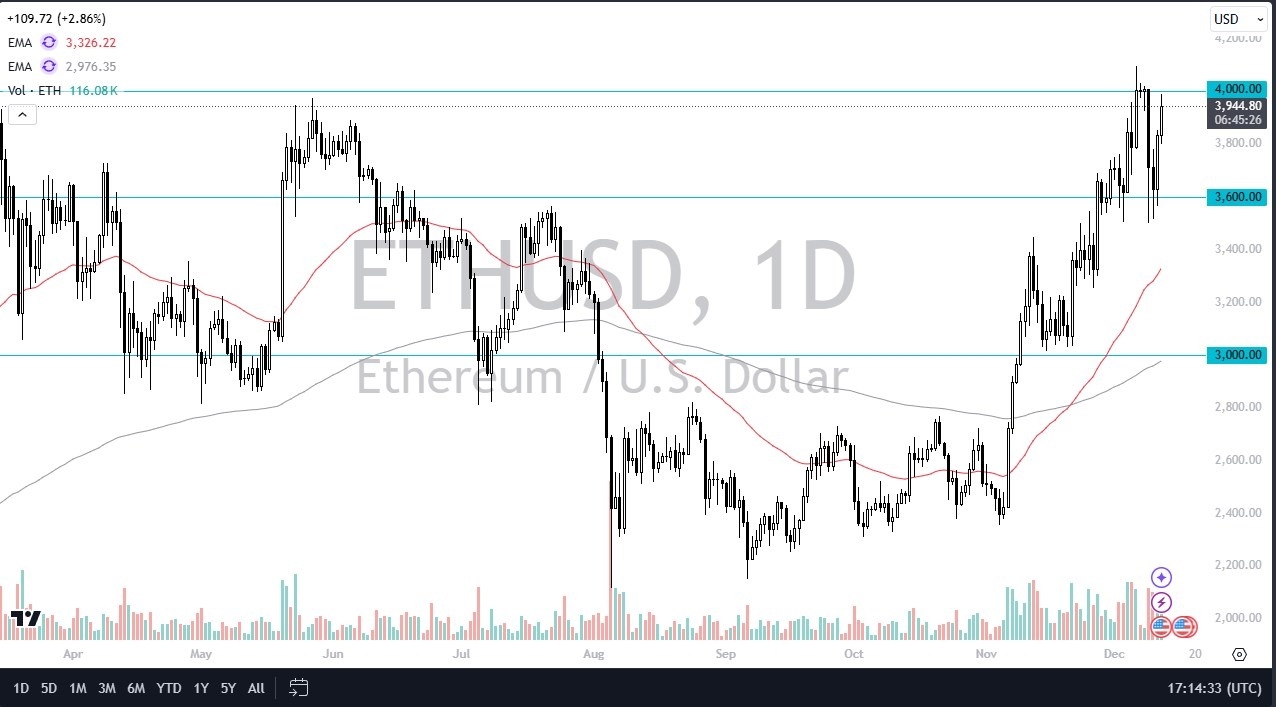

- Ethereum's had a good day on Thursday rallying about 3%, but more importantly, threatening that crucial $4,000 level.

- $4,000 is a large round psychologically significant figure.

- In this case, more importantly, near the all-time highs back earlier this year.

So, the question is, now can we break out? I think the answer is simple. I think it's a two-part answer. Number one, yes, momentum is still with Ethereum, but the other part of the answer is probably in the form of a question. What exactly is Bitcoin going to do? If it breaks out to the upside, it will drag Ethereum with it. That's been the correlation for ages, and I don’t see that changing anytime soon, as the markets are creatures of habit.

Top Forex Brokers

Ethereum Has Been Bullish for Some Time

Furthermore, you have to keep in mind that Ethereum has been very bullish for some time anyway, so that might just be the excuse to go higher. I recognize that Ethereum is not Bitcoin. It's a little bit different animal, but it does tend to follow the correlation, a lot like gold and silver will do in the precious metals markets. There are small coins that jump on the Ethereum ecosystem and as more crypto projects get added and pick up a little bit of popularity, that also helps Ethereum, especially with transactions on DeFi in such cases which I imagine without looking at chain on analytics are probably flying at this point with the way most crypto is behaving. So, with this, it looks like the Ethereum market is going to continue to be more or less a buy on the dip scenario with a heavy emphasis near the $3,600 level, maybe $3,500 for significant support.

The market will continue to wait for momentum, but it appears that we are getting closer and closer to this happening. I remain bullish, but recognize we need to see “value” as an offering for me to get aggressive at this point in time.

Ready to trade our Ethereum forecast? We’ve shortlisted the best MT4 crypto brokers in the industry for you.