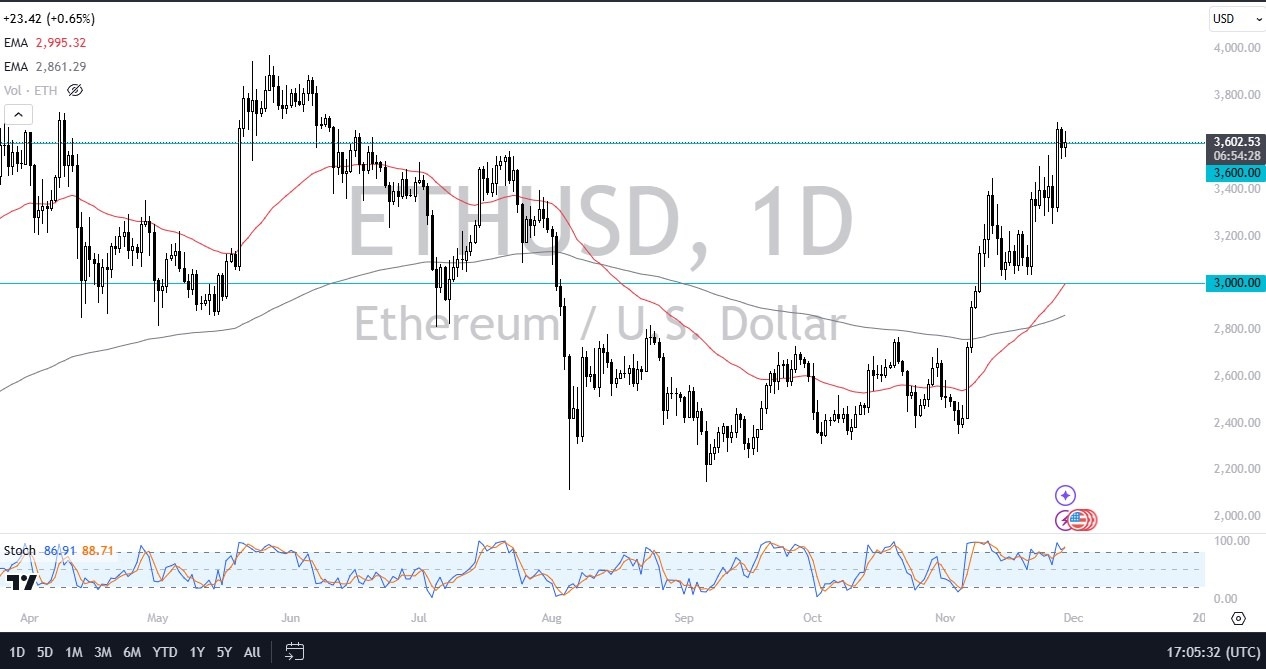

- Ethereum has gone back and forth during the trading session on Friday as we continue to hang around the crucial $3,600 level.

- This is an area that's been resistant more than once, so it's a bit interesting to find that the market is hanging out here.

- But I also recognize that Ethereum is essentially following Bitcoin.

- Bitcoin's doing everything it can to rally enough to break above the $100,000 level. This area will be the biggest headline of the day if and when it happens.

As Goes BTC, So Goes ETH

Top Forex Brokers

So, I think two things will happen: Bitcoin will break $100,000 while Ethereum breaks above the $3,600 level. If we do break out to the upside, then the $4,000 level comes into the picture, and you need to pay close attention to it. On the other hand, if we drop from here, the $3,300 level is pretty significant support followed by the massively important $3,000 level. Anything below this level would have me concerned.

Everybody's excited about crypto now that the Americans have elected the Donald Trump administration because they are more crypto friendly. Keep in mind that alternative coins out there are humming right along and most of them use the Ethereum ecosystem. So that has an effect here as well. It looks like a very bullish market to me, but I also like the idea of buying pullback so I can find a little bit of value.

You can have a little bit of space to build up momentum to finally break out. If we break down from here, then I will watch the crucial $3,300 level and then again, the $3,000 level. If we were to turn around and break down below the $3,000 level, I suspect you'd see Bitcoin falling pretty drastically as well as everything becoming somewhat interlocked.

Ready to trade our Ethereum forecast? We’ve shortlisted the best MT4 crypto brokers in the industry for you.