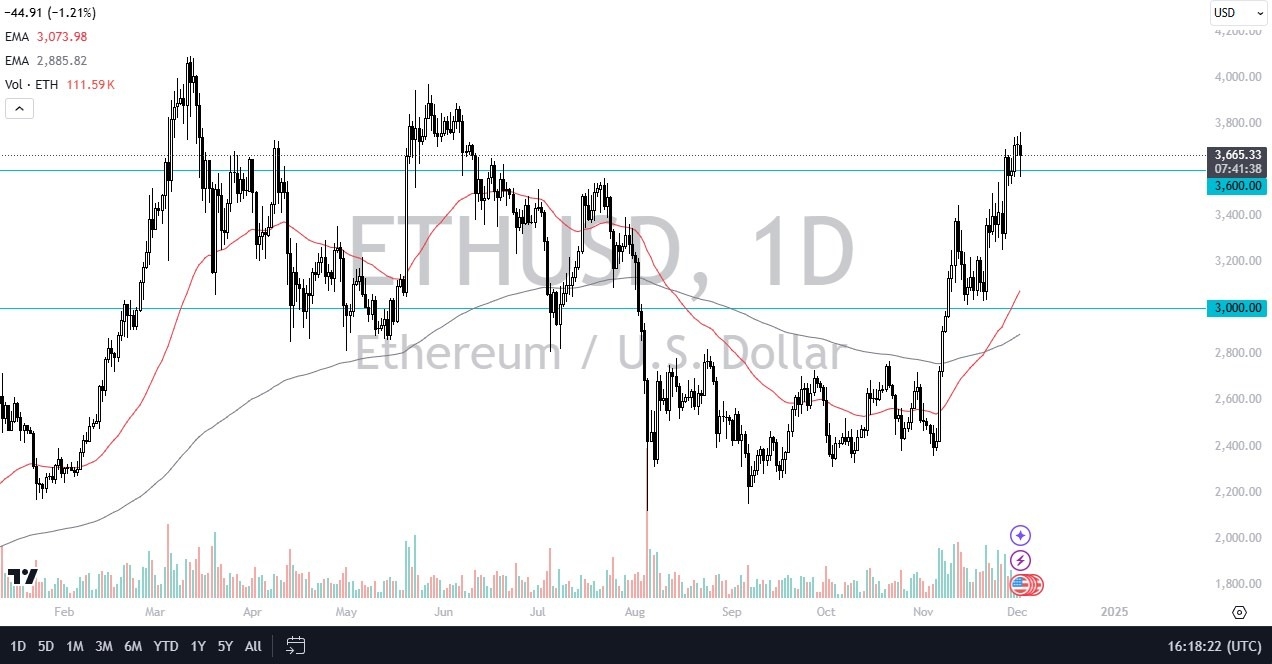

- During my daily analysis of the cryptocurrency markets, the Ethereum market has caught my attention, because we initially did try to rally, only to give back gains and drop to the $3600 level.

- This is an area that’s been important multiple times, and it is an area that I have mentioned a few times here recently, and the fact that we managed to break above it and now are sitting just above it with potential support showing at this level.

- I think you get a situation where traders are trying to build up the necessary momentum to go higher.

Linked with Bitcoin

Keep in mind that any move higher is probably going to be linked with a move in Bitcoin. Keep in mind that this is a market that has been playing “2nd fiddle” to the Bitcoin market, so if Bitcoin starts to take off again, then it probably drags Ethereum right along with it. Furthermore, you have to pay close attention to the “altcoins” as well, because most of them are sitting on the Ethereum ecosystem, driving up demand if they do in fact become more active. We have seen several do exactly this, so it most certainly is something that we need to pay attention to as well.

All of this being said, the market is very bullish over the last several weeks, and I think we’ve got a situation where traders are trying to get back to the $4000 level, an area that obviously would be psychologically important, and have some resistance built into it not only from the psychological standpoint, but the fact that it had previously been a swing high region. If we were to break down, then you have the 50 Day EMA sitting right around the $3000 level. The $3000 level of course is an area that has shown itself to be important recently, as well as in the past. You can also make an argument for the $3250 region, as it offered short-term support in the past. Either way, I don’t have any interest in trying to short Ethereum one way or the other right now.

Ready to trade Ethereum? Here are the best MT4 crypto brokers to choose from.