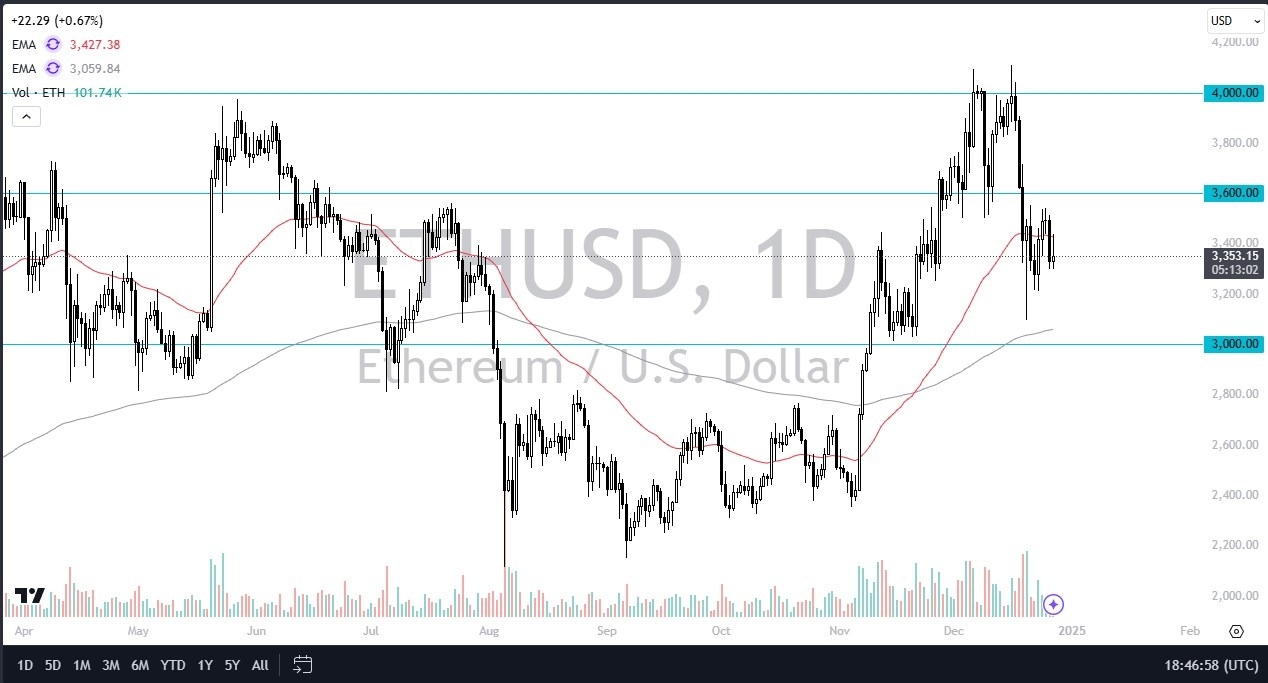

- In my daily analysis of the crypto markets, Ethereum captures my attention because we have just seen a typical technical analysis move play out.

- The market initially tried to rally during the trading session on Friday but found the area near the $3400 level to be a bit too much, and we pull back from there, showing signs of hesitation at a large, round, psychologically significant figure.

Beyond that, we also have the 50 Day EMA in the same vicinity, and we have been consolidating in this general vicinity for a couple of weeks now anyway. Recently, we plunged from the $4000 level, and now it looks like we are trying to do everything we can to find our footing. We are about halfway between the 50 Day EMA and the 200 Day EMA indicators, an area that typically causes some type of reaction. It is because of this that I’m paying close attention to Ethereum, because it could be a mover sooner or later.

Top Forex Brokers

Volume Matters

The volume in the markets right now is anemic, as we are between Christmas and New Year’s Day. Despite the fact that crypto trades nonstop, the reality is that the institutions or not there, and therefore it does change the dynamic of the market. It now falls on the shoulders of retail traders and gamblers, meaning that we could see sudden and erratic moves, but I don’t know if we see anything that has any real follow-through over the next couple of sessions.

While I am bullish of Ethereum overall, I recognize that it will also need help from Bitcoin, which has had its own problems as of late. In other words, we need Bitcoin to really get going to the upside and perhaps take out the $100,000 level for Ethereum to start attracting lot of bullish behavior as well. I don’t necessarily want to call the top of the crypto market right now, but it would not surprise me at all if we ended up being somewhat near the top of the cycle, because the rhetoric online is getting ridiculous again. This is almost always the first sign that there’s trouble ahead.

Ready to trade ETH/USD? Here’s a list of some of the best crypto brokers to check out.