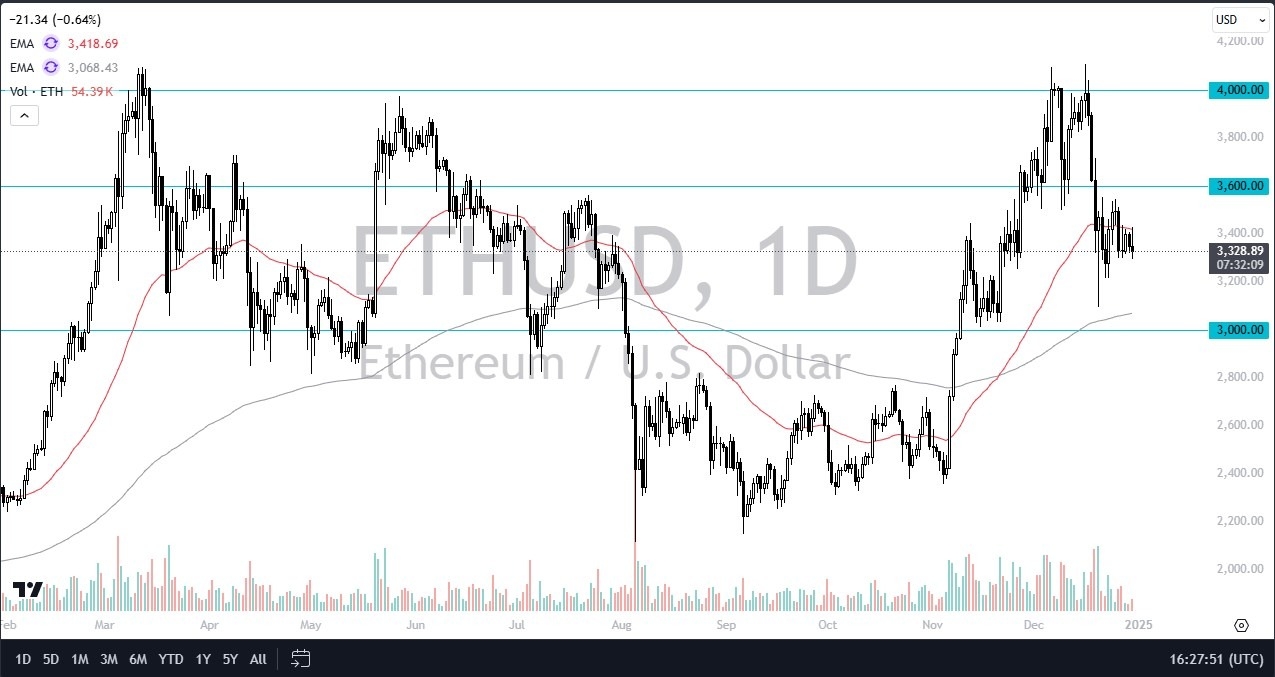

- Ethereum has gone back and forth during the trading session here on Monday, as we continue to dance around just below the 50 day EMA.

- This is a market that I think continues to see the $3,400 level as a bit of a magnet, if you will, of price.

- This is a market that if we do drop from here then the 200 day EMA comes into the picture as it sits just above $3,000.

If we turn around and brink above the $3,600 level, then I think the market goes looking to the $4,000 level. Ethereum needs Bitcoin to help it because that's where people go first is Bitcoin. If Bitcoin starts to rally, then people start to look to Ethereum to play that peripherally.

Top Forex Brokers

Remember, there's the old adage that Bitcoin is gold and Ethereum is silver. So, we'll have to wait and see how that plays out. Interest rates in America do continue to climb and that does work against most digital and risk appetite-based assets. So that's part of what we're seeing, but we're also seeing a lack of volume. It's almost New Year's. So really there's no point in institutional traders at least getting very aggressive at this point. I think things are kind of quiet for a minute here.

I Still See the 200 Day EMA as Important

But I do look at the 200 day EMA as a major floor in this market, at least as things stand right now. Probably a lot of sideways action is what you can expect over the next week or two, before we start to see liquidity strengthen and momentum pick back up in the market.

Ready to trade Ethereum? Here are the best MT4 crypto brokers to choose from.