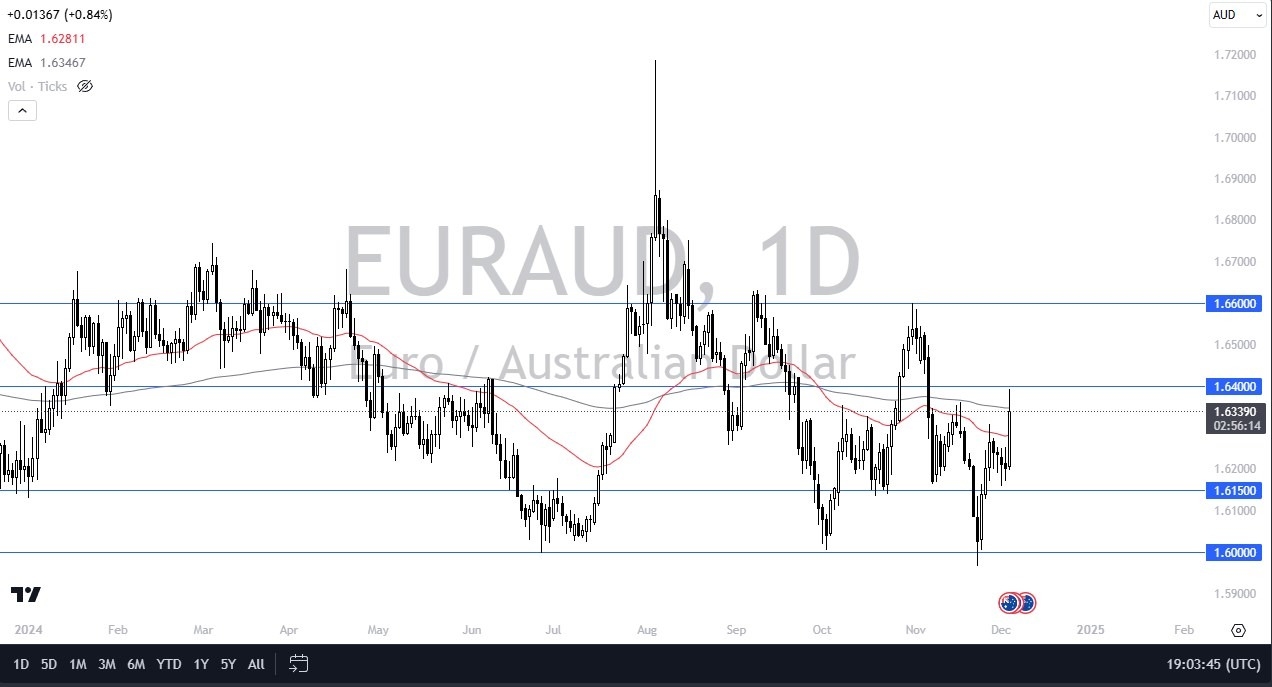

- The euro shot higher against the Aussie during the trading session gaining almost 1%, but did give back a little bit of the gains once we reached the crucial 1.64 level.

- The 1.64 level has been important multiple times over the long term. So, it's not a huge surprise to see a little bit of market memory in that area, especially as we've seen so much momentum in the early hours.

- That being said, we are resting right around the 200 day EMA. So, it'll be interesting to see if we can continue.

- At this point, I think the most obvious signal would be if the euro broke above the 1.64 level against the Australian dollar. And that does make a certain amount of sense that it could happen. After all, the Australians reported over than anticipated GDP number overnight.

Top Forex Brokers

Momentum Needed

With this being the case, I think you've got a situation where a little bit of momentum might send this market towards the 1.66 level, which is resistance as well. When you look at this market through the prism of the last year or so, we've been bouncing around in maybe three areas, and we just touched one. So that makes a certain amount of sense. With this being said, keep an eye on the Australian dollar against the US dollar because at this point the Aussie had fallen pretty hard against the Green Bank while the Euro just kind of went back and forth. That's a sign of at least stability.

If we do pull back from here, I think there's plenty of support down at the 1.6150 level, but after a candlestick like this, typically you will see at least an attempt to follow through to the upside. This is a market that could move quickly, but I think we have some work to do to make all of that happen.

Ready to trade our daily Forex analysis? Here's a list of the best brokers FX trading Australia to choose from.