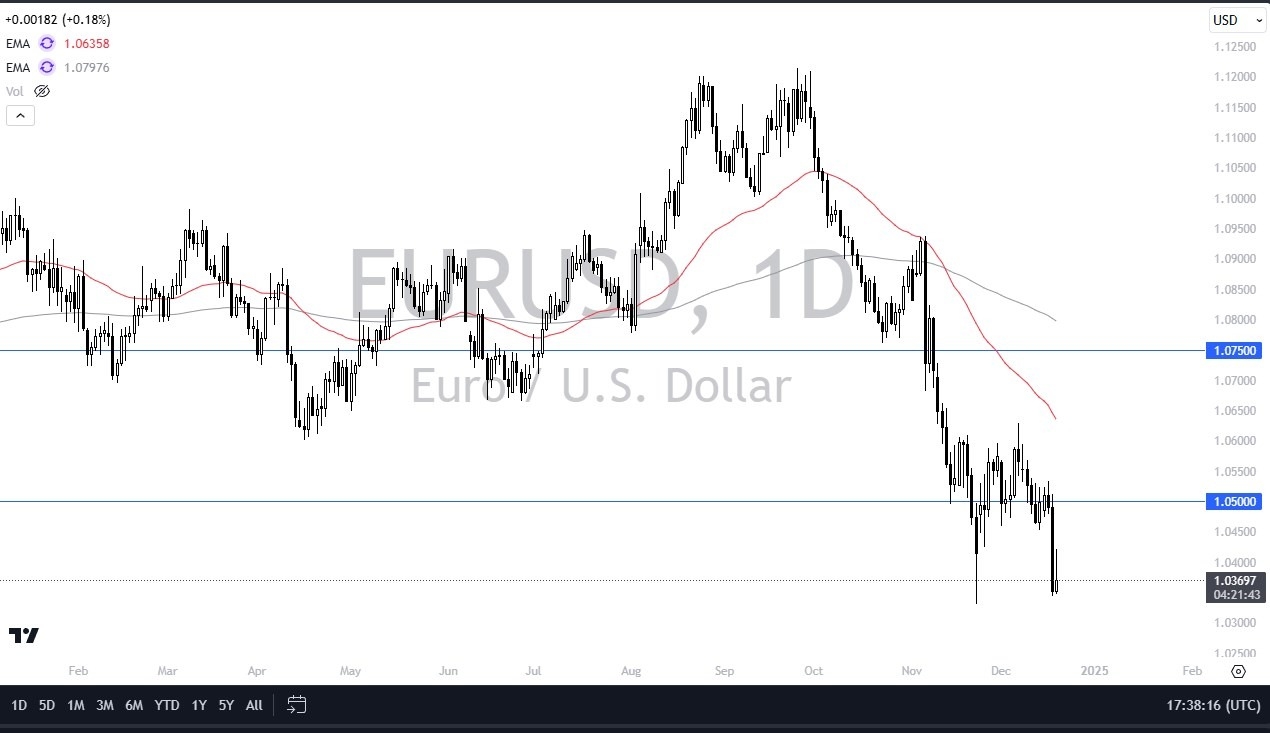

- As you can see, the Euro initially did rally against the US dollar during the trading session on Thursday, but it has been slapped right back down.

- I think it's probably only a matter of time before the Euro drops down to the parity level, possibly lower than that, because there is really nothing good about the European Union at the moment.

- In fact, I think there are some serious structural issues that will come to the forefront of attention soon.

EU is a Mess

We have countries, parliaments, governments collapsing, we have the US dollar strengthening anyways. And then we have a situation where interest rates in America continue to go to the upside. In America, while in Europe, the ECB is likely to continue to see a lot of reasons to put interest rates going forward. So that makes the US dollar much more attractive. Furthermore, the US economy is infinitely stronger than most of the European economies.

Top Forex Brokers

While We Are at Low Levels…

So, all things being equal, we are at an extraordinarily low level. But I think we will go lower. This is a market that I short every time we get a little bit of a bounce for short term trades, mainly due to the time of year, the market will face some liquidity issues over the next couple of weeks. And there could be a nice rally due to short covering as we had into New Year's Day. But that should be thought of as a potential opportunity. It's really not until we break above the 1.0650 level that I would consider going long. That's three full handles from here. And even then, I would be a bit cautious. I think rallies are to be squashed just like we've seen during the trading session on Thursday.

Ready to trade our Forex EUR/USD daily forecast? We’ve shortlisted the best forex broker list for you to check out.