- The euro has been all over the place during the trading session on Wednesday, as we continue to see a lot of noisy behavior in general.

- That being said, I think this is a situation where I think the market is trying to do everything it can to find some type of floor, but it also is keeping an eye on the Friday session as the Friday session features the non-farm payroll announcement.

- The services PMI numbers in the early part of the session did miss in the United States, but I don't think that changes much longer term.

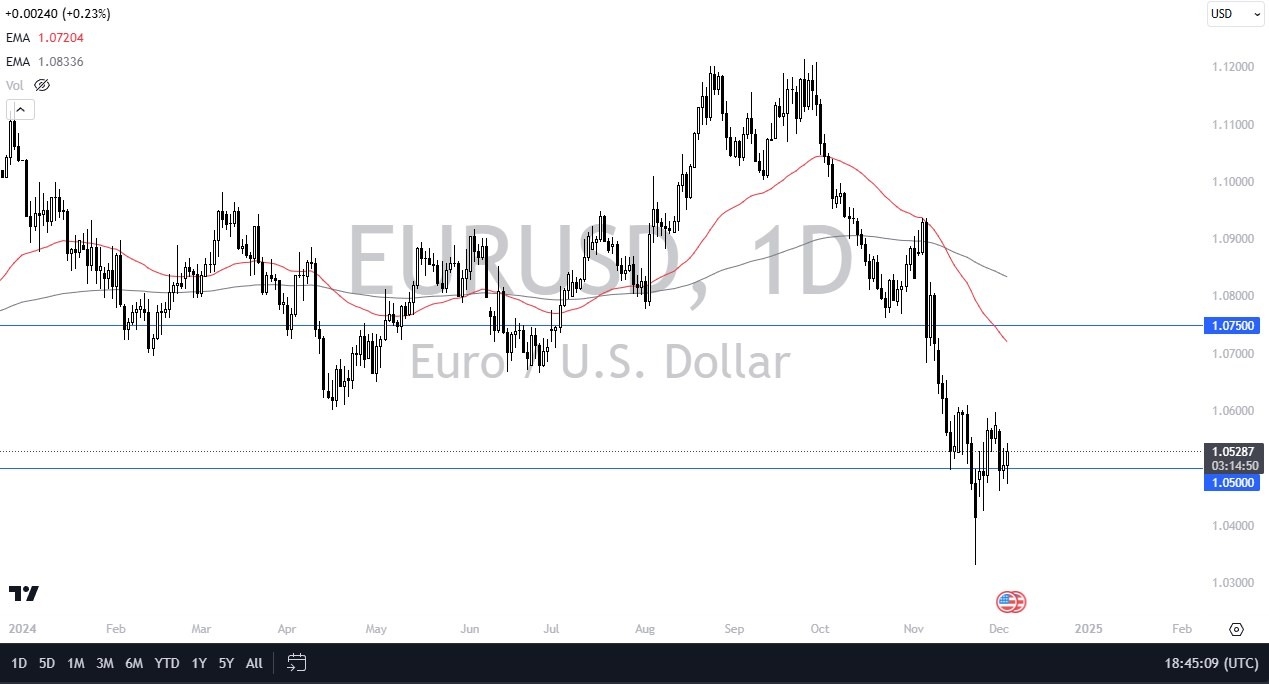

- If the market bounces from here, the 1.06 level is an area that could be a bit difficult to get above and if we were to do that, then the market could go look into the 1.0750 level.

- Anything above there would be a massive shift in the attitude of the US dollar, and I think this would be seen in various currency pairs, not just this one.

Top Forex Brokers

With This, The Market Will Watch the Downside

On the other hand, if we turn around and break down below the 1.04 level, then the market is likely to find the 1.03 level as its next target. Keep in mind that interest rates in America continue to be fairly robust. Despite the fact that the Federal Reserve is expected to cut rates, European markets are going to have to deal with the fact that the German economy is struggling as well.

So, all things being equal, I do favor the US dollar, but we may need to see a little bit of a bounce before we get overly aggressive to the downside. I'd like to fade signs of exhaustion after a significant rally. I might get that on Friday. We'll just have to wait and see. But between now and then, I think this is more or less a range bound market.

Ready to start trading the EUR/USD daily analysis? Get our top rated Forex brokers list here.