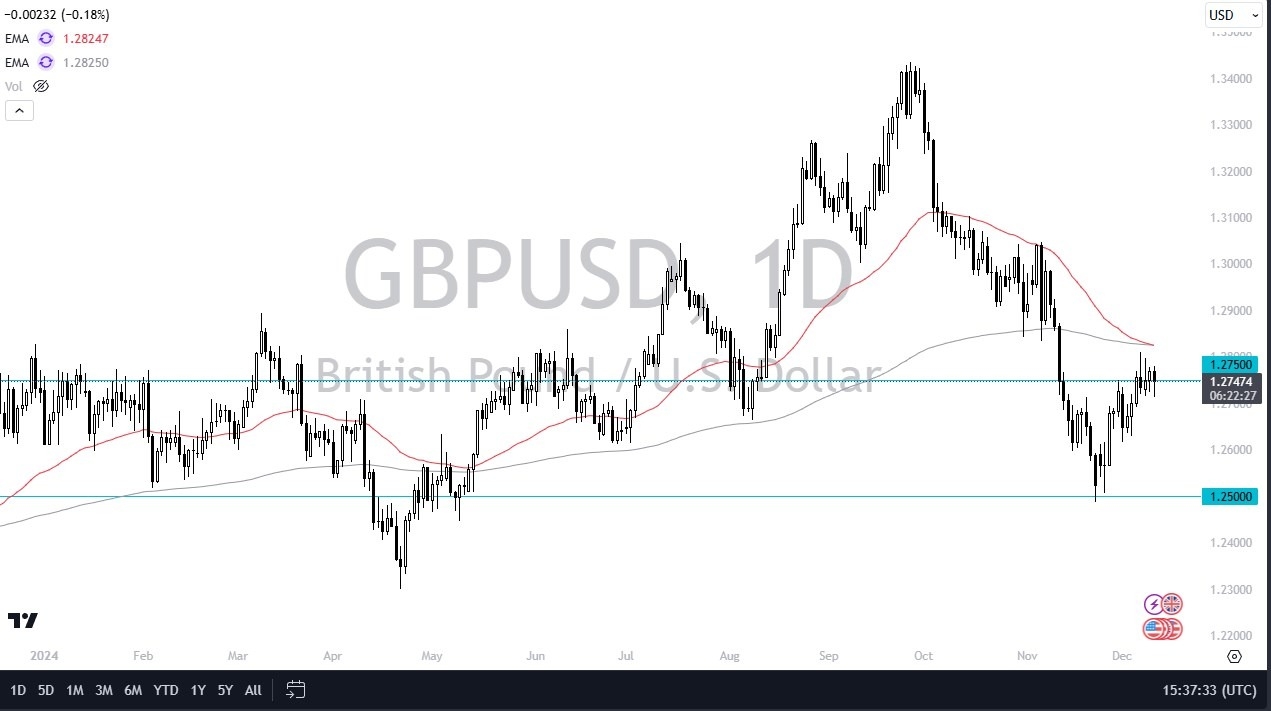

- During my daily analysis of the major currency pairs around the world, the GBP/USD pair has captured my attention, due to the fact that we are at a very important level.

- The 1.2750 level is an area that continues to show quite a bit of push and pull in this market, and it is possible that we could be set up to make some type of bigger decision.

Inflation and GDP

The CPI numbers in the United States came out at 0.3% month over month, suggesting that it is still humming right along as far as strength is concerned. That being said, it was right along consensus, so it was not a shock for the market. However, both Thursday and Friday feature economic numbers that will capture quite a bit of attention. On Thursday, we get the Producers Price Index numbers coming out of the United States, which will give us an idea as to whether or not producers are able to pass on higher prices to the general public, which directly leads into inflationary conditions. On Friday, we will see the Gross Domestic Product numbers coming out of the United Kingdom, which will obviously have a major influence on the British pound. In short, I suspect the next couple of days could be very noisy.

Top Forex Brokers

That being said, there are a couple of levels that I am watching. If after one of these announcements we find ourselves breaking one of these levels, then I think we are setting up a trade that might be feasible. If we break above the 1.2820 level after one of these announcements, it’s likely that the British pound will attempt to climb toward the $1.30 level. However, if the GBP/USD currency pair drops below the 1.27 level after one of these announcements, it’s very possible that the British pound will find itself testing the $1.26 level below. Either way, I think we are setting up a “binary event” over the next 48 hours. I will be watching these levels very closely.

Ready to trade our daily GBP/USD Forex forecast? Here’s some of the best forex broker UK reviews to check out.