- During my daily analysis of major currency pairs, the GBP/USD pair has captured my attention, because the British pound has rallied to reach the 1.20 level.

- What is particularly interesting about this is the fact that we are heading into a couple of extraordinarily busy days for both of these currencies.

To kick things off, on Wednesday we will have the FOMC Interest Rate Announcement, and of course the press conference and statement that goes along with it. On Thursday, we have the Monetary Policy Committee coming out of the Bank of England, which is the equivalent announcement. In other words, I expect to see a lot of volatility in this pair, as it will be “Ground Zero” for a lot of noise.

Top Forex Brokers

Technical Analysis

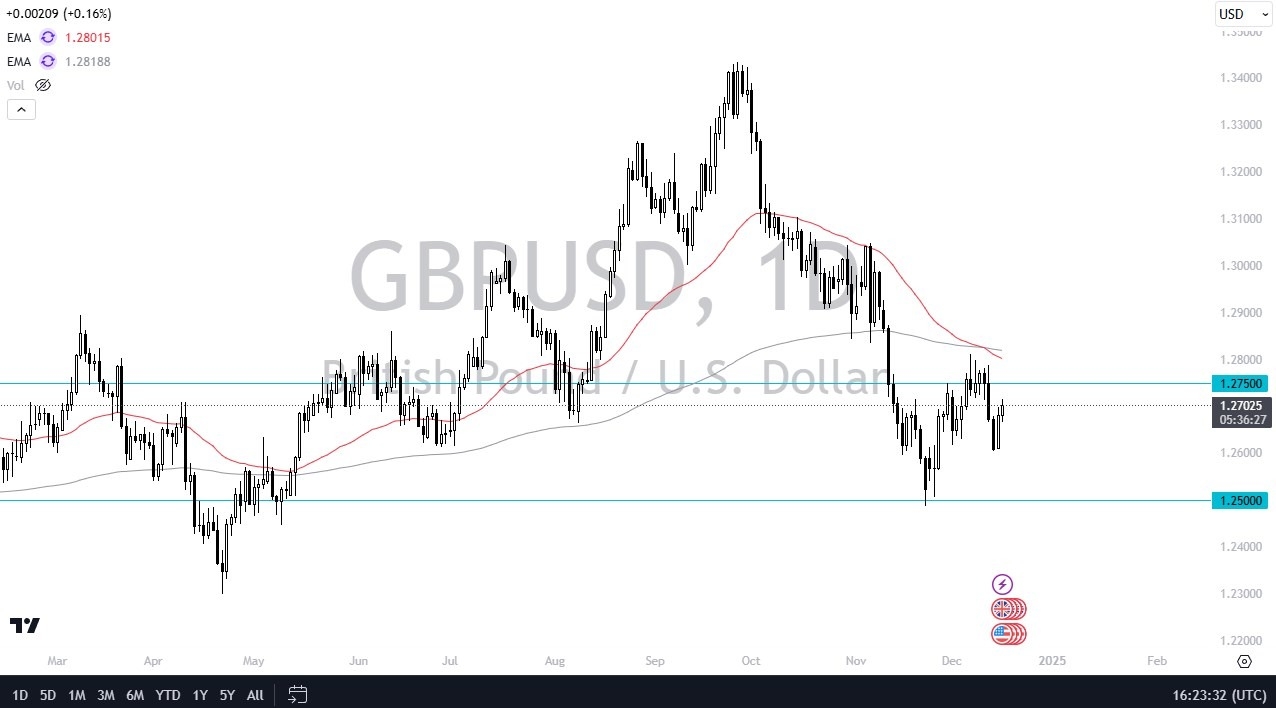

I do think that the 50 Day EMA near the 1.28 level continues to act as a bit of a ceiling in this pair, and it’s not until we break above there that I would be convinced that something is changing. What I anticipate is that we will get a little bit of a rally, and then perhaps a bit of exhaustion that short sellers will be interested in. The 200 Day EMA sits just above the 50 Day EMA, so that could also come into the picture as far as a bit of a ceiling is concerned.

Underneath, we have the 1.26 level offering intermediate support, and the 1.25 level offering much more important support. I do think that this pair will be very noisy over the next couple of weeks, because quite frankly we have a situation where traders are trying to understand where the global economy is going. The Bank of England is expected to keep its interest rates flat, giving it a 25 basis points advantage over the US dollar, assuming that the FOMC does in fact cut by 25 basis points on Wednesday. In other words, it’s going to make the British pound a little bit more resilient than most other currencies against the greenback, but I think we have so much going on right now around the world and of course so much interest in investing in the United States suddenly, that we have a situation where the upside is most certainly limited. This might end up being a fairly range bound pair over the next month or 2.

Ready to trade our free trading signals? We’ve made a list of the best UK forex brokers worth using.