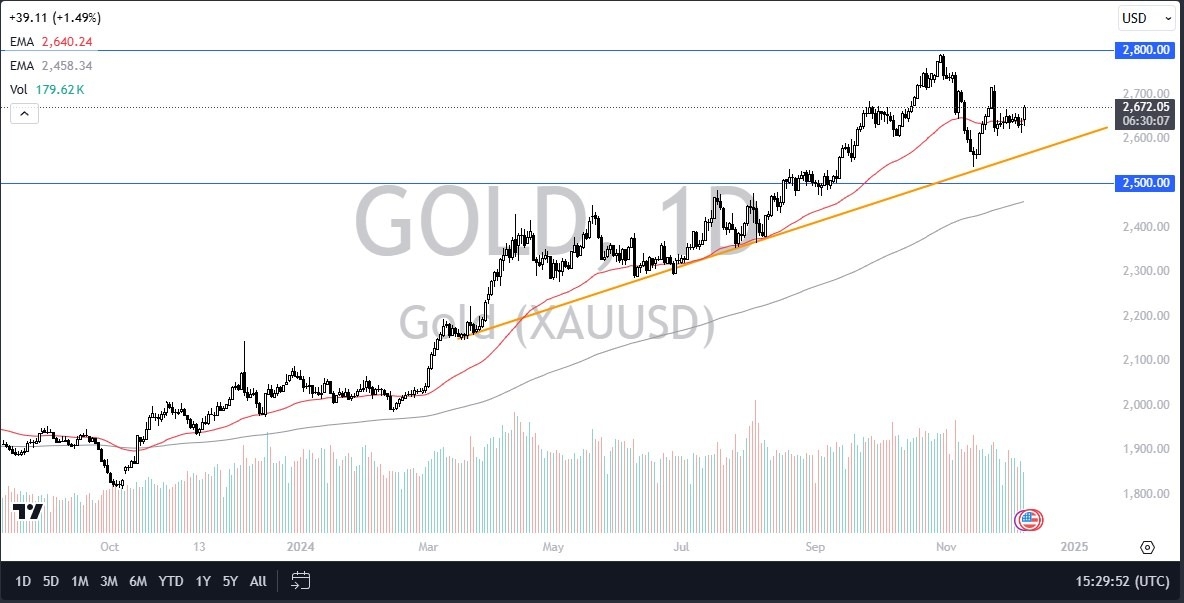

- During my daily analysis of the gold market, the first thing that comes to my attention is that we are in fact trying to break out to the upside for a short-term move.

- If we can do so, then I think it puts the $2705 level into focus, followed by the $2720 level.

- All things being equal, this is a market that I do think continues to see a lot of volatility, but at the end of the day, I think that we are waiting for a few answers from the inflation side of the US economy.

Top Forex Brokers

This Week Could Be Important

This week could be important for the gold market, as we continue to try to determine whether or not the overall uptrend will continue. After all, we have to worry about inflation, and we get a couple of economic indicators as we that could give us a bit of a “heads up” as to where we might be going in the near term. After all, the Consumer Price Index in the United States gets released on Tuesday, and then of course on Thursday we get the Producers Price Index, both of which are important inflation numbers coming out the United States. Furthermore, we have a lot of noise coming on central banks in Canada, the European Union, and Switzerland as they all have interest rate decisions.

Syria has fallen, and regardless of the political ramifications of this, traders may be jumping into the gold market mainly as a way to protect their wealth in that region of the world. After all, this doesn’t have the look of a smooth transition, and we don’t know exactly how this will play out. I have had several people mention the fact that an Islamic caliphate right next door to Israel will obviously cause some issues that makes gold much more attractive. It’ll be interesting to see what the United States does in reaction over the longer term, especially as we see a new administration coming in. In other words, chaos breeds a need for protecting your wealth. I think gold probably rallies from here but we may have some volatility over the next couple of days.

Ready to trade today’s Gold prediction? Here’s a list of some of the best XAU/USD brokers to check out.