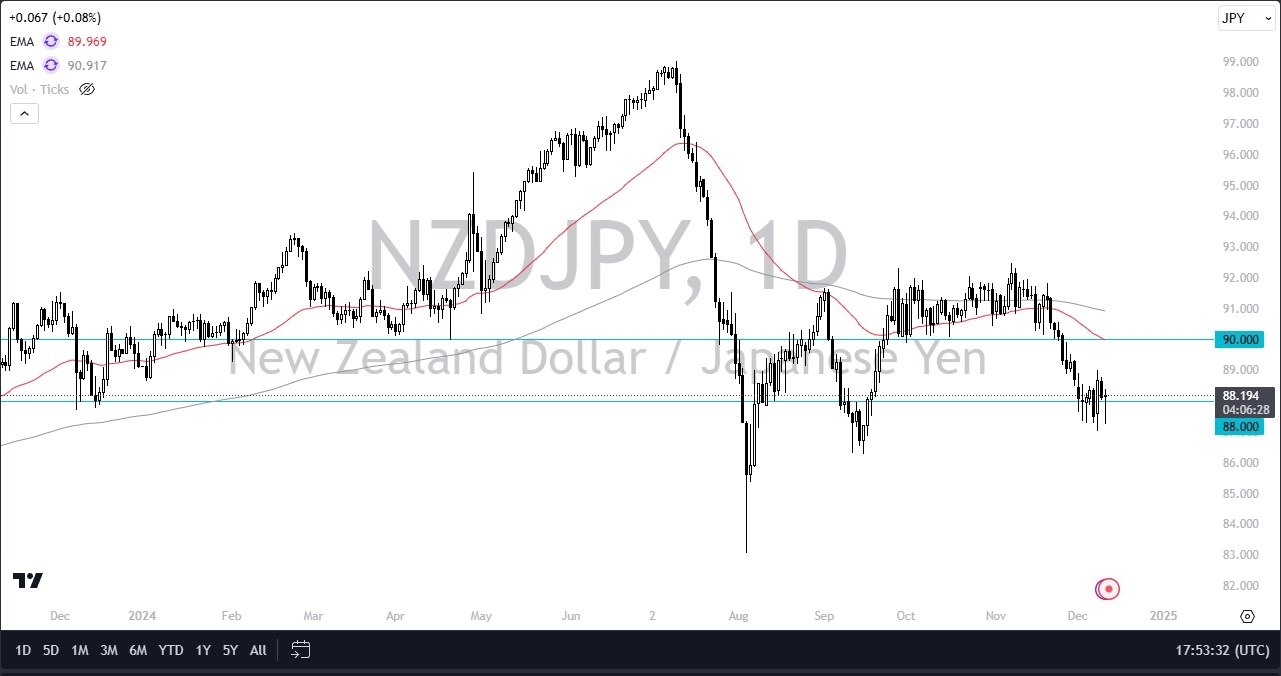

- The New Zealand dollar initially plunged during trading on Wednesday only to turn around and show signs of life.

- By doing so, the market looks very much like a scenario where we are trying to find some type of bottom near the 88 yen level, perhaps even the 87.50 yen level as well.

The market looks as if it is trying to form a hammer for the trading session. So that's obviously a bullish sign. And it's probably worth knowing that the Japanese yen has struggled against most currencies during the trading session. Now, when I look at this, I don't necessarily think it's a market that is ready to go extraordinarily higher, but a bounce towards the 90 yen level would make a certain amount of sense. Keep in mind that the Japanese yen, of course, is a funding currency for carry traders. That might be a little bit of what's going on here. Nonetheless, I think we've got a situation where even if we do drift a little lower from here, the downside is probably somewhat limited, mainly due to the weakness coming out of Japan itself.

Top Forex Brokers

Remember, the Bank of Japan is Limited in What They Can Do

The Bank of Japan can do nothing to tighten monetary policy, but it isn't exactly like the New Zealand dollar is the strongest currency either. It just isn't as bad as the Japanese yen. So, with this, I think you are trying to see if we get a little bit of momentum. And it is worth noting that the yen softened against the US dollar specifically, and that should have a knock on effect over here. It's a short-term trade. It's not the end of some type of trend or anything, but it does look like the Kiwi is trying to bounce a bit from here.

Want to trade our daily forex analysis and predictions? Here's a list of forex brokers in Japan to check out.