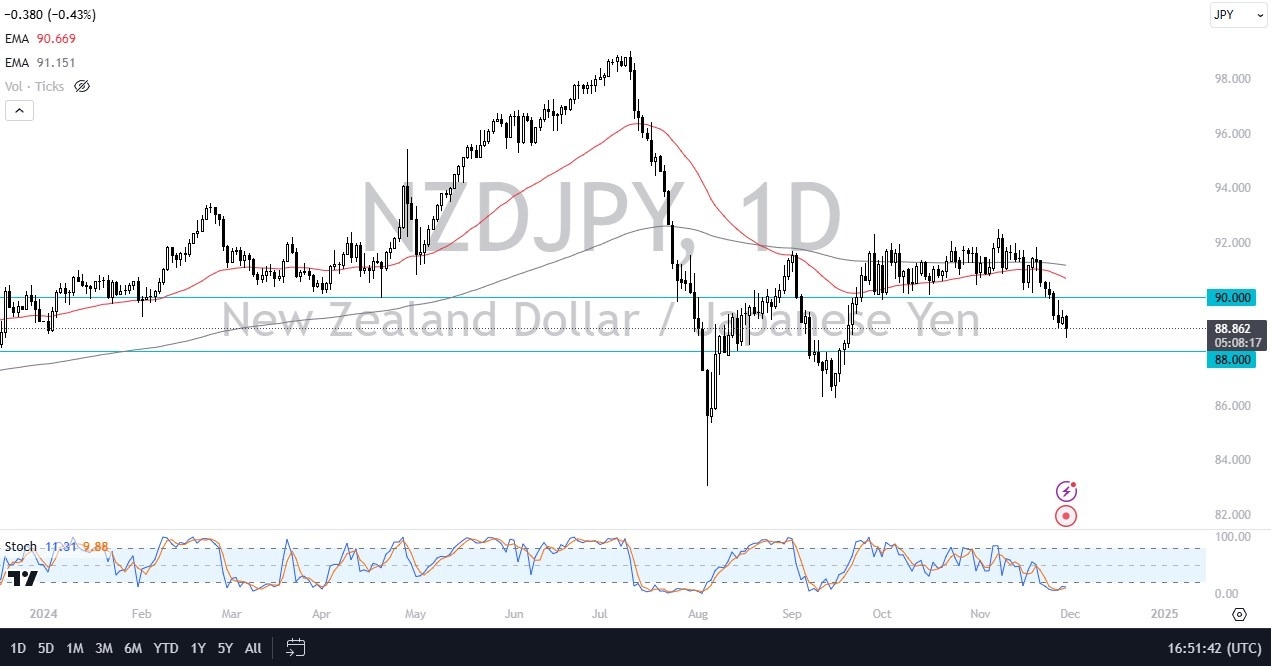

- The New Zealand dollar has fallen pretty significantly during the trading session against the Japanese yen, which has been strengthening against most other things.

- We are currently between a couple of major levels that are worth watching with the 90 yen level above being significant resistance, at least based on market memory as it was massive resistance previously and pretty steadfast support over the last several months.

If We Drop From Here

On the other hand, if we break down from here, the 88 level offers support, which is previous resistance. The fact that we bounced a bit toward the end of the day does suggest that perhaps we could have a move to the upside. It's probably worth noting that the US dollar has bounced from the 150 yen level.

Top Forex Brokers

So maybe that's a little bit of a knock on effect with the yen, but keep in mind that this is a pair that is highly driven by risk appetite and as New Zealand is a commodity currency. The Japanese yen is a safety currency. If we do rally from here and can get above the 90 yen level, that would be a very bullish sign. You probably would see most Japanese yen currency related pairs going higher.

On the other hand, if we do break down below the 88 level, it's likely that we could drop down to the 86 level. This is a noisy market, and I think as we are going to go back and forth and look to see whether or not we can get some type of momentum. All things being equal, the interest rate differential continues to be a driver as well, so it's probably only a matter of time before the buyers come back. It's just now whether or not we get that now or later.

Ready to trade our daily Forex analysis? Here's a list of the brokers for forex trading in New Zealand to choose from.