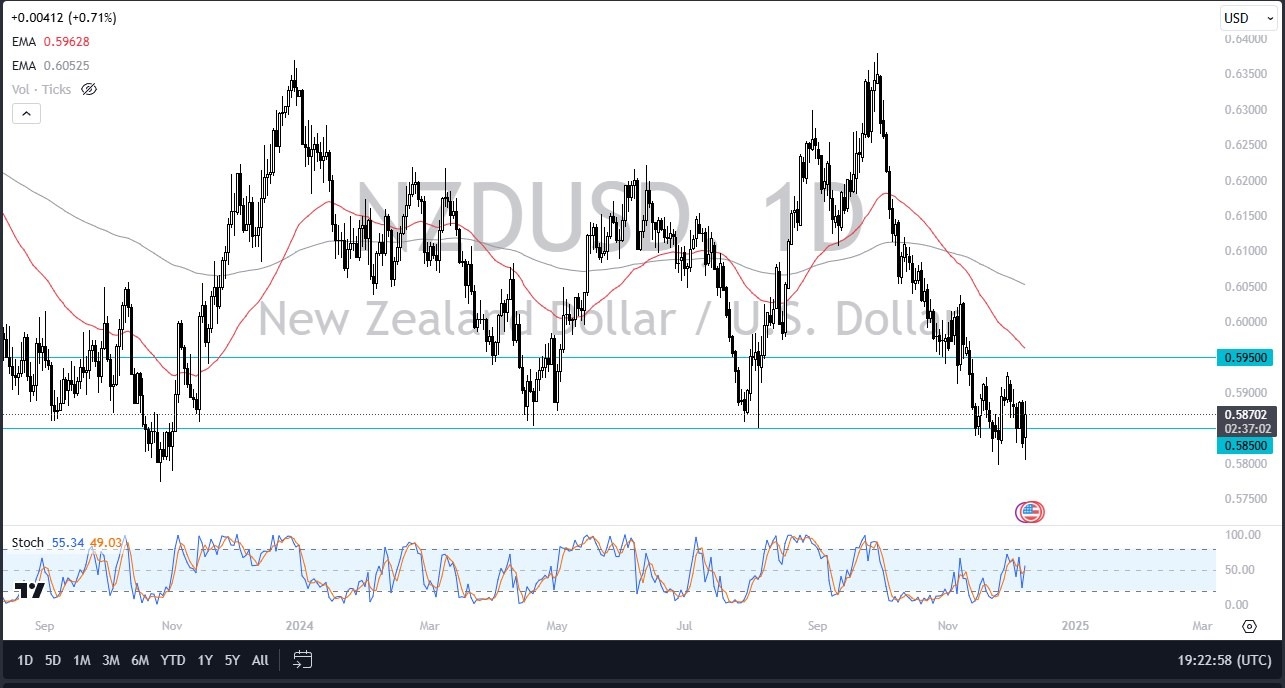

- The New Zealand dollar has shown itself to be somewhat resilient during the trading session on Monday at the crucial 0.58 region.

- Between there and the 0.5850 level, I think there is a significant amount of support, and we most certainly are hanging around this area trying to turn things around.

Keep in mind that there is an RBA interest rate decision early on Tuesday, and while Australia is not New Zealand, the two currencies do tend to move in the same direction. So, you might expect a little bit of volatility via sympathy over the next 24 hours. The question then is, can we truly continue to go higher? I think that gets answered on Wednesday and Thursday due to the CPI number and then the PPI numbers coming out of the United States.

Top Forex Brokers

Nobody's impressed by New Zealand or Australia at the moment, and they certainly are impressed by Asia. The United States has been one of the better performing economies in the world, and if that continues to be the case, there's no reason to think that the greenback is something that should be shorted.

If I Were to Guess…

In fact, if I were forced to make a trade now, I would simply wait for some type of bounce that shows signs of exhaustion that I could start shorting again. That being said, we are at extreme lows, so it does make sense that we pause a bit here. I think this week is extraordinarily backloaded, so it's worth watching very closely what happens next because more likely than not, we will see a fake out and then the market trying to continue with US dollar dominance. But I would also put an asterisk next to that statement saying that inflation comes out as expected in America.

Ready to trade our daily Forex analysis? Here's a list of the brokers for forex trading in New Zealand to choose from.