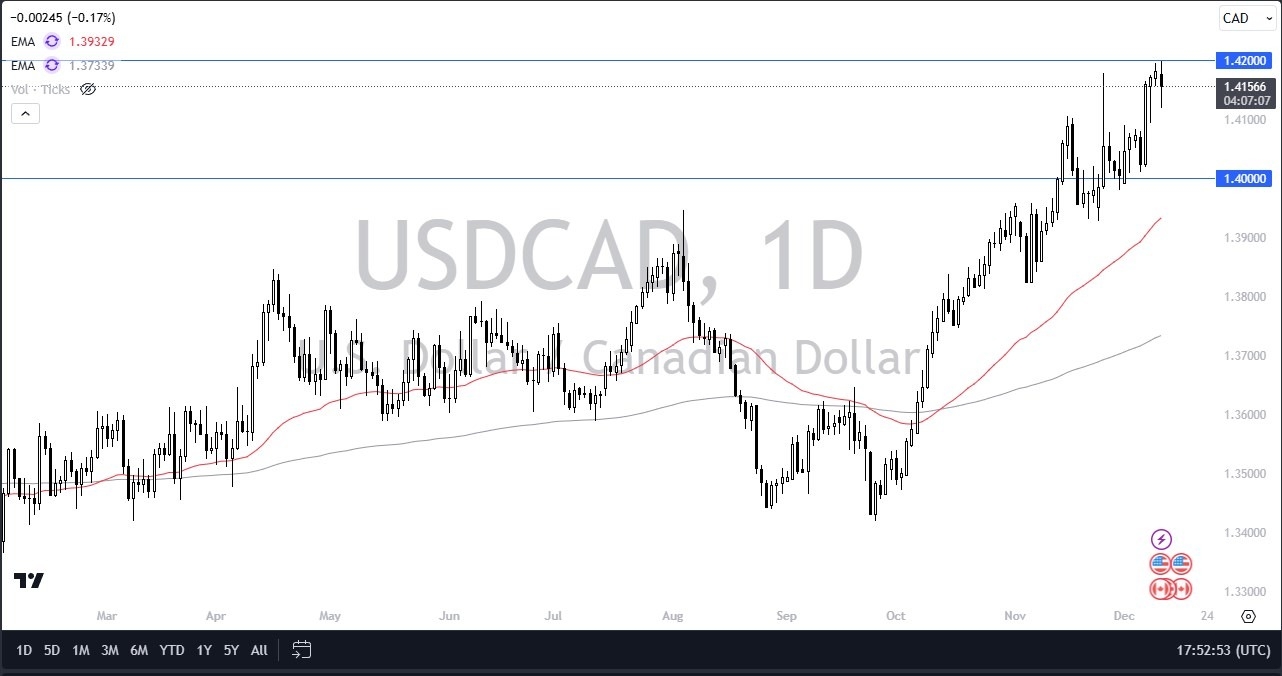

- The US dollar had initially tried to break above the 1.43 level before falling pretty significantly to only turn around and rally again.

- The 1.42 level continues to be very difficult to overcome.

- I think this is an area where we will continue to see a lot of fighting.

If we can break above the 1.42 level, then it's likely that we could see an attempt at least to get to the 1.45 level. The Canadian dollar continues to be like a punching bag for multiple currencies, not just the green bag. So, it does make sense that we continue to see value hunters on dips. The problem we run into here is that we are very close to some extreme highs over the last 10-15 years. Therefore, we may be a little overdone, but I would really like to see some type of pullback that I can take advantage of.

Top Forex Brokers

Major Support is Just Below

The 1.40 level underneath is major support and as long as we can stay above there, I remain bullish, but I also recognize that it is going to be very choppy. It's also worth noting that the 50 day EMA sits just below the 1.40 level and that will come into the picture as well.

I do not have any interest in shorting this USD/CAD pair, at least not until we break down below the 1.39 level, and of course only if the US dollar starts to shrink against other currencies around the world, not just this one. It's very likely that we will probably end up going sideways more than anything else in the short term, and therefore I think short term traders will continue to look at this through the prism of trying to go back and forth and just take advantage of the range that has been so important and obvious over the course of the last couple of weeks.

Ready to trade our USD/CAD daily analysis and predictions? Check out the best currency exchange broker Canada for you.