- The US dollar initially tried to rally a bit during the trading session but gave back gains and then plummeted pretty significantly to break down lower than the previous trading session.

- However, it's worth noting that we have bounced again.

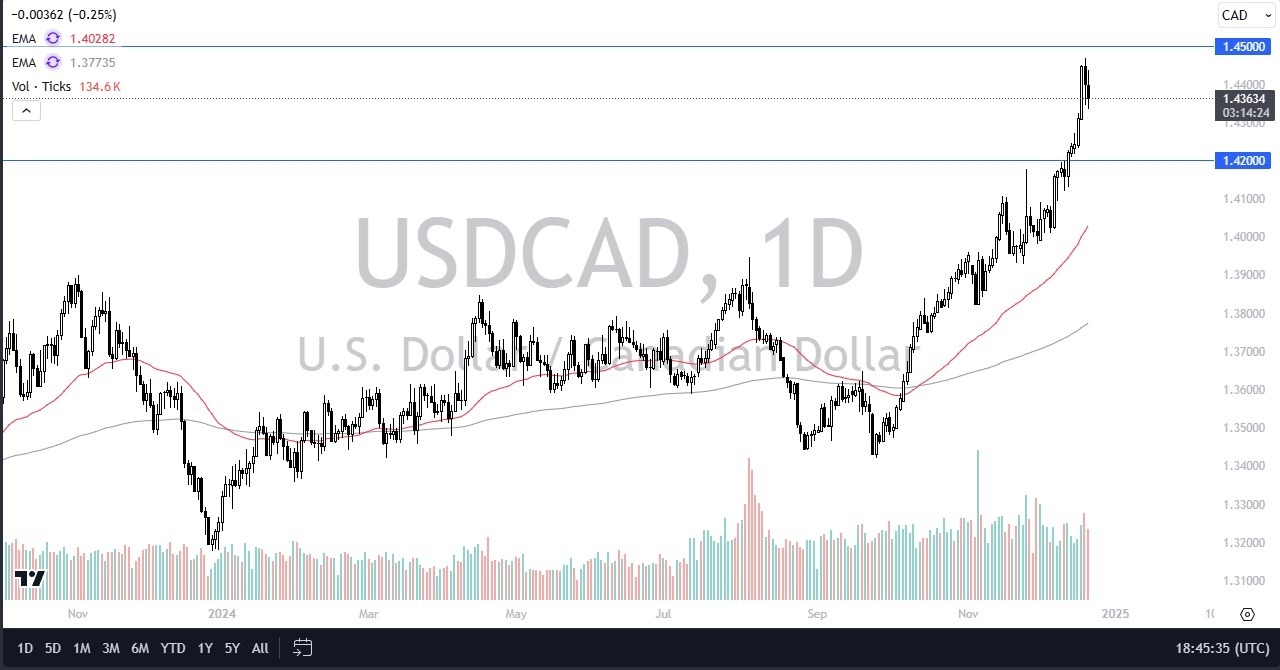

- I think what we've got here is a situation where the pair is just simply trying to do what it can to sort out whether or not we have enough momentum to continue going higher.

This will almost certainly be based on interest rates in America and what they are doing. Even if we do pull back from here, and I think that's probably still somewhat of a possibility, I anticipate that the 1.42 level underneath should offer significant support as it had been previously massive resistance. This area has a lot of “market memory” potential.

Top Forex Brokers

Ceiling Above? Maybe.

It's also worth noting that the 1.45 level above is pretty significant resistance and an area where we've seen some action previously. So, with all of that, I'm looking at this through the prism of buying dips, but I don't know that we've had a big enough dip yet to get overly excited.

I have no interest whatsoever in shorting this USD/CAD pair, at least not until we break down below the 1.40 level, which is light years from where we are now as far as a pullback, but we have not had a significant bounce yet to convince me that momentum is running back into the US dollar. Furthermore, you also have to pay attention to other currency pairs to see if the US dollar starts to take off against other currencies because if it does, then in general, it will have an influence over here. After all, in general, if you “get the Dollar right, you get most of Forex correct.”

Ready to trade our USD/CAD Forex forecast? Here’s some of the best regulated forex brokers in Canada to check out.