- The US dollar initially rallied a bit during the early hours on Tuesday but has given back some of the gains against the Canadian dollar as we continue to consolidate overall.

- I wouldn't read too much into the action on Monday and Tuesday, which would have been in a very thin environment, but what I am paying attention to is the fact that there wasn't a lot of profit-taking.

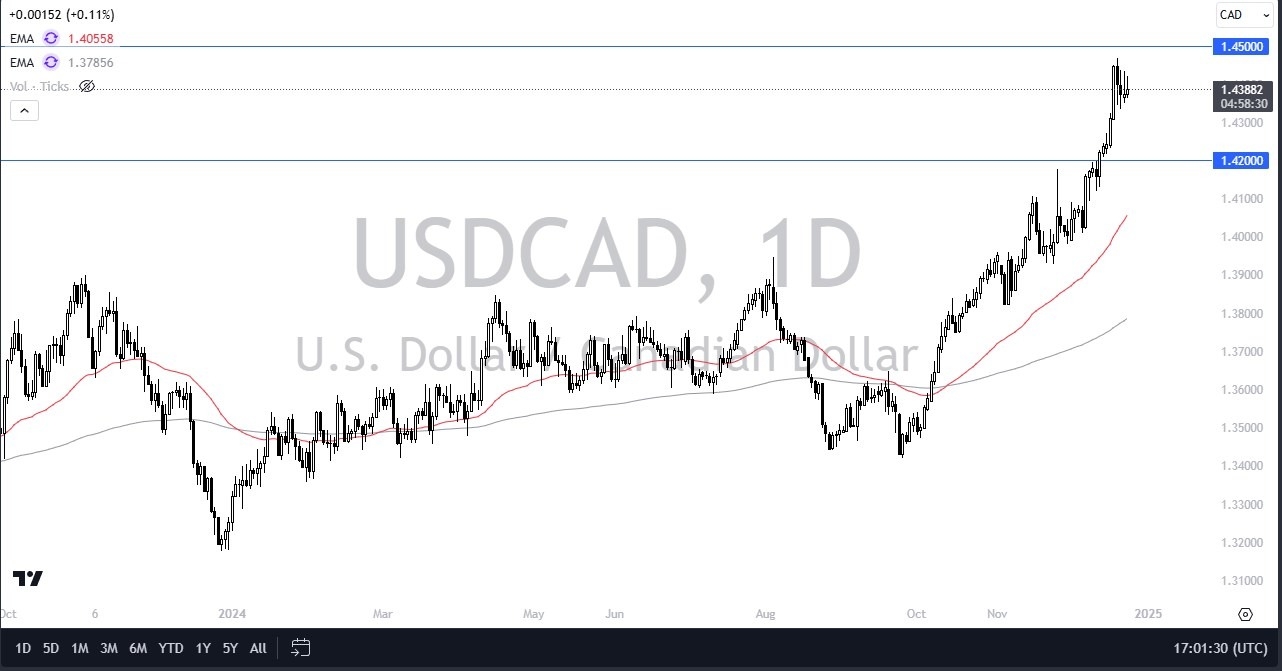

When you look in relation to the massive move higher, there has not been a lot of profit-taking. As you would expect, if the market were to pull back from here, we could see the 1.42 level offer support, and that's an area that I would be very interested in. The 50-day EMA currently sits right around 1.4050 and is climbing rapidly.

Top Forex Brokers

The 50 Day EMA

So, the 1.42 level is an area that, depending on the timing, might very well be where the 50-day EMA is. The 1.45 level above remains pretty significant as far as resistance is concerned, but there's really nothing here that suggests that the US dollar is about to take a nosedive against the Canadian dollar. It really would take a lot of US dollar weakness.

Recently, with the interest rates climbing the way they have, I just don't see that, especially against the Canadian dollar, which has a host of massive political problems behind it. We have a Canadian government that's barely functioning at this point. The fact that the Canadian economy has been soft anyway, there are too many things working against the Loonie right now to make it something that I would want to be buying.

So, in short, I like the idea of buying pullbacks in this USD/CAD currency pair all the way down to at least the 1.42 level. If we break below there, then I would have to “reset” my beliefs and expectations about any potential trade set up.

Ready to trade our USD/CAD daily analysis and predictions? Here are the best Canadian online brokers to start trading with.