- In my daily analysis of major currency pairs, the USD/CAD pair has caught my attention as we continue to see a more upward trajectory than anything else at the moment.

- The Canadian situation is getting a bit dire, and with a lot of political concerns when it comes in Canada, I don’t think this gets any better anytime soon.

- That being said, there are some technical analysis clues that we can take for an idea as to where to go next.

Top Forex Brokers

Technical Analysis

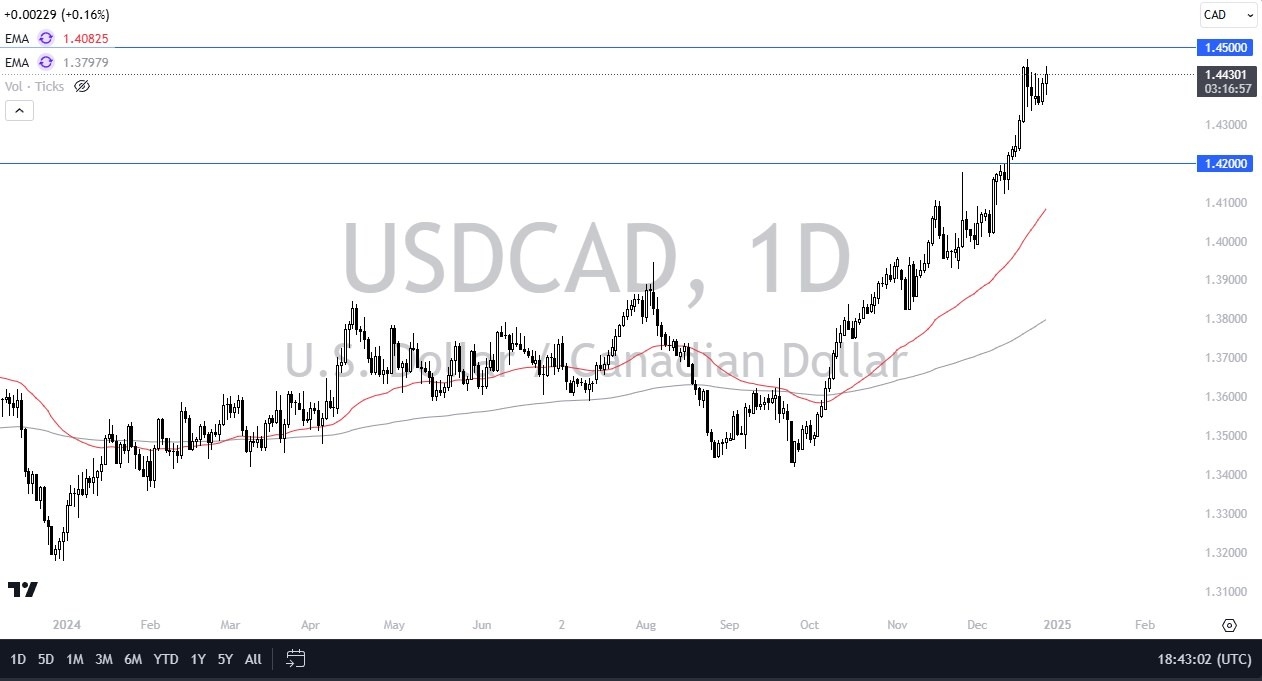

Technical analysis for this market is obviously very bullish, but at the same time you have to keep in mind that the 1.45 level above has been a significant barrier several times in the past. Quite frankly, if this market were to break significantly above there, we might be entering “no man’s land” as to where we could go next. We would have to look back decades in order to find levels to trade off of. The Canadian dollar continues to suffer at the hands of relatively weak crude oil, although that’s something that’s going to be changing soon, and of course the fact that the bank of Canada is so loose with its monetary policy.

At the same time, you have the Federal Reserve in a situation where it may not be able to cut rates as much as people had thoughts 4 2025, so this could end up putting more upward pressure on the US dollar anyway. Short-term pullbacks I think continues to offer buying opportunities near the 1.4350 level, and then again at the 1.42 level. Speaking of the 1.42 level, if we get near there, it’s very possible that the 50 Day EMA will meet us. That obviously is a technical indicator that a lot of people pay attention to, so I would be very interested in seeing how the market would behave had we reached to that level. All things being equal, I have no interest in shorting this market, nor do I have any interest in shorting the US dollar overall.

Ready to trade our Forex daily analysis and predictions? Here's a list of the best Forex Trading platform in Canada to choose from.