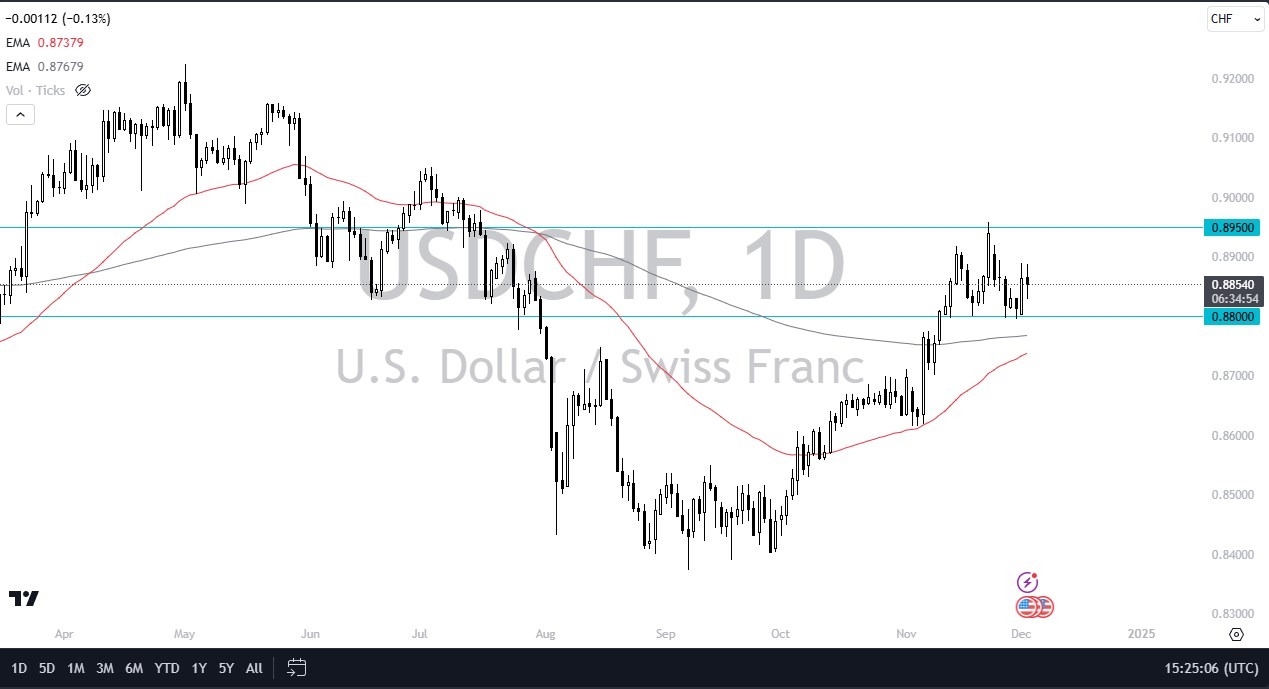

- During the trading session on Tuesday, we've seen the US dollar go back and forth against the Swiss franc, which does make a significant amount of sense considering that we've been consolidating for three or four weeks now.

- It looks like we are just simply trying to sort out whether or not we are going to go higher or if we are going to roll over again.

- There are a couple of levels that I'm watching very closely, with the 0.88 level being a massive support level, while the 0.8950 level is significant resistance.

If We Continue Here…

Top Forex Brokers

As we continue to go back and forth in this region, I think you have to look at this through the prism of a market that is probably going to continue to see a lot of external noise due to the fact that both of these currencies are considered to be safety currencies. Nonetheless, it does pay you at the end of the day to hold dollars against Swiss francs, but we also have services PMI coming out on Wednesday, the weekly unemployment claims coming out on Thursday, and then of course we have the non-farm payroll announcements coming out on Friday. So, I don't anticipate breaking out of this range unless we get some type of huge shock in one of those announcements, probably more likely than not the non-farm payroll announcement.

So, with that being said, if you're a range-bound trader, you might be able to pull up something like a stochastic oscillator and pay close attention to these two levels. The USD/CHF market right now seems to be somewhat tentatively bullish, but there is a certain amount of hesitation. The 200-day EMA sits just below the 0.88 level, and the 50-day EMA is rising to perhaps kick off a golden cross, but we'll have to wait and see.