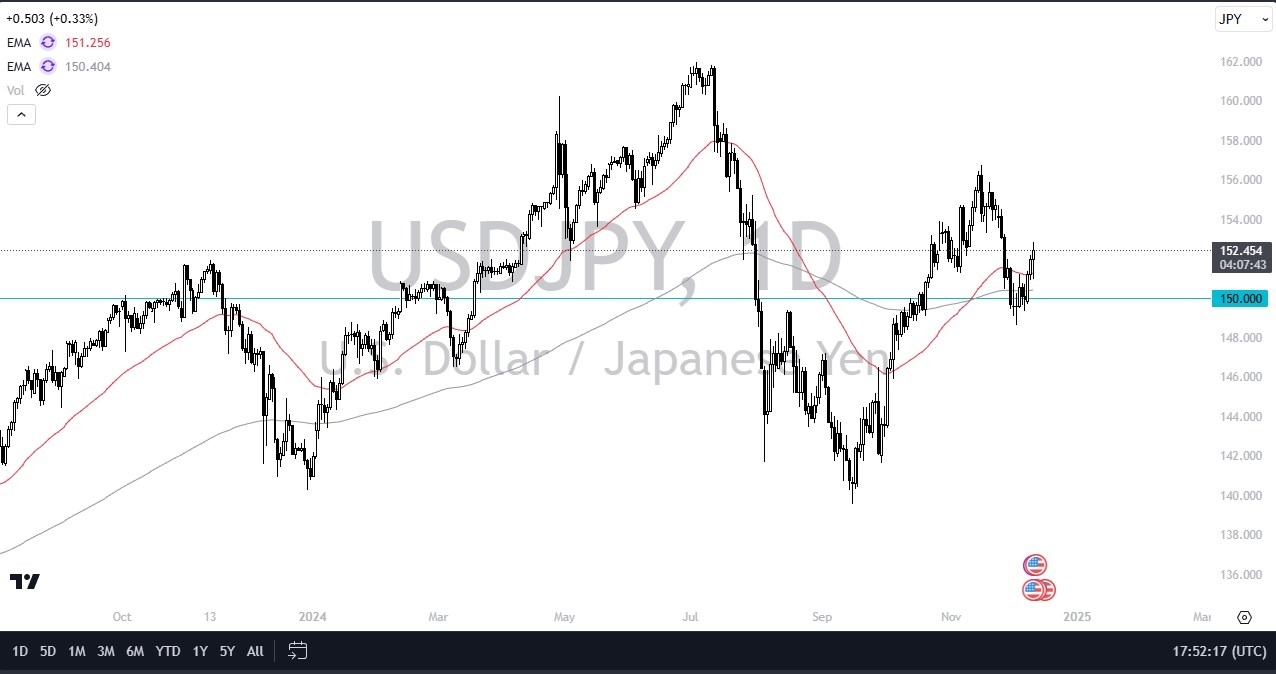

- The US dollar has gone back and forth there in the course of the trading session on Wednesday, as we continue to see a lot of noisy behavior.

- The 50 day EMA underneath will offer significant support and above if we can break above the 153 yen level, then I think it would be a really bullish sign.

- All things being equal, it's worth noting that we did pull back to the crucial 150 yen level only to turn around and rally.

A breakdown below the latest swing low would obviously be very negative, which is closer to the 148.50 yen level. And that juncture would probably not only see the dollar losing strength against the Japanese yen, but probably almost everything else. Remember, the yen tends to move in one direction everywhere.

Top Forex Brokers

You Must Pick Your Battles

That's why you have to pick your battles, you don't want to be caught on one trade across seven or eight different markets shorting the yen, for example. And then getting it wrong. It's absolutely devastating. In general, I think you've got a situation where I do think we see a lot of volatility, but the interest rate differential continues to favor the United States, which is huge for the average Forex trader.

While the Federal Reserve is expected to cut interest rates by 25 basis points this month, the reality is that the CPI numbers have come out during the day on Wednesday exactly as expected. So, it really doesn't change much. Furthermore, the United States is expected to keep its interest rates still pat on the January meeting. So that continues to feed the idea of the carry trade in this USD/JPY market, which has been quite profitable over the long term, and at times where the interest rate differential continues to see a lot of influence.

Want to trade our USD/JPY forex analysis and predictions? Here's a list of forex brokers in Japan to check out.