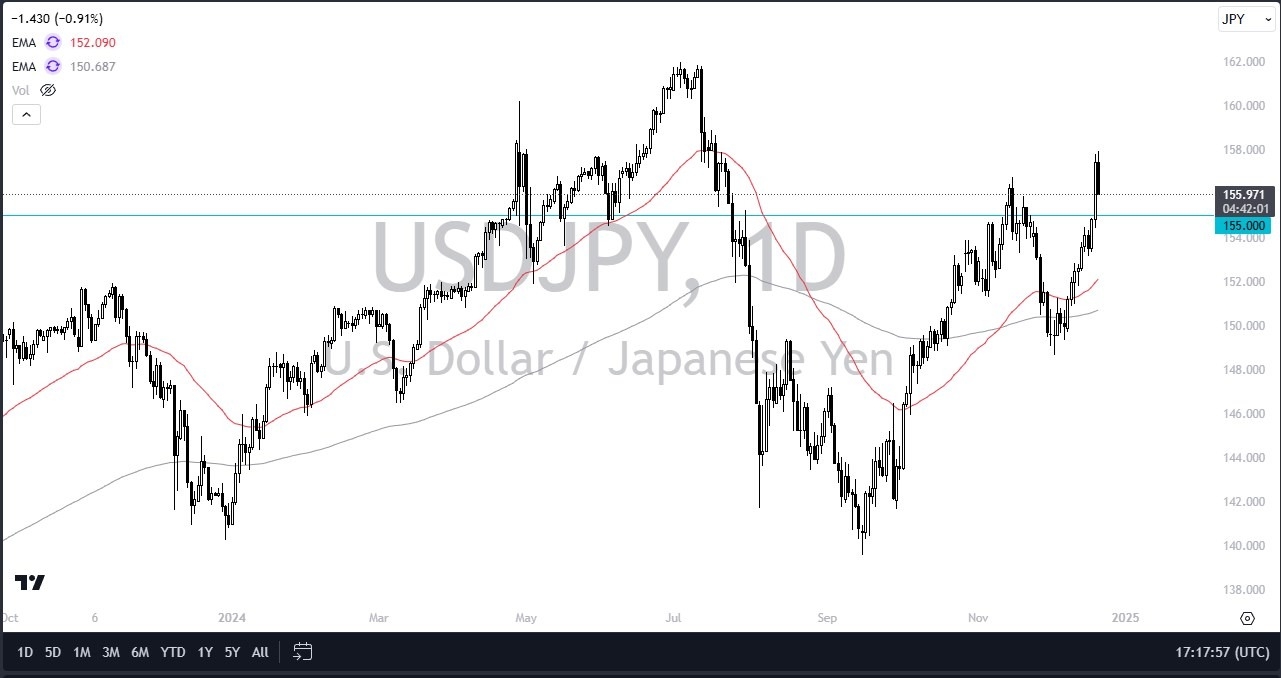

- The US dollar initially did try to rally during the trading session on Friday, but gave back the gains rather rapidly as the US dollar is certainly overbought at this point.

- Furthermore, interest rates in America dropped, which of course helps a lot of people get away from the greenback, and therefore it does make a certain amount of sense that we pulled back a bit.

- The ¥155 level underneath is a large, round, psychologically significant figure, and an area that previously had been important. I think ultimately this is a scenario where we are waiting to see some type of value that we can take advantage of.

Top Forex Brokers

Technical Setup?

It is possible that we have a technical setup coming, with the ¥155 level being a prime example of an area where people would be willing to jump into. This would be a complete repudiation of that massive candlestick on Thursday, and of course one would assume that there would be a certain amount of volume right there, as it was where the candlestick jumped from. Any bounce in that area could end up being a nice buying opportunity, but if we were to break down below there, then we may have to go looking to the 50 Day EMA near the ¥152 region.

On the other hand, if we were to turn around a break above the ¥158 level, then it just shows a significant amount of momentum jumping into the market, and perhaps pushing this market toward the ¥160 level. After that, we have a much bigger move just waiting to happen, and I do think that eventually the US dollar continues to strengthen against the Japanese yen, if for no other reason than the fact that monetary policy in 2025 ends up being a somewhat tight year for the Federal Reserve. Conversely, the Bank of Japan can do very little to normalize rates, at least not anything significant. With this, I prefer to buy dips going forward.

Want to trade our USD/JPY forex analysis and predictions? Here's a list of forex brokers in Japan to check out.