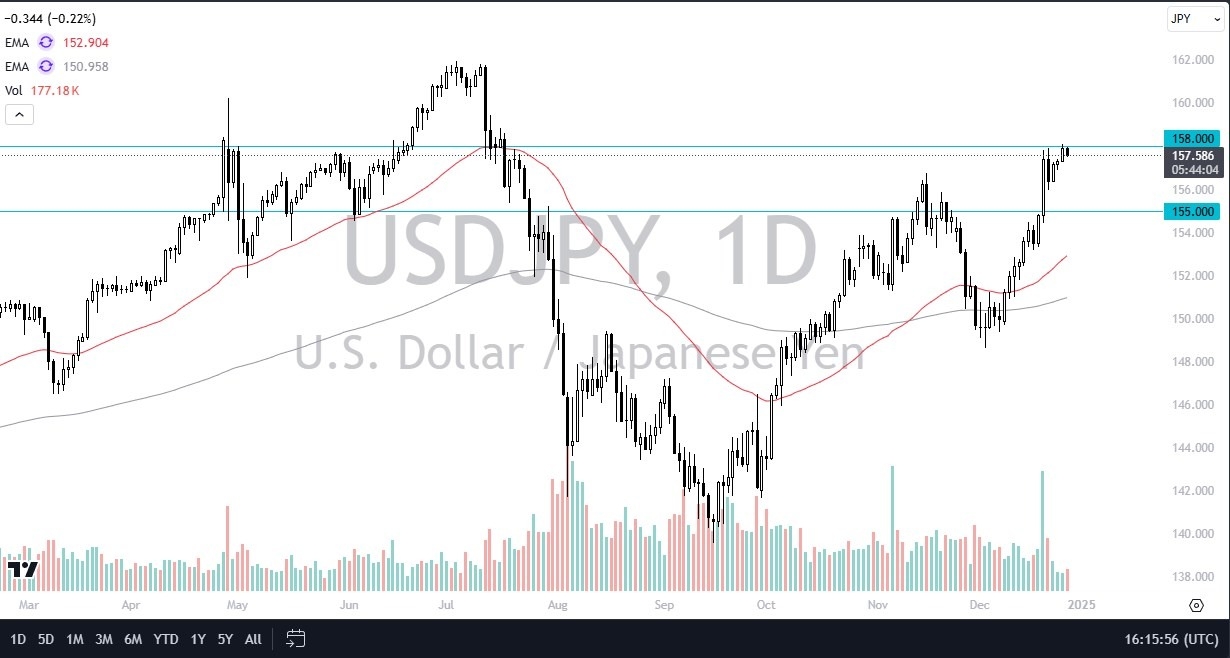

- The US dollar pulled back just a bit during the early hours on Friday, as it looks like the 158 yen level continues to be a major barrier.

- This is an area where we've seen a lot of action in the past, so it does make a certain amount of sense that we would continue to look at this through the prism of a market that's trying to bust through a major barrier.

I think it's going to take some work, and I also think it is difficult to assume that the market is just going to be able to slice through there. Longer term, I do believe that the interest rate differential in the United States, in comparison to Japan will be a major factor. And we will eventually break out to the upside, but we may have to pull back a couple of times in order to build up pressure in a market that is a little extended. And of course, we also have the specter of illiquidity at the moment due to the fact that we are between two major holidays.

Top Forex Brokers

In Conclusion

So, in short, the way I look at this USD/JPY chart is I am trying to find a buying opportunity on pullbacks that show signs of a bounce. I would be very patient at this point in time, there's no need to rush this because once traders come back after New Year's Day, it is likely to be very volatile and very noisy. Therefore, you have to keep in mind that you've got a situation where traders will probably have to deal with a lot of back and forth chops.

The 155 yen level at the moment for me at least is going to be the floor in the market. If we were to break down below there, then we may have to rethink some things. But as things stand right now, I just think you don't have enough volume in the market to finally break out above the 158 yen level, at least not right now.

Want to trade our USD/JPY forex analysis and predictions? Here's a list of forex brokers in Japan to check out.