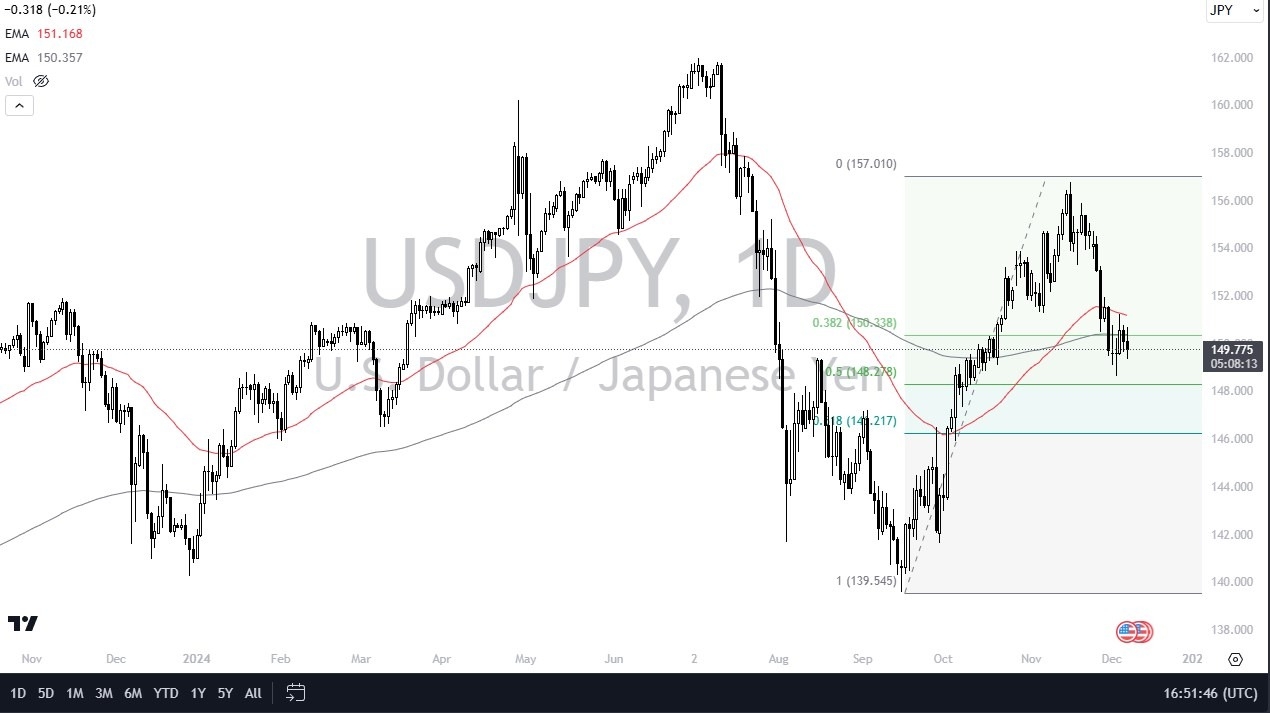

- During the trading session on Friday, my daily analysis of the USD/JPY pair continues to look very messy, just due to the fact that we cannot seem to overcome the 200 Day EMA.

- Having said that, we are not necessarily breaking down either, or I think this is a market that is trying to figure out what to do with itself over the longer term.

- I do believe that the interest rate differential will matter, but with the FOMC Meeting coming, it’s possible that traders are waiting to see what the press conference and statement has to say about future trajectory of interest rate cuts or whether or not the Federal Reserve is going to sit still.

Top Forex Brokers

The candlestick for the Friday session is rather unimpressive, and we find ourselves sitting right around the crucial ¥150 level as well. With this being the case, think we have got a situation where traders are trying to figure out where to go next, but if we could get above the 50 Day EMA, then the market could really start to take off to the upside. This will be more likely than not if Jerome Powell sounds rather hawkish after the FOMC meeting, or perhaps even more impressively, if the Federal Reserve decides not to cut rates. Remember, the market has a 25 basis point rate cut priced in at the moment in the Fed Futures Funds markets.

Fibonacci

While I’m not a huge Fibonacci ratio trader, it is worth noting that we had recently bounced from the 50% Fibonacci retracement level, and we are hanging around the 38.2% Fibonacci retracement level. While we haven’t necessarily set still, we really haven’t gone anywhere over the last week or so. The US dollar is stronger than most other currencies, but there are certain amount of traders out there pretending that the Bank of Japan can do something to tighten monetary policy. The endgame for Japan is a major collapse of the currency, just due to the massive amount of debt that the Japanese have been living on. However, that doesn’t mean it has to happen today, so I am waiting for a move above the 50 Day EMA to start buying again.

Want to trade our daily USD/JPY analysis and predictions? Here's a list of forex brokers in Japan to check out.