Potential signal:

- I’m a buyer of the USD/JPY pair if the CPI number comes out at 0.3%, or higher.

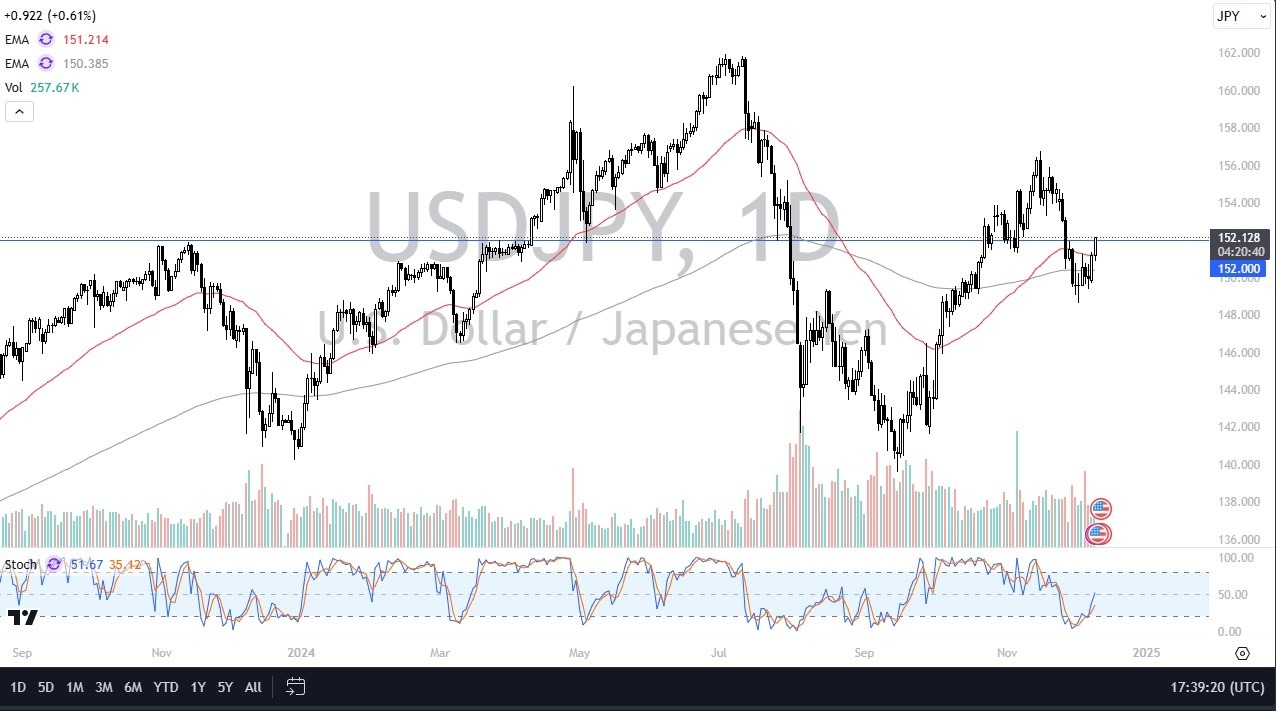

- I would have a stop loss at the ¥152.50 level and be looking to get to the ¥155.12 level.

During my daily analysis of the USD/JPY pair, we broke above the crucial ¥152 level, an area that of course is rather important. Ultimately, by doing so it looks as if the US dollar is going to continue to climb against the Japanese yen, and perhaps try to make a move toward the ¥156 level. Short-term pullbacks will almost certainly attract a certain amount of attention, but there are some things that we need to pay close attention to over the next couple of days that will determine where this pair goes.

Top Forex Brokers

Wednesday and Thursday

The next 48 hours are going to be important for the US dollar against the Japanese yen, and more specifically for the US dollar overall. With the Consumer Price Index numbers coming out on Wednesday at 1:30 PM GMT, we will get an idea as to how inflation is progressing in the United States. The CPI measures inflation on consumers directly, so that of course is very important, and we need to understand that the idea that inflation is cooling-off has been the norm most of the year. However, recently we have seen some conflicting reports, and at this point if the CPI number comes out above the 0.3% month over month consensus number, the US dollar should take off.

We also get the PPI number on Thursday, but it generally takes a backseat to the CPI number overall. Nonetheless, the same results are expected, in the same effect could be intact here. However, the exact opposite could send the US dollar down to bed.

Federal Reserve

Keep in mind that the Federal Reserve is expected to cut rates by 25 basis points this month, but we are now seeing the market price in the idea of the Federal Reserve sitting still during the January meeting, which means that the interest rate differential should remain somewhat stable between the United States and Japan, thereby making it a pair that you get paid to hang onto at the end of every day.

Want to trade our daily forex analysis and predictions? Here's a list of forex brokers in Japan to check out.