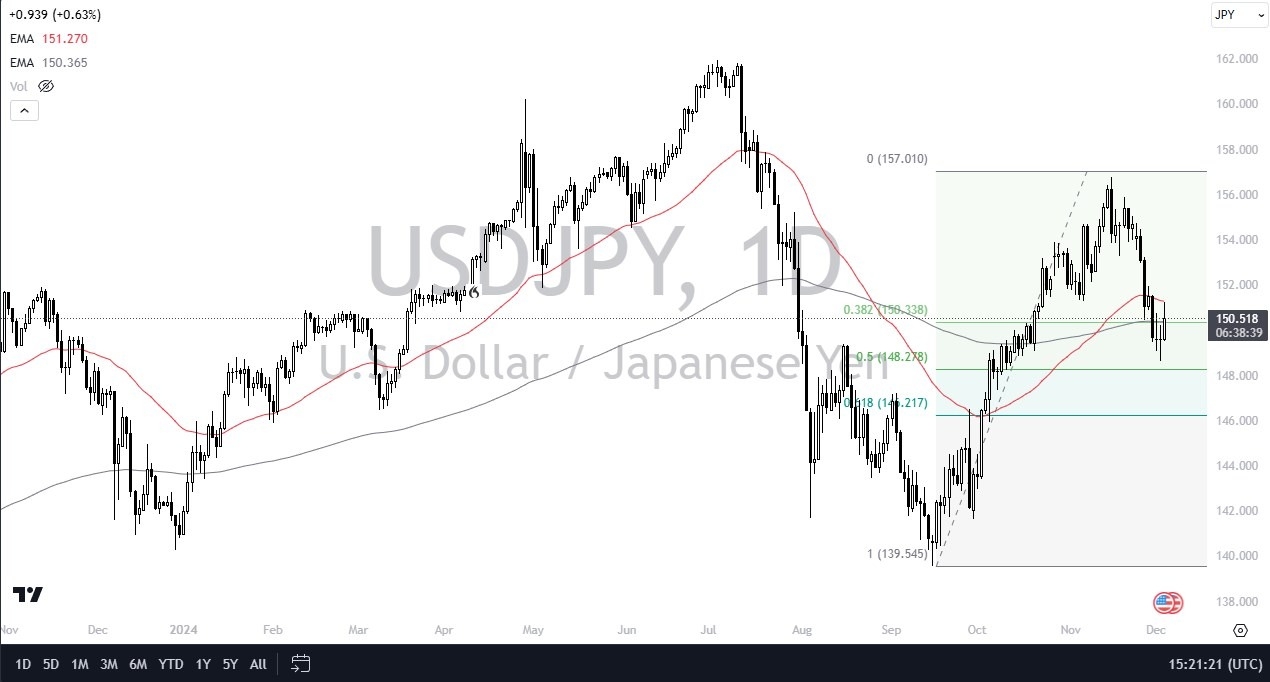

Potential signal:

- I am a buyer of this market on a move above the 50 Day EMA.

- At that point, I would have a stop loss near the ¥150 level, and would try to target the ¥154 level.

During my daily analysis of the USD/JPY pair, the first thing I noticed is that the US dollar slammed against the 50 Day EMA, but pulled back a bit after the market has received the Services PMI numbers, which came in at 52.1, as opposed to the expected 55.7 by the market. This suggests that perhaps the inflation situation in the United States is a bit all over the place, so this has caused a little bit of a dark cloud to form over the greenback.

Top Forex Brokers

However, it’s worth noting that we had rallied quite significantly from the 50% Fibonacci retracement level during the previous session, so I think we are in the midst of trying to sort out what’s next. The market is currently hanging around the 200 Day EMA as well, so it does make a certain amount of sense that the market is trying to sort out what it wants to do for the longer-term move. I think at this point, if we can break above the 50 Day EMA, then the market could go looking to the ¥156 level.

On the other hand, if we were to break down below the ¥148 level, which is basically where the 50% Fibonacci retracement level since, then we could see the market drop down to the ¥146 level, or the 61.8% Fibonacci retracement level. Obviously, this is all about the technical analysis at this point, because the interest rate differential continues to favor the United States dollar.

Interest Rate Differential

The interest rate in USD/JPY market differential obviously favors the US dollar as the 10 year yield in America is roughly 3% higher than the one in Japan. Because of this, you cannot overlook the fact that you get paid at the end of every day to hold onto this pair, and I think traders are trying to get back into the frame of the carry trade, but this causes a little bit of a headache during the session when you get the Services PMI numbers missing a bit. However, it’s probably worth noting that the Manufacturing PMI numbers were hotter than anticipated on Monday. In other words, I think we probably continue to go higher regardless.

Want to trade our daily forex analysis and predictions? Here's a list of forex brokers in Japan to check out.