- The US dollar has rallied rather significantly during the trading session on Wednesday, as the FOMC in the United States cut interest rates by 25 basis points.

- It wasn’t necessarily that the cut itself is a surprise, it has more to do with the fact that the forward guidance suggests that the United States is still running rather hot as far as the economy is concerned, so therefore interest rates in America will probably remain somewhat elevated.

Top Forex Brokers

Furthermore, you also have to keep in mind that the trump administration will be much tougher on immigration, as the open border policy of the United States will almost certainly be reverse. There is a sizable amount of transactions that take place in this currency pair due to remittances from migrants sending money back to their families in Mexico. Because of this, that added “bonus trade” will be gone. Furthermore, you also have to keep in mind that the Mexican economy is slowing down quite drastically, so it all ties together for trouble with the Mexican peso itself.

Technical Analysis

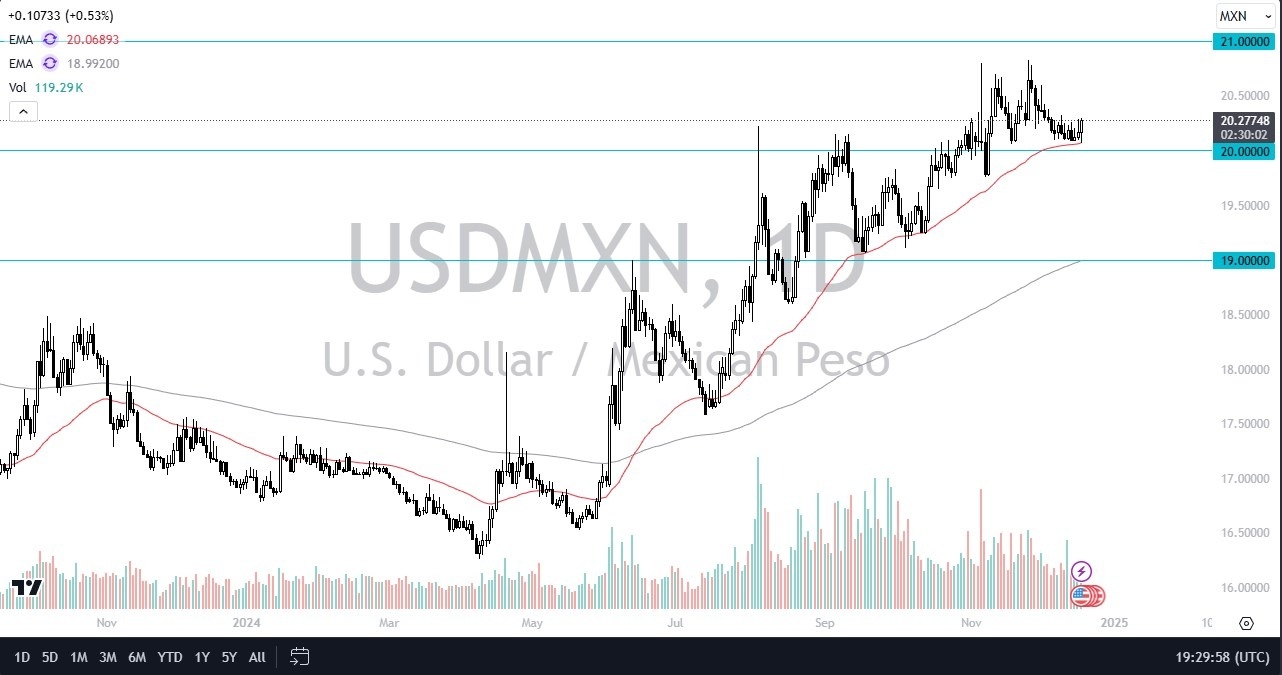

The technical analysis for this pair is obviously very bullish, as we had initially pulled back to reach the 50 Day EMA, only to turn around and show signs of life again. By doing so, the market looks likely to continue to go higher over the longer term, especially as the economy in the United States remain so strong, and it’s likely that we will see some type of tariff on Mexican goods.

With that in mind, I think this is a situation where the market will eventually go looking to the highs again, and I believe it’s probably going to continue to be a market that will look toward the 21 MXN level, which is an area that previously had been a major barrier. Anything above there could send the US dollar going much higher.

Ready to trade our Forex daily analysis and predictions? Here are the best forex brokers in Mexico to choose from.