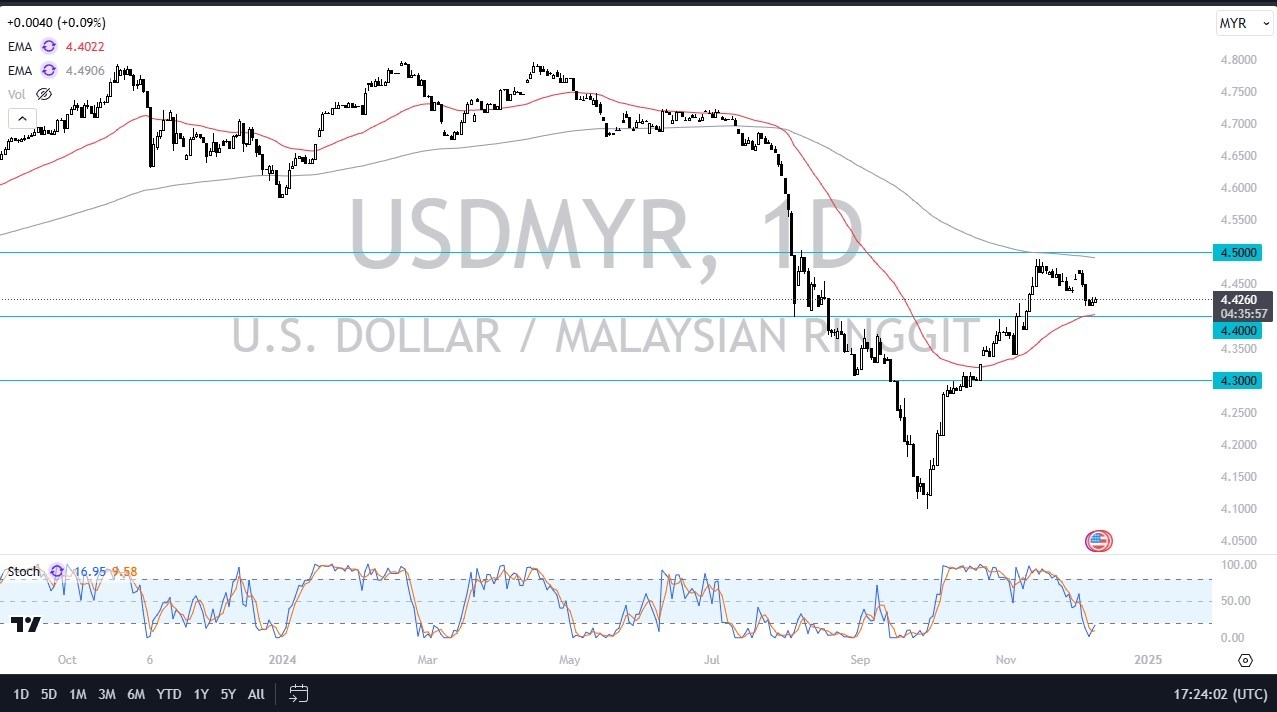

- In my daily analysis of exotic currency pairs, the USD/MYR currency pair has caught my attention as we are sitting between 2 of the biggest moving averages that traders follow, and of course are getting fairly close to a significant support level in the form of the 4.40 MYR level.

- In other words, we are at an area where traders may look to start getting things going, therefore I am watching to see whether or not we see some type of momentum pick up in this pair.

Top Forex Brokers

Technical Analysis

The technical analysis for this pair is at a fairly significant juncture, as the Stochastic Oscillator is crossing over in the oversold condition, while the pair is sitting just above the 50 Day EMA, the 4.40 MYR level, but sitting underneath the 200 Day EMA above, and typically when you are sitting between 2 major moving averages like this, it suggests neutrality.

However, it should be noted that the market is currently digesting the massive gains that we had made over the last couple of months, so I think we’ve got a situation where the market needed to work off some of the excess froth, as the market had gotten too far ahead of itself. Furthermore, we need to keep an eye on what the US dollar is doing in general. After all, the market is going to move in the same direction for the USD against both currencies under normal circumstances, so it’ll be interesting to watch not only how we behave here, but how we behave against other currencies such as the ZAR, MXN, etc.

If we were to break down below the 4.40 level, then I think we could drop to the 4.30 level. On the other hand, if we turn around and break above the 4.50 level, that opens up a much bigger move, perhaps to the 4.71 level over the longer term. This would be accompanied by the US dollar beating up on most other currencies around the world as well would be my first thought with this type of set up.

Ready to trade our daily Forex forecast? Here’s a list of some of the top forex brokers in Malaysia to check out.