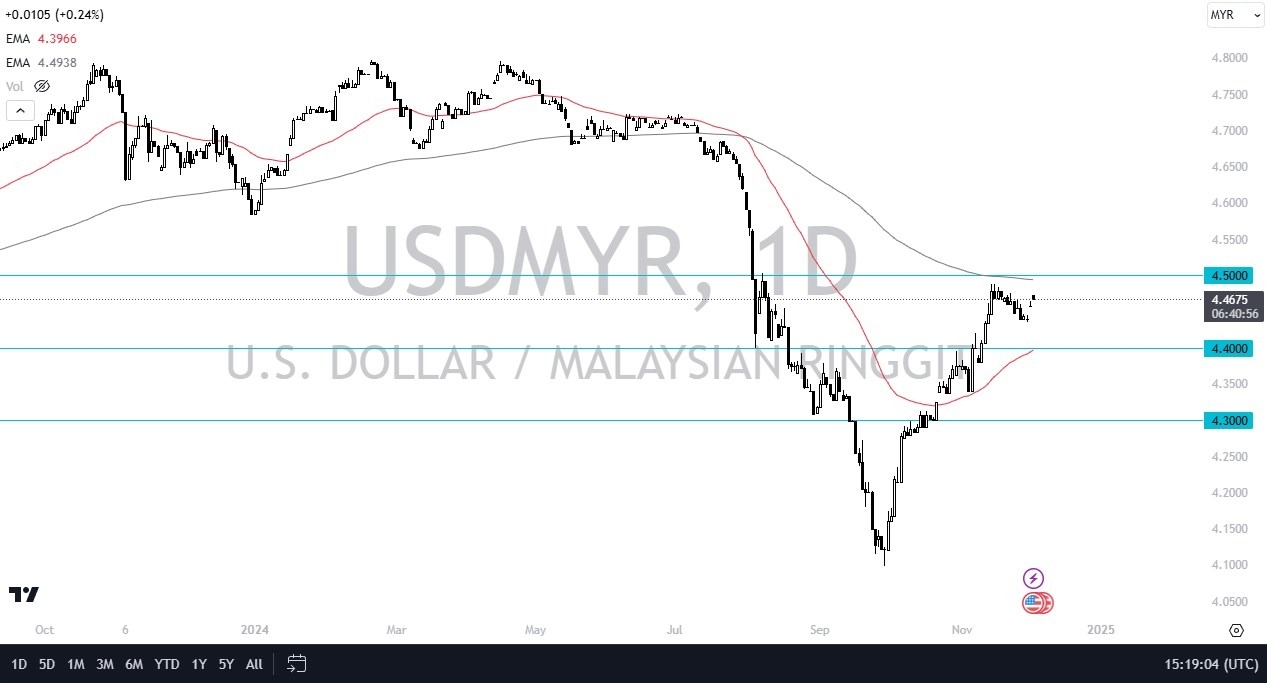

Potential Signal:

- I am a buyer of this pair on a daily close above the 4.50 level.

- I would have a stop loss at the 4.44 level and would be looking for the market to eventually reach the 4.695 level, but I would also keep an eye on the US dollar for what it’s going to be doing against multiple other currencies as well.

- If the US dollar is strengthening against other currencies overall, the ringgit won’t stand a chance.

The US dollar has rallied a bit against the Malaysian ringgit, gaining about a quarter of a percent early during the trading session on Tuesday. At this point, I find this USD/MYR pair very interesting because it is an interesting technical analysis setup. The market has been trying to form some type of bullish flag, but beyond that, it's also been flagging just below the 200-day EMA.

Top Forex Brokers

The 200-day EMA is an indicator that a lot of people pay close attention to, so I think it does have a bit of technical resistance there. Further compounding this potential barrier is the fact that the 200-day EMA sits right at the 4.50 level, which is a large round psychologically significant figure, and an area where we had seen a little bit of resistance previously.

If We Can Break Higher

If we can clear that market level and perhaps even on a daily close, then the market goes looking to the 4.70 level, a fairly significant move. In the meantime, though, I think we've got a situation where a lot of sideways action is probably more likely than not with the 4.40 level underneath being significant support, especially now that the 50 day EMA is sitting right there as well. The US dollar is swallowing almost everything else right now, and that might continue to be the case even against the ringgit, which of course had been very strong previously due to Malaysian growth. As things stand right now though, it looks like we are trying to build up enough pressure to finally break out to the upside.

Ready to trade our daily Forex signals? Here’s a list of some of the top forex brokers in Malaysia to check out.