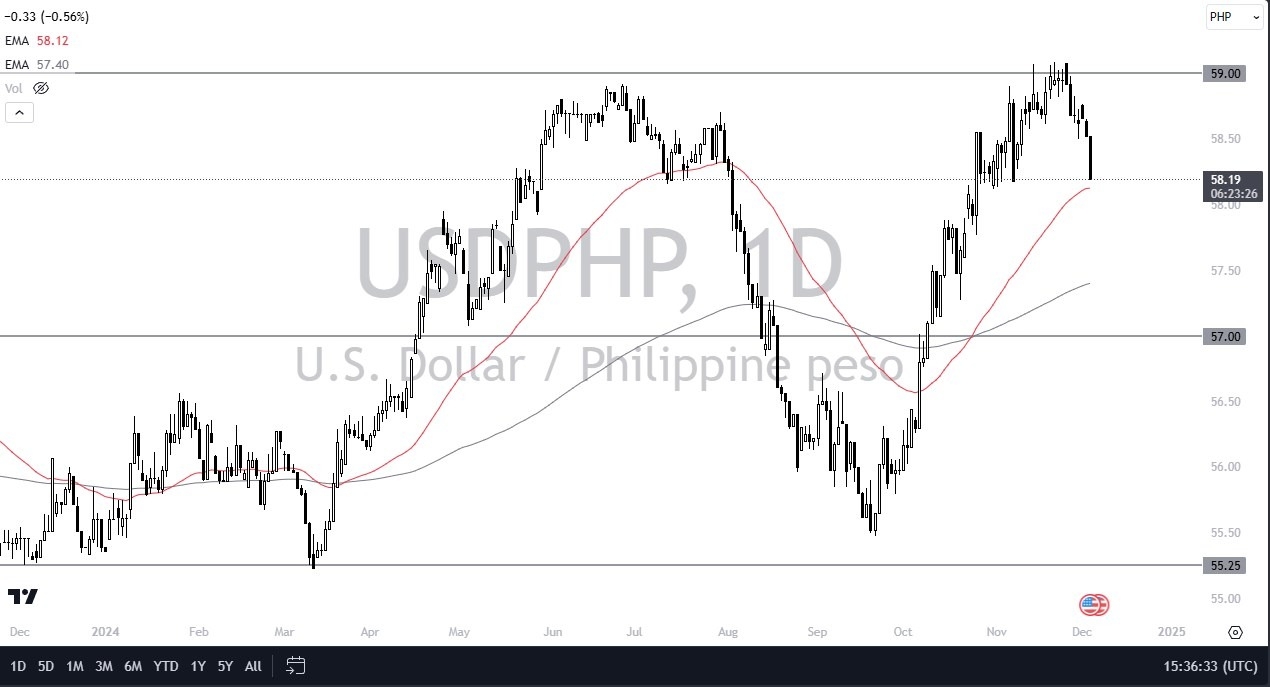

- During my daily analysis of the exotic currency pairs, the market that really stood out to me was the US dollar against the Philippine peso.

- The US dollar recently shot up to the 59 PHP level but has since plunged as the market got a little overdone.

- As I look at the chart on Wednesday, we are testing the crucial 50 Day EMA, so I think that you need to pay close attention to what happens next.

The candlestick for the day is trying to close at the very lows of the range, so this of course is a very ugly look. However, you have to keep in mind that the market has recently rallied rather significantly, and a bit of a pullback does make quite a bit of sense. Longer-term, I still believe that the US dollar is considered to be a “safer bet”, but I also recognize that you need momentum to start to turn this thing around and start buying. I would not get overly exposed to emerging markets at the moment, as the global economy seems to be struggling a bit at various pain points.

Top Forex Brokers

Technical Analysis

The technical analysis for this pair is somewhat murky in the short-term, but longer term we have seen the market slam into a major resistance barrier in the form of the 59 level, an area that has been important multiple times and therefore it’s not a huge surprise to see that “market memory” came into the picture to make things a bit difficult. That being said, a pullback to the 50 Day EMA makes a certain amount of sense, and therefore we are going to have to be very cautious with the overall attitude of the market, meaning that we need to see the US dollar bounce a bit.

We do get the jobs number on Friday, and it’s likely that we could see the US dollar start to move as a result. The Philippine economy has been fairly strong until recently, and therefore I think that comes into play as well. As things stand right now, I fully anticipate that this pair drops below the 50 Day EMA to only find buyers above the 200 Day EMA. A little bit of patience probably goes a long way.

Want to trade our daily forex analysis and predictions? We’ve made a list of the best forex demo accounts worth trading with.