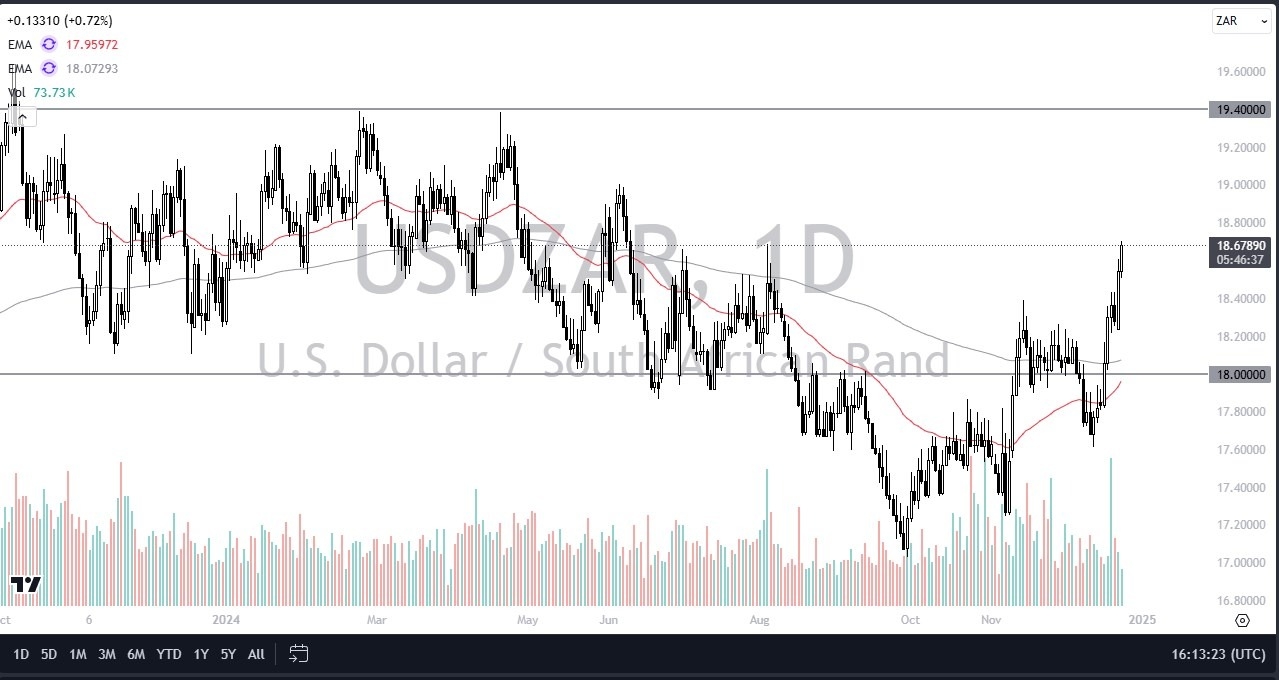

- During my daily analysis of the exotic currency pairs, the USD/ZAR pair is starting to capture my attention again, as the US dollar has rallied quite significantly.

- All things being equal, short-term pullbacks should continue to be a potential play going forward as the US dollar is a little bit overdone at this point, but it does make quite a bit of sense that we would continue to see strength over the longer term.

Emerging Markets

Emerging markets continue to be a place that I would run from, due to the fact that the monetary policy of the United States is going to start changing quite radically, and of course it’s also worth noting that the Federal Reserve is likely to end up being lighter than anticipated during the 2025 year, and therefore I think we’ve got a situation where we will continue to see US dollar strength based on interest rate differential. After all, despite the fact that the Federal Reserve has cut rates, it’s worth noting that the 10 year yield has rallied about 80 basis points, which means you get paid to hold US dollars against quite a few other assets.

While the interest rates in South Africa are a whopping 7.75%, the reality is that the South African central bank cut interest rates by 25 basis points and are leaning toward a more dovish stance. As long as that’s going to be the case, then you need to keep an eye on the fact that the rate of change favors the US dollar. Granted, you do have to pay some swap to get long of this pair, the reality is that there will be so much running toward the treasury markets for safety that I think the South African Rand will continue to have issues.

I think this is true with most emergent markets, but you should also keep in mind that South Africa itself is a bit of a conundrum due to its internal politics.

Ready to trade our daily Forex forecast? Here’s some of theTop-Rated Trading Platforms in South Africa to check out.