Fundamental Analysis & Market Sentiment

I wrote on 22nd December that the best trade opportunities for the week were likely to be:

- Short of the EUR/USD currency pair. This fell by 0.08%.

- Long of the NASDAQ 100 Index following a daily (New York) close above 22,100. This did not set up.

- Long of Cocoa futures or a Cocoa ETF/ETC following a Cocoa futures close above 12,565. This did not set up.

The weekly gain of 0.08% equals 0.03% per asset.

Last week was very quiet due to the Christmas holiday, the very few key takeaways were:

- Canadian GDP was slightly higher than expected, showing a month-on-month increase of 0.3% when only 0.2% was anticipated.

- US Unemployment Claims were almost exactly as expected.

Last week was basically about a continued quiet recovery in risky assets, mainly in stock markets, although this was knocked back on Friday. Bitcoin also performed poorly.

In the Forex market, the commodity currencies are notably weak, especially the AUD and the NZD, while the US Dollar and the British Pound are strong.

The Week Ahead: 30th December – 3rd January

The coming week has a very light schedule as it is the week of the New Year holiday, with many major markets on holiday this Wednesday. This means it will likely be a light week.

The coming week’s important data points are:

- US ISM Manufacturing PMI

- US Unemployment Claims

- Chinese Manufacturing PMI

Tuesday is a public holiday in Germany and Japan, and Wednesday is a widespread public holiday (New Year’s Day) almost everywhere, while Thursday is a public holiday in Switzerland and Japan. Japan is also on holiday on Friday.

Monthly Forecast January 2025

For the month of December, I forecasted that the EUR/USD currency pair would fall in value. The performance of my forecast so far is:

For the month of January, I forecast that the USD/JPY currency pair will rise in value, and that the EUR/USD currency pair will fall in value.

Weekly Forecast 29th December 2024

Last week, I made no weekly forecast as there were no unusually strong price movements in currency crosses, which is the basis of my trading strategy.

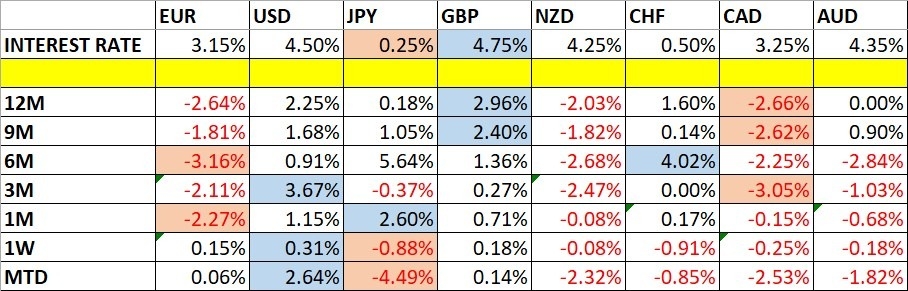

The US Dollar was again the strongest major currency, while the Japanese Yen was again the weakest. Volatility was sharply lower last week, with fewer than 4% of the most important Forex currency pairs and crosses changing in value by more than 1%. It is likely to remain very low again this week.

You can trade these forecasts in a real or demo Forex brokerage account.

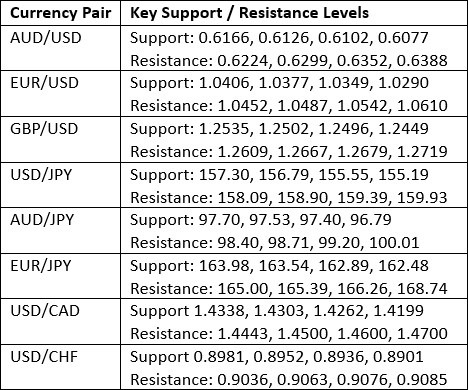

Key Support/Resistance Levels for Popular Pairs

Technical Analysis

US Dollar Index

Last week, the US Dollar Index again printed a bullish candlestick that continued in the direction of the long-term bullish trend, making its highest close in more than 2 years. The price is above its price from three and six months ago, suggesting a healthy long-term bullish trend in the greenback that should be exploitable. However, the price has also again rejected the resistance level shown below at 107.95, and the candlestick is an inside bar, both of which might be bearish factors.

I have plenty of fundamental reasons to be bullish on the US Dollar after the Federal Reserve’s hawkish tilt two weeks ago which took markets by surprise and triggered a rise in the greenback and a sharp selloff in stocks, while US treasury yields rose.

There is a bullish trend, but it may be a bit weak and show slowing momentum. Overall, I see the Dollar as more likely to rise than fall over the coming week. A successful breakout beyond 107.95 would make me more bullish as the price would then technically have more room to rise.

EUR/USD

The EUR/USD currency pair is in a valid long-term bearish trend. This currency pair typically takes its time to move, with its trends usually including plenty of deep retracements, but for almost three weeks after plunging to a new long-term low price well below $1.0400, the price consolidated without turning definitively bearish.

This has changed over the past couple of weeks, and the downwards pressure was given a strong boost from the Federal Reserve’s more hawkish approach on rate cuts going forward. However, the bearish momentum seems to have slowed, with the price refusing to spend much time below the big round number at $1.0400 let alone the lowest recent daily close at $1.0351.

This currency pair often has very reliable trends, which is why I am interested in being short, but more cautious traders might want to wait for a new low in the daily close.

Top Forex Brokers

USD/JPY

The USD/JPY currency pair continued to rise firmly for the third consecutive week, making its highest weekly close since last summer. This can be taken by trend traders as a signal to enter a long trade. However, it is worth nothing that the weekly candlestick was an inside bar, which can indicate loss of momentum and indecision, although as last week was a holiday week, that is probably an aggressive interpretation of the situation.

The US Dollar has continued to advance, although at a slower pace.

The Japanese Yen as the other side of this currency pair has weakened lately, especially after the Bank of Japan passed on a potential rate hike two weeks ago. There is still no work from any Bank officials about when rate hikes are likely to start.

I see this currency pair as a buy as it tends to trend quite reliably over the long term.

NZD/USD

Last week, the NZD/USD currency pair printed a fourth consecutive large, bearish candlestick, closing not far from its low. It closed at a new 2-year low, which is a significant bearish breakdown in any asset.

The Australian Dollar has got a lot of attention lately as it weakened to new long-term lows as the RBA passed on a rate cut, but it is worth noting that the New Zealand Dollar is also very weak, although the Aussie is showing slightly stronger bearish momentum than the Kiki now.

This currency pair does not trend very reliably, so I don’t take long-term trades in it, but it certainly looks very weak right now. A good approach might be to use a combination of the AUD and the NZD as the short components in any medium-term Forex trades over the coming week.

AUD/USD

Last week, the AUD/USD currency pair printed a firmly bearish candlestick, closing just a few pips off its low. It closed at a fresh 2-year low, which is a significant bearish breakdown in any asset.

The Australian Dollar has got a lot of attention lately as it weakened to new long-term lows as the RBA passed on a rate cut, but it is worth noting that the New Zealand Dollar is also very weak, as are all the commodity currencies to some extent. The Australian Dollar is the weakest of all, and the linear regression analysis shown within the price chart below suggests a reliable bearish trend has taken hold over the past several weeks

This currency pair does not trend very reliably, so I don’t take long-term trades in it, but it certainly looks very weak right now. All the commodity currencies are performing very poorly, so one idea to partially diversify risk in Forex trading might be to be short of all of them against the asset you are bullish on, especially the Australian and New Zealand Dollars.

NASDAQ 100 Index

Last week saw the NASDAQ 100 Index fall quite firmly on Friday after gaining strongly during the first three days of the week. Leading tech shares were hit by worries on Friday, although by the day’s close, the tech index had regained some of its losses.

There is a long-term bullish trend, but it may be wise to wait for the price to close at a new record high before entering a new long trade for two reasons. Firstly, because the short-term price action is not bullish, especially after Friday’s drop so we may have seen the peak for a while already. Secondly, because it is the year-end period which can see strange and volatile moves as institutions reposition, partly for changing forecasts, partly for tax reasons, which can make markets unpredictable.

I see the NASDAQ 100 Index as a buy, but only after making a new daily close above 22,100. Despite the recent bearish price action, it is worth remembering that the price is not far off its record high made just a few days ago above 22,100, and bulls could easily push the price above that level over the coming week so make a new record high.

The support at 21,023 looks strong, so another approach might be to buy after another bullish bounce from that area.

Bottom Line

I see the best trading opportunities this week as

- Short of the EUR/USD currency pair following a daily close below $1.0351.

- Long of the USD/JPY currency pair.

- Long of the NASDAQ 100 Index following a daily (New York) close above 22,100.

Ready to trade our weekly Forex forecast? Check out our list of the top 10 Forex brokers in the world.