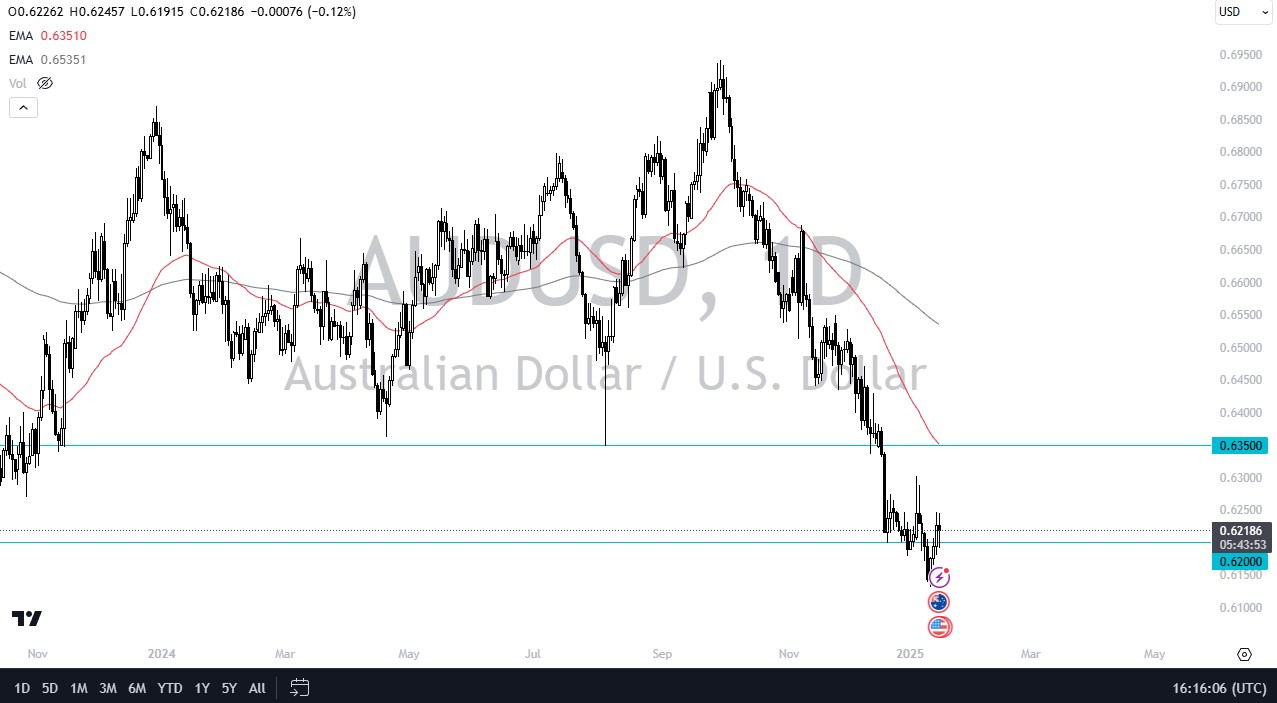

- In my daily analysis of major currency pairs, the AUD/USD is what I find very interesting, as we are hanging around the 0.62 level, an area that of course is a large, round, psychologically significant figure, and an area that I think a lot of people will be paying close attention to.

- After all, it has recently been an area of volatility, and as a result I think we continue to see the Australian dollar chop back and forth overall.

All of that being said, I am very negative on the Australian dollar in its prospects, and I think we’ve got a situation here where the market will probably continue to see a lot of selling pressure on short-term rallies, but quite frankly we have seen that time and time again over the last several weeks. Australia is unfortunately attached to China, and China of course is slowing down quite a bit. With that being the case, I think you need to keep in mind that until China turns things around, Australia probably doesn’t stand much of a chance.

Top Forex Brokers

Technical Analysis

The technical analysis for the AUD/USD is still rather bearish, and I think at this point in time we are more likely than not going to be a bit of a bounce here and there, but given enough time, I think you’ve got a situation where the traders out there are going to be looking to step on any rally that opens up. A rally that reaches the 0.63 level would be interesting for me to start shorting, just as a move to the 0.6350 level will as well. Furthermore, it’s worth noting that the 0.6350 level is where we see the 50 Day EMA, so it because a little bit of a resistance barrier as well. If we were to break above there, then I might consider buying the Australian dollar.

All things being equal, it would not surprise me at all to see this market go looking to the 0.60 level, which of course is a large, round, psychologically significant figure, and an area where we have seen a lot of noise in the past.

Ready to trade our daily AUD/USD Forex analysis? Here's a list of the best brokers FX trading Australia to choose from.