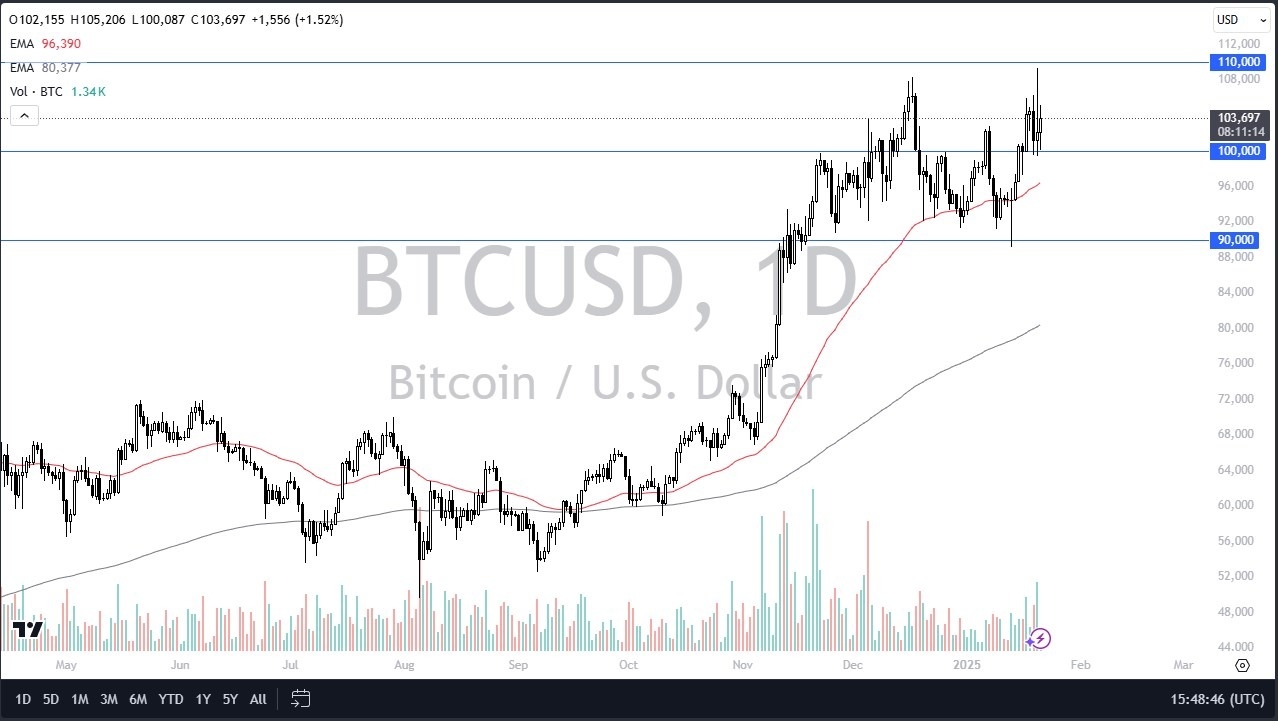

- Bitcoin has gone back and forth during the trading session here on Tuesday as we continue to bounce around in the same consolidation area.

- I do believe that Bitcoin will eventually break out to the upside, but the biggest problem we have now is that there does seem to be a bit of a brick wall near the $110,000 level. Fortunately, though, the last couple of days has been all about the $100,000 level being supported.

- And I think that might continue to be the case, but even if it isn't, the consolidation zone extends all the way down to the $90,000 level. And with the 50-day EMA near the $96,000 level, I think it all comes in quite nicely for a buy-on-the-dip type of opportunity.

Crypto Friendly US Government

After all, we have a pro-crypto administration in the White House now, and although they haven't done anything yet, it is expected that crypto will become more mainstream during the Trump administration. If that's going to be the case, and it certainly would make sense, as he wants America to be the epicenter of the Bitcoin ecosystem, then one would have to assume that institutional traders will still be involved.

We have recently seen a massive gain since the Trump election. So now we're working that off. We've been consolidating. We've seen this before, where the market will just consolidate for what seems like a lifetime and then take off again at the next major catalyst. I think right now we're just waiting for that catalyst to show up. Accumulation is a word that I hear a lot and practice a lot in this market. And I think that dips continue to be buy-on the dip type of opportunities that traders will flock to. I have no interest in shorting Bitcoin.

Top Forex Brokers

Ready to trade our daily Forex signals? Here’s a list of some of the best crypto brokers to check out.