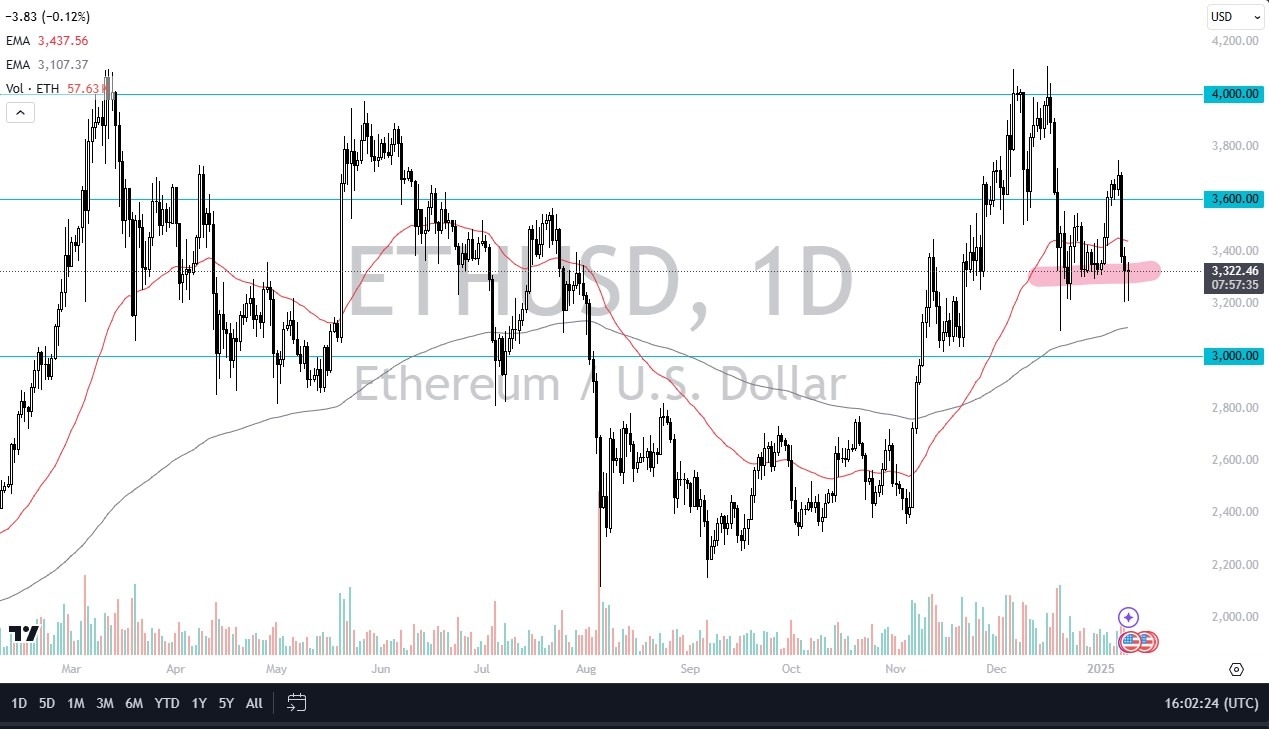

- During my review of cryptocurrency markets, the Ethereum market has captured my attention due to the fact that we are sitting right at a major support level that I had pointed out a couple of days ago.

- The Thursday session was very similar to the Wednesday session, where we had dropped rather drastically, only to see the market turn around and pick up momentum yet again.

- The fact that we are forming a bit of a hammer suggest that we are going to continue to see buyers on dips, and I think that is the main theme here, as well as most crypto in general.

Never Forget the Influence of Bitcoin

Top Forex Brokers

The one mistake that you see a lot of Ethereum traders make is that they forget that Ethereum is essentially “silver to Bitcoin’s gold.” In other words, Bitcoin will continue to be the main driver of what happens with digital assets, and it happens to be consolidating at the moment. All things being equal, you should also pay attention to the fact that the 50 Day EMA sitting just above is relatively flat, so we can break above there, then it’s possible that the market could go looking to the $3600 level. If we were to turn around and break down below the $3200 level, then it’s possible that we could go down to the 200 Day EMA, which is closer to the $3100 level.

Keep in mind that Ethereum is still pretty far out there on the “risk appetite curve”, and therefore think you need to recognize that if one risk gets eviscerated again, that will be very negative for Ethereum. Keep in mind that Friday is the Non-Farm Payrolls announcement coming out of the United States, which of course will have a major influence on where we go as far as risk appetite is concerned as well. After all, most traders are more worried about what the Federal Reserve is going to do than anything else, so if we continue to see hot economic numbers out of the United States, it could cause a little bit of a “knee-jerk reaction” that could be negative for risk appetite assets such as Ethereum, but quite frankly I think we’ve got a situation where that will only end up being a buying opportunity.

Ready to trade our Ethereum forecast? We’ve shortlisted the best MT4 crypto brokers in the industry for you.