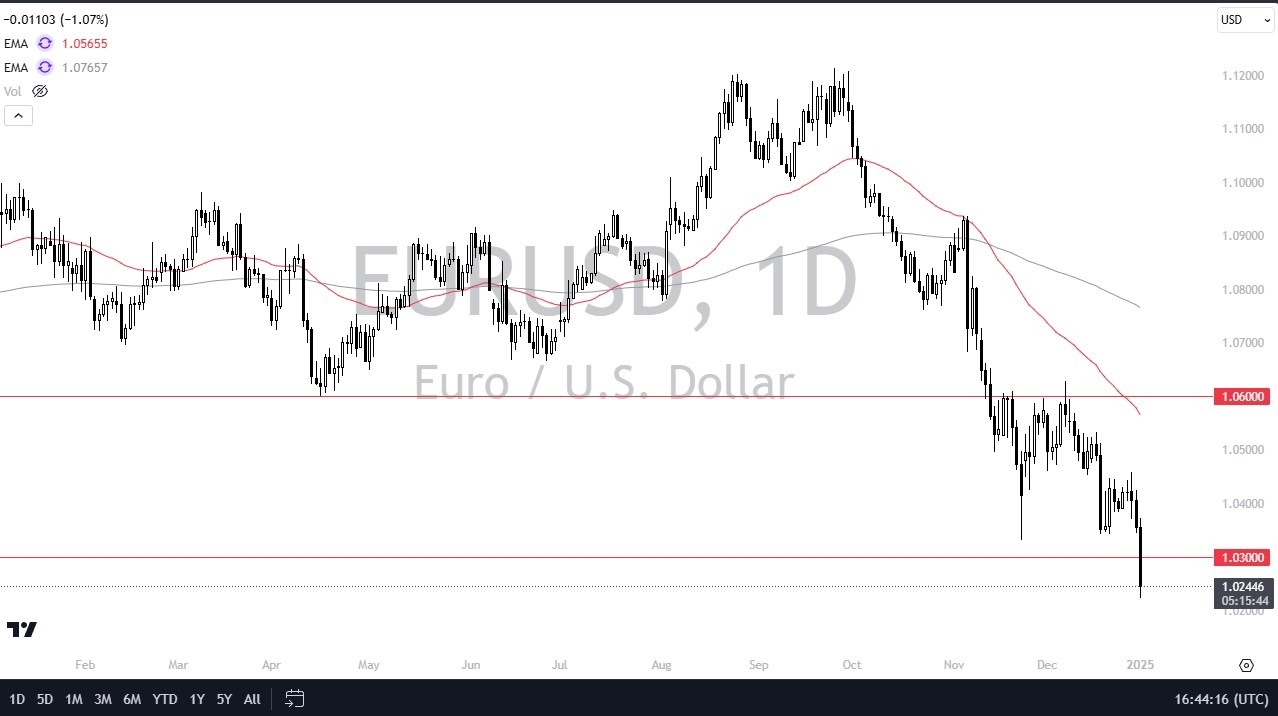

- The euro fell apart during the trading session on Thursday as traders came back to work.

- Piercing the 1.03 level does matter. Whether or not we can stay below there for a sustained move remains to be seen, but this sets up a very probable breakdown towards the parity level. Why wouldn't it?

- The ECB is looking to loosen interest rates. The Federal Reserve may not have a choice but to keep them somewhat elevated. So, you already get paid to hang on to this short position.

America > Europe

Top Forex Brokers

Furthermore, the economic news out of Europe is one bad thing after another, while the Americans can barely calm themselves down long enough to bring inflation back down to normal levels. So, with massive debt problems around the world, it does make sense that the US dollar continues to strengthen. We also have the safety bid, which comes into the picture as well. Let's be honest here, there are plenty of things out there to be worried about that people are probably better off, at least in their minds, of just buying bonds with a reasonable yield and sitting this one out. The first place that comes to mind, of course, is Ukraine. But we also have the Middle East and the other parts of the world right now that have seen so much in the way of conflict.

So, with all of this coming together, when you look at the technical analysis, it's not a huge surprise that we're down here. If we break down below the daily candlestick for the session, there's nothing to stop this from going to parity unless there's some type of surprise announcement. I'll be looking to either fade short term rallies on short, short, charts, such as maybe the 30 minute chart or the hourly chart on signs of exhaustion. That's been the play all along, but we haven't gotten the bounce that I really wanted to see. I wanted to find more value in the dollar. But I don't even think this is going to happen. When you look at the US dollar against so many other currencies during the session, it's clear it's greenback or bust for most forex traders.

Ready to trade our daily EUR/USD Forex forecast? Here’s a list of some of the top forex brokers in Europe to check out.