- During my daily analysis of major currency pairs, the EUR/USD pair is one that I always check first, and right now it looks like it’s very neutral.

- This makes a certain amount of sense considering that the market had sold off quite drastically, and therefore we probably need to digest some of the gains from the US dollar.

- While I am not necessarily looking to get aggressive here, I would be willing to let the market bounce a bit before taking advantage of “cheap US dollars.”

Technical Analysis

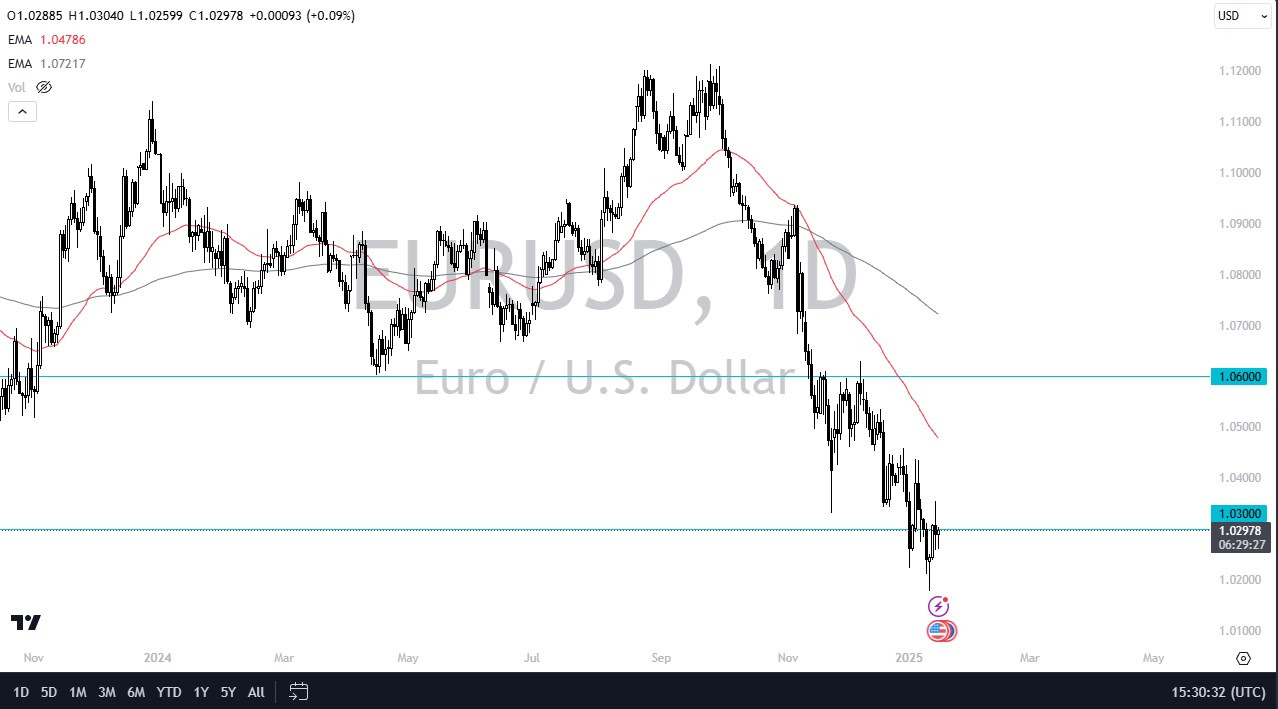

The technical analysis for the EUR/USD pair is obviously very negative, but it is also worth noting that we had ventured a little far from the 50 Day EMA, which sits right around the 1.05 level. Any rally toward that area would have be very interested in shorting this pair at the first signs of exhaustion. That’s been the case for a while, you just simply wait for the euro to get a little bit of a rally, and then you start fading. I think this will probably remain the case for some time, but it is worth noting that a little bit of patience probably goes a long way here.

Top Forex Brokers

To the downside, the 1.02 level is an area that I think will offer significant support, and therefore you need to pay close attention to it. If we were to break down below there, then I think the bottom falls out in the euro, and that would be the sign that we are in fact getting ready to go to the parity level. For what it is worth, I believe that the parity level will eventually be tested, but that doesn’t mean we get there easily. Furthermore, it’s also worth noting that there has to be a certain amount of profit-taking sooner or later, so that might also be a factor in this pair. I have no interest in buying the euro, and if I wanted to buy something against the US dollar, the euro would be just about at the bottom of that list.

Ready to trade our EUR/USD daily forecast? Here’s a list of some of the top forex brokers in Europe to check out.