- The pair has been very noisy over the last 24 hours. That is not a huge surprise, considering Donald Trump is in office now, and, of course, he has been tweeting already, talking about tariffs and causing absolute chaos. I think that's probably what you are going to see for the next four years.

- That's certainly what we saw during his first administration - he would just throw comments out there and cause chaos for traders. Because of this, you are going to have to adjust the position size for a while, understanding that volatility is a feature, not a bug, of a Trump administration.

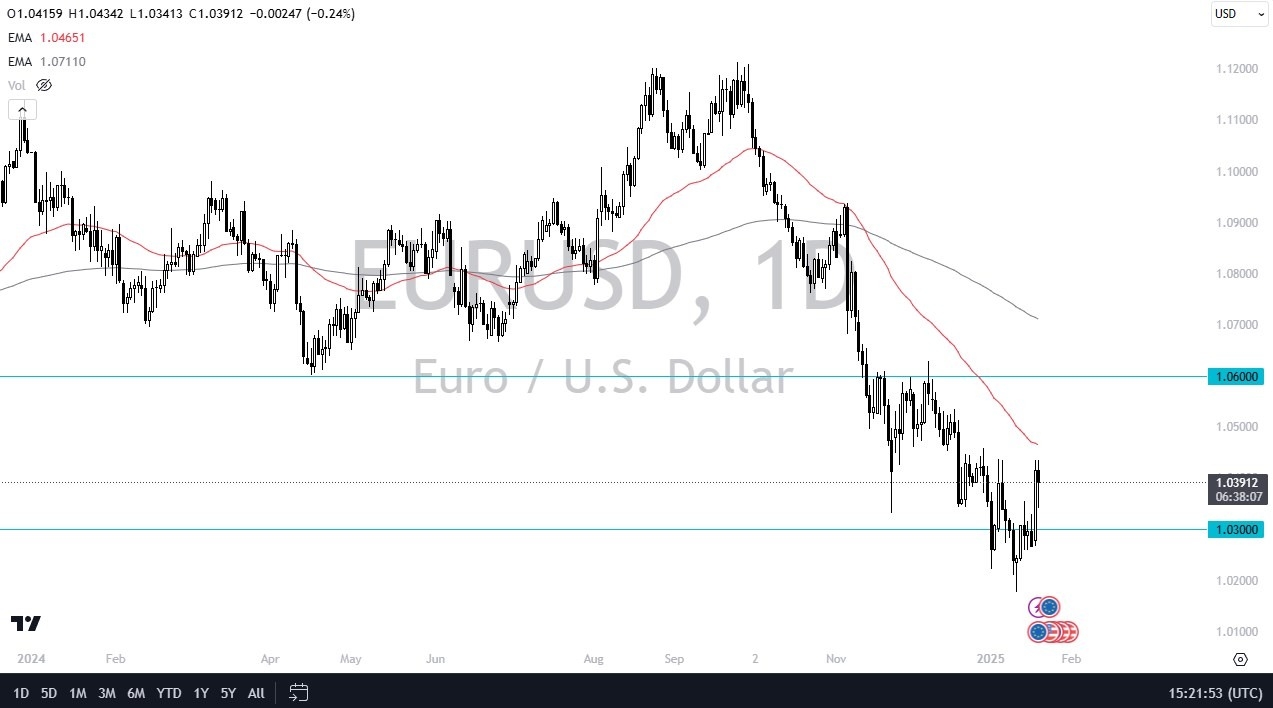

There are a lot of opportunities here though, and this might send the Euro a little higher, but I think there are plenty of reasons to think that the upside is somewhat limited. The 50-day EMA causes a bit of a barrier, and if we can break above there, then we have the 1.06 level offering a barrier as well. And in fact, it's really not until we get above there that I take any rally seriously. I'll be looking to buy cheap US dollars, in other words, short this market.

Support

There is quite a bit of interest near the 1.03 level, but until there's reason to believe that Europe is going to get its house in order, I just don't have any interest in buying this pair. I think a bounce, and then a shorting opportunity is what you're looking for. And that's actually been the case for a moment here. So, with the US dollar being so overbought against so many other currencies, I think it makes sense that we see the Euro, the Australian dollar, the British pound all rise a bit before shorting starts again as interest rates in America continue to be stubbornly strong.

Top Forex Brokers

Ready to trade our free trading signals? We’ve made a list of the best European brokers to trade with worth using.