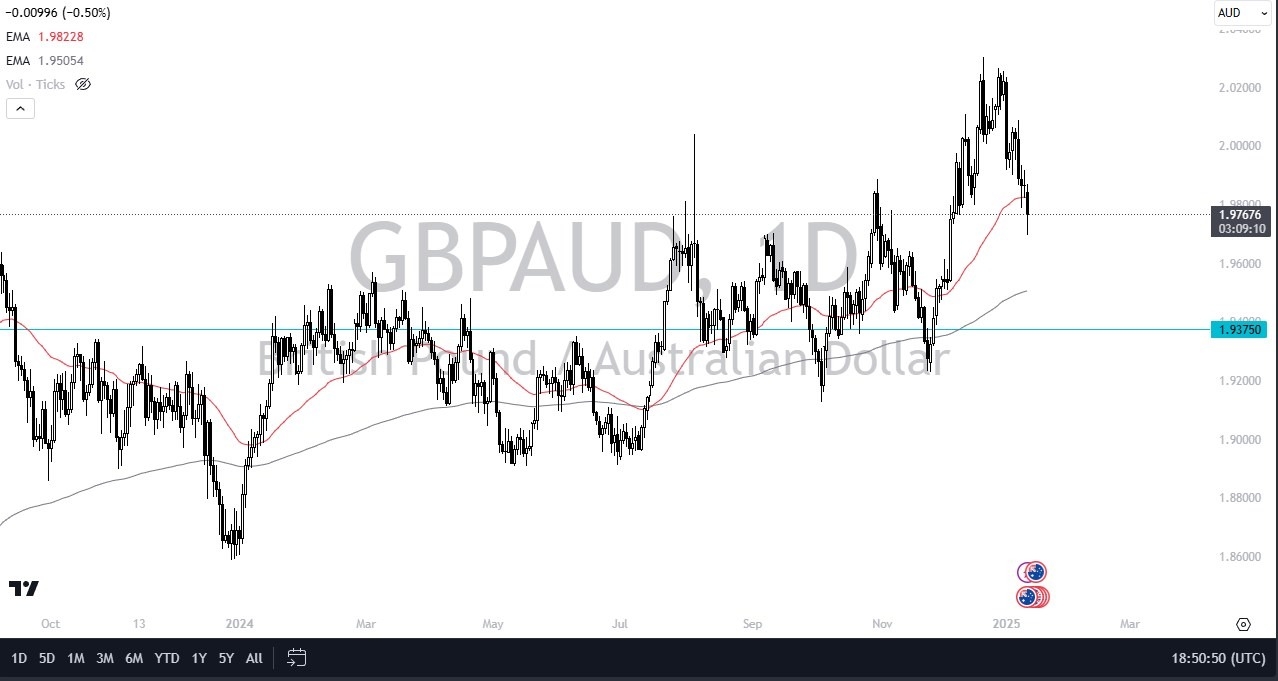

- The British pound has fallen pretty significantly across the board during the trading session on Monday. That includes the Australian dollar.

- However, it does look like the 1.97 level is trying to offer support.

- That would not be a huge surprise because it's an area that's been important a couple of times in the past. This should bring in the concept of “market memory” going forward.

This is literally going to be a fight between a couple of lightweights. So read into that which you will. And the British pound bouncing the way it has does suggest that perhaps it is trying to do everything you can to continue the move to the upside. If we can break above the 1.9850 level, then it's possible that this market will continue that move and go looking for the 2.02 level, near where we peaked out at previously. This should continue to be an important area to look at, and as a result, this is worth watching and keeping in mind at this point.

Top Forex Brokers

The United Kingdom Government is the Problem

While the British pound has a world of hurt attached to it due to the incompetencies in the UK government, and including scandals and poor budgeting, the Australians, unfortunately for them, are highly levered to the Chinese economy, and that has a major influence on how they play out. After all, if China goes down, so does the Australian economy. Australia sends almost all of its exports in bulk to the Chinese mainland these days So therefore the two economies are inexorably Intertwined with this being the case. I don't like the Aussie dollar regardless but if we start to see the pound recover across the board This might be the secret backdoor play to take advantage of that because I don't really want to short the US dollar for example.

Ready to trade our Forex daily analysis and predictions? Check out the largest forex brokers in Australia worth using.