Gold

Gold markets had a very strong week, testing the crucial $2700 level. The $2700 level is an area that a lot of people will be watching closely, as it has been important multiple times. Because of this, it will be important to watch whether or not we can break above there, but if we do get a daily close above the $2700 level, that could be the sign that we are going to continue to go higher. On the other hand, we could pull back, but that will more likely than not only offer a buying opportunity in this consolidation that of course was preceded by a big move to the upside.

Gold markets had a very strong week, testing the crucial $2700 level. The $2700 level is an area that a lot of people will be watching closely, as it has been important multiple times. Because of this, it will be important to watch whether or not we can break above there, but if we do get a daily close above the $2700 level, that could be the sign that we are going to continue to go higher. On the other hand, we could pull back, but that will more likely than not only offer a buying opportunity in this consolidation that of course was preceded by a big move to the upside.

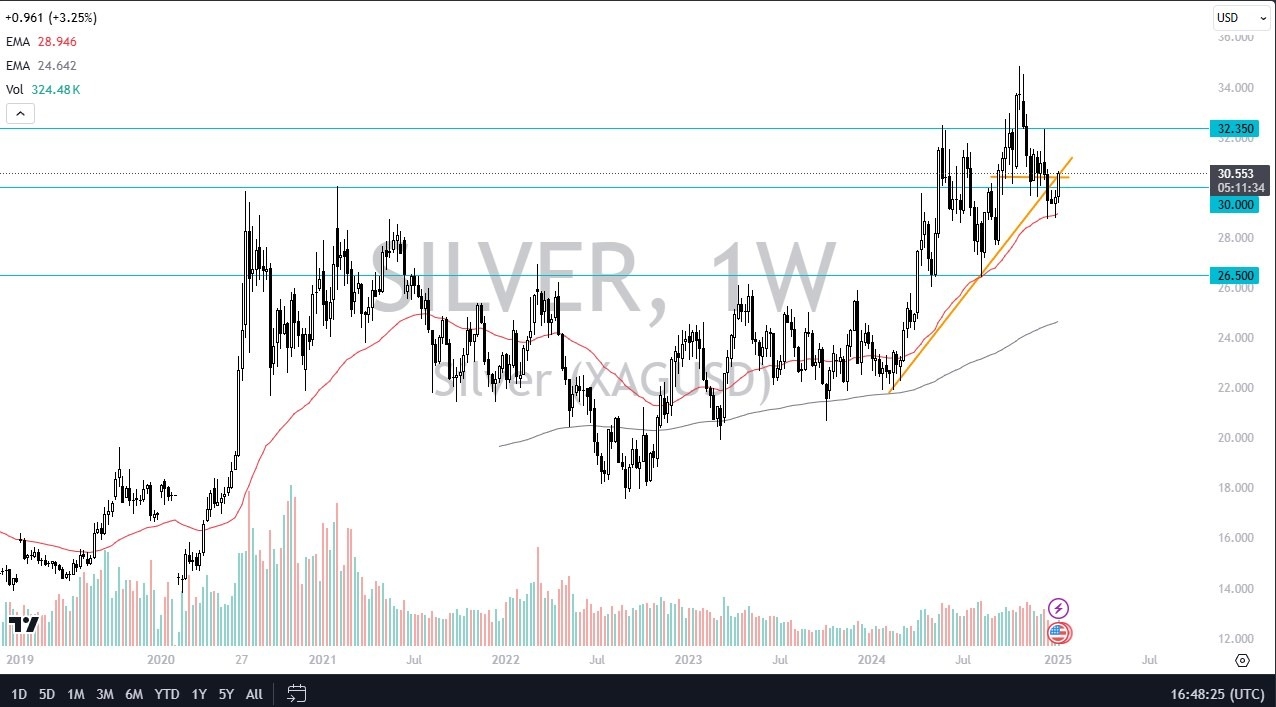

Silver

Silver has rallied rather significantly during the course of the trading week and finds itself near a major resistance region. We have a previous uptrend line, and on the daily charts we have the 50 Day EMA. With that being said, I think we are at a major point of inflection, and this week is the decision that we have been waiting for. At this point, the market can break above the $31 level, then it’s likely that we can continue to go much higher. On the other hand, if we break down from here, a move below the $30 level could signal that there’s a bit more trouble.

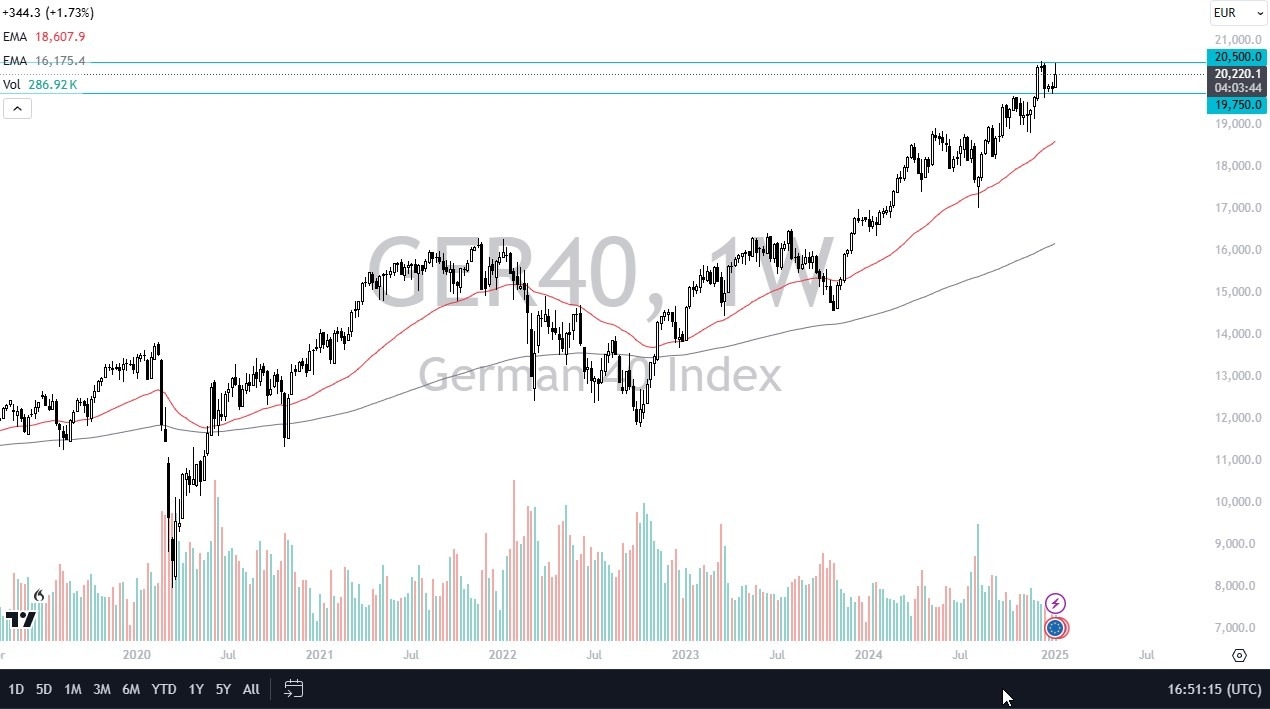

DAX

The German index had a positive week but continues to see a lot of noisy behavior near the €20,500 level. The €20,500 level is an area that previously has offered a bit of resistance, so does make a certain amount of sense that we would see it pushing markets back down again. Short-term pullbacks though should end up being nice buying opportunities, and I think buyers will of course look at any opportunity to “buy the dip” as a potential opportunity. As things stand right now, I don’t have any interest in trying to short this market.

The German index had a positive week but continues to see a lot of noisy behavior near the €20,500 level. The €20,500 level is an area that previously has offered a bit of resistance, so does make a certain amount of sense that we would see it pushing markets back down again. Short-term pullbacks though should end up being nice buying opportunities, and I think buyers will of course look at any opportunity to “buy the dip” as a potential opportunity. As things stand right now, I don’t have any interest in trying to short this market.

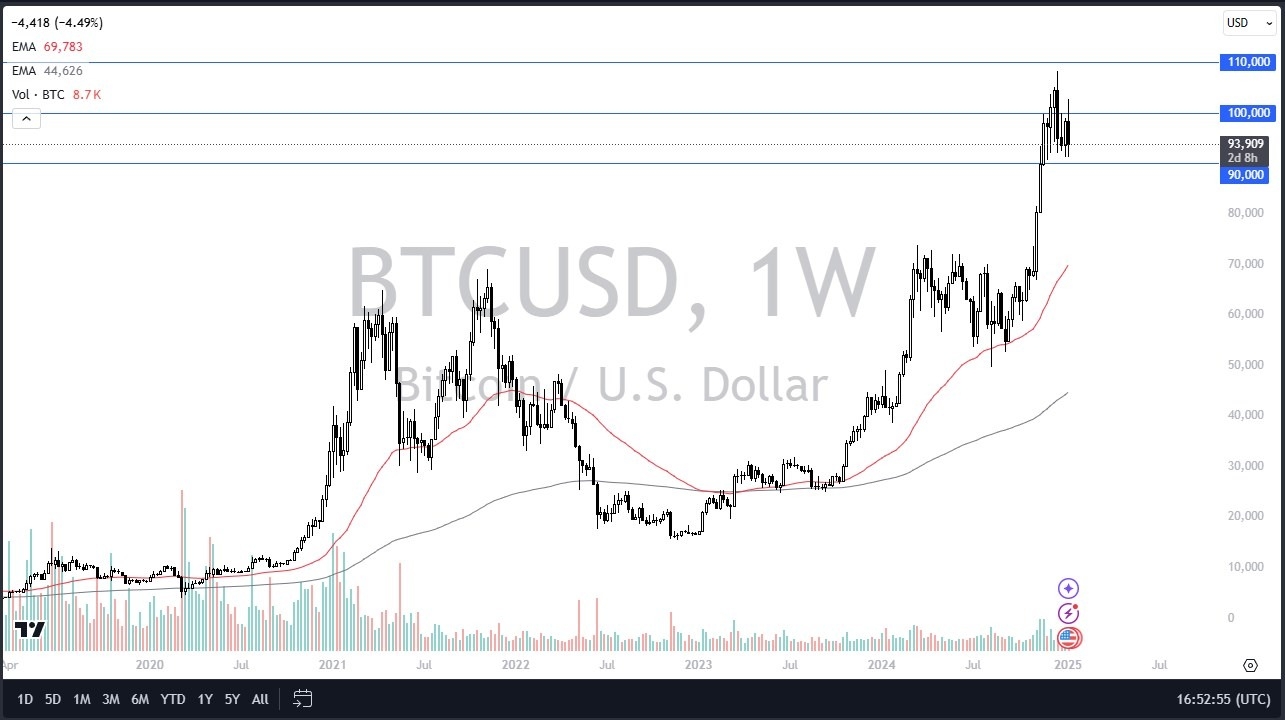

Bitcoin

Bitcoin has gone back and forth during the course of the trading week, as we tried to break out to the upside and above the $100,000 level. However, we failed and ended up plummeting toward the $93,000 level yet again. This is an area that’s been pretty significant in support, and I think it will probably continue to be. Anything below the $88,000 level for me gets this market selling off quite drastically, perhaps dropping all the way down to the $74,000 level. On the other hand, if we can break above the top of the candlestick for the week, it opens up the possibility of a move back to the $109,000 level.

Top Forex Brokers

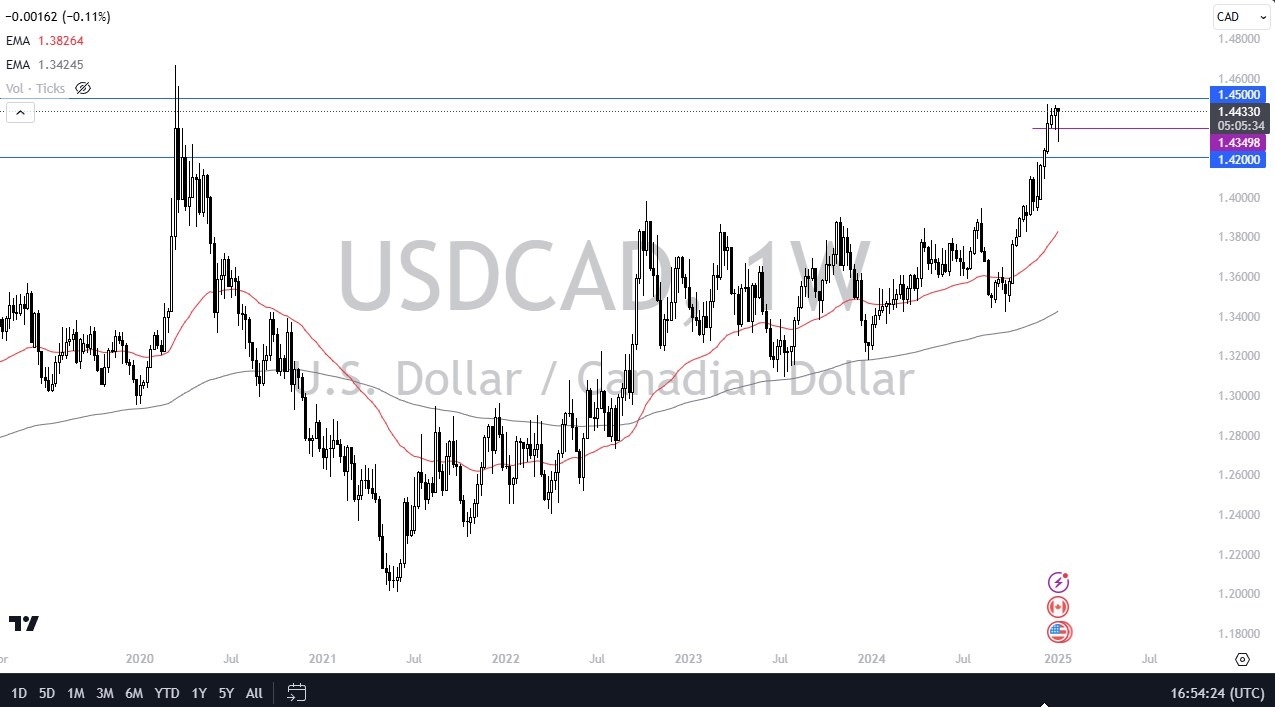

USD/CAD

The US dollar initially fell against the Canadian dollar during the course of the trading week but has turned around to form a massive hammer. By doing so, it demonstrates just how much upward pressure there is in this pair, and quite frankly with the Canadian Parliament on pause, it’s really difficult to imagine a lot of people wanting to throw money at the Canadian dollar. Given enough time, it looks like we will probably break the psychologically and structurally important 1.45 level. Short-term pullbacks should continue to be buying opportunities.

USD/JPY

The US dollar has pierced the crucial ¥158 level during the course of the trading week, but after the jobs number fell pretty significantly. This was just after shooting straight up in the air, so it shows just how much volatility there is in this market, and it would not be overly surprising to find out later down the road that the Bank of Japan was involved. If we can break above the top of this candlestick, it should send this market higher given enough time, but quite frankly I think you still need to look at this as a “buy on the dips” type of market.

The US dollar has pierced the crucial ¥158 level during the course of the trading week, but after the jobs number fell pretty significantly. This was just after shooting straight up in the air, so it shows just how much volatility there is in this market, and it would not be overly surprising to find out later down the road that the Bank of Japan was involved. If we can break above the top of this candlestick, it should send this market higher given enough time, but quite frankly I think you still need to look at this as a “buy on the dips” type of market.

NASDAQ 100

The NASDAQ 100 initially tried to rally for the week, but then turned around and break down below the lows of the last couple of weeks, showing signs of extreme weakness. Furthermore, Wall Street is whining about the idea that the US economy is fairly strong, and therefore they will get cheap money from the Federal Reserve anytime soon. That being said, I do think eventually people start to think about the idea that the strong economy might actually be a good thing, but as things stand right now, it’s very unlikely that we are entering a strong downtrend, rather I think value hunters will jump in sooner or later.

The NASDAQ 100 initially tried to rally for the week, but then turned around and break down below the lows of the last couple of weeks, showing signs of extreme weakness. Furthermore, Wall Street is whining about the idea that the US economy is fairly strong, and therefore they will get cheap money from the Federal Reserve anytime soon. That being said, I do think eventually people start to think about the idea that the strong economy might actually be a good thing, but as things stand right now, it’s very unlikely that we are entering a strong downtrend, rather I think value hunters will jump in sooner or later.

S&P 500

The S&P 500 initially tried to break above the 6000 level but has since been slammed as we are pressuring the 5800 level now. This is an area that should be significant support, but quite frankly this is a market that is reacting to a strong US economy, which of course is horrible for stocks. Beyond that, you have US dollar strength, so traders are now starting to talk about the idea of US exports becoming too strong for other countries around the world. Regardless, I think you will get a bounce that you can start buying into.

The S&P 500 initially tried to break above the 6000 level but has since been slammed as we are pressuring the 5800 level now. This is an area that should be significant support, but quite frankly this is a market that is reacting to a strong US economy, which of course is horrible for stocks. Beyond that, you have US dollar strength, so traders are now starting to talk about the idea of US exports becoming too strong for other countries around the world. Regardless, I think you will get a bounce that you can start buying into.

Ready to trade our weekly Forex forecast? We’ve made a list of some of the best regulated forex brokers to to choose from.