USD/MXN

The US dollar has rallied rather significantly against the Mexican peso during the previous week but has given back some of the gains. All things being equal, think we continue to focus significantly on the 21 MXN level, which is an area that if we were to break above, it could open up a huge move higher. I think at this point, it’s very likely that we will continue to go back and forth, with more or less a “buy on the dip” type of attitude. If we break down below the 20 MXN level, then we could see more of a deeper correction.

USD/CAD

The US dollar initially fell against the Canadian dollar during the week but has turned around to show signs of significant strength. By doing so, the market looks as if it is going to continue to see more of a “buy on the dip” attitude, as market participants continue to pay close attention to the 1.45 level. If we can get above there, then it’s likely that the market will continue going higher, perhaps breaking out through massive resistance. Between now and that move, I anticipate that we will see the occasional pullback in order to take profit. I also believe that there are plenty of buyers out there willing to get involved.

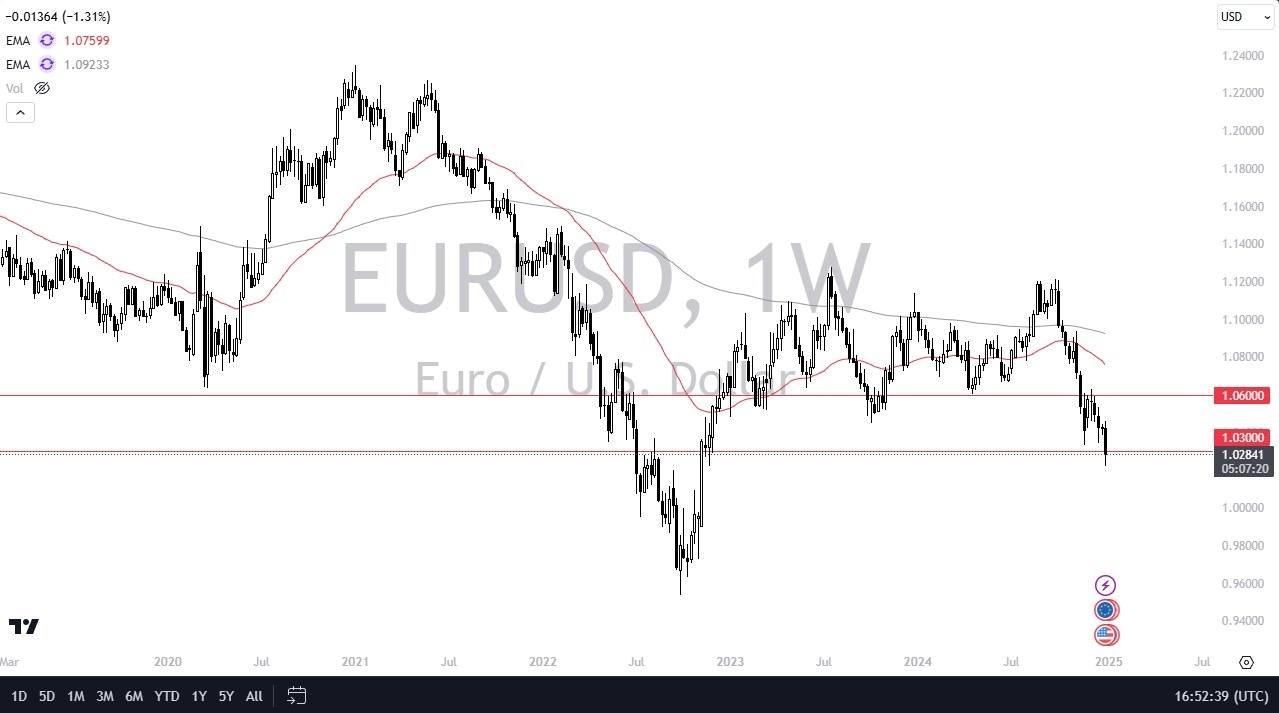

EUR/USD

The euro initially tried to rally during the week but then fell apart as we broke below the 1.03 level. The 1.03 level of course is a large, round, psychologically significant figure, and an area that previously had been massive support. The fact that we have pierced that level suggests to me that we are going to continue going lower. All things being equal, I like the idea of feeding short-term rallies that show signs of exhaustion, and I think the euro is eventually going to go looking to the parity level.

GBP/USD

The British pound broke down during the course of the week, finally breaking below the 1.25 level. The 1.25 level of course is an area that a lot of people will be paying close attention to, as now that we are below it, there’s a chance that this market will run to the downside. That being said, I think short-term rallies are probably selling opportunities, but I would also point out that the British pound has outperformed many of its peers against the US dollar, so I think the downside is going to be a little less drastic here than it is in other major currency pairs denominated in USD.

USD/JPY

The US dollar has won a bit against the Japanese yen during the previous week, but quite frankly this is a situation where traders are still ready to step in and pick up any offered “value” in the greenback that they get a chance to. The ¥155 level underneath continues to be a major support level, while the ¥158 level above ends up being a massive barrier. If we can break above the ¥158 level, then the US dollar is likely to spike and go looking to the recent swing high near the ¥161.50 level.

Top Forex Brokers

NASDAQ 100

The NASDAQ 100 has been a bit noisy, but really at this point in time it looks like a market that continues to be more or less a “buy on the dips” scenario. The 21,000 level is an area that a lot of people are paying attention to as potential support, but if we were to break down below the lows of the week, this would be an area that could trigger a bit more selling. At that point, I would anticipate that the NASDAQ 100 will go looking to the 20,000 level for a significant amount of support based on the large, round, psychologically significant figure, and of course the fact that it has been important previously. All things being equal though, I expect this market to be more back and forth during most of the week, as we have the Non-Farm Payroll numbers coming out on Friday. Either way, I’m bullish longer term.

Gold

Gold markets have gone back and forth during the trading week, which makes sense considering that we are just simply killing time in trying to sort out where we are going next longer term. I think we are entering a rather large consolidation area, as we had originally shot straight up in the air, and therefore I think you’ve got a situation where we have to work off some of the froth. I am very neutral on the gold market right now, but I recognize that any pullback will probably look at the $2500 level as “value.”

DAX

The German DAX was rather quiet during the trading week, which is not a huge surprise considering that Germany has been on and off as far as working. This was the same as the previous week, but I do find it interesting that the €19,750 level has offered a significant floor in the market over the last 3 weeks. If we can break higher, clearing the €20,000 level, I don’t see any reason why the DAX will go looking toward the highs at the €20,500 level.

Ready to trade our weekly Forex forecast? We’ve made a list of some of the best regulated forex brokers to to choose from.