Potential Signal

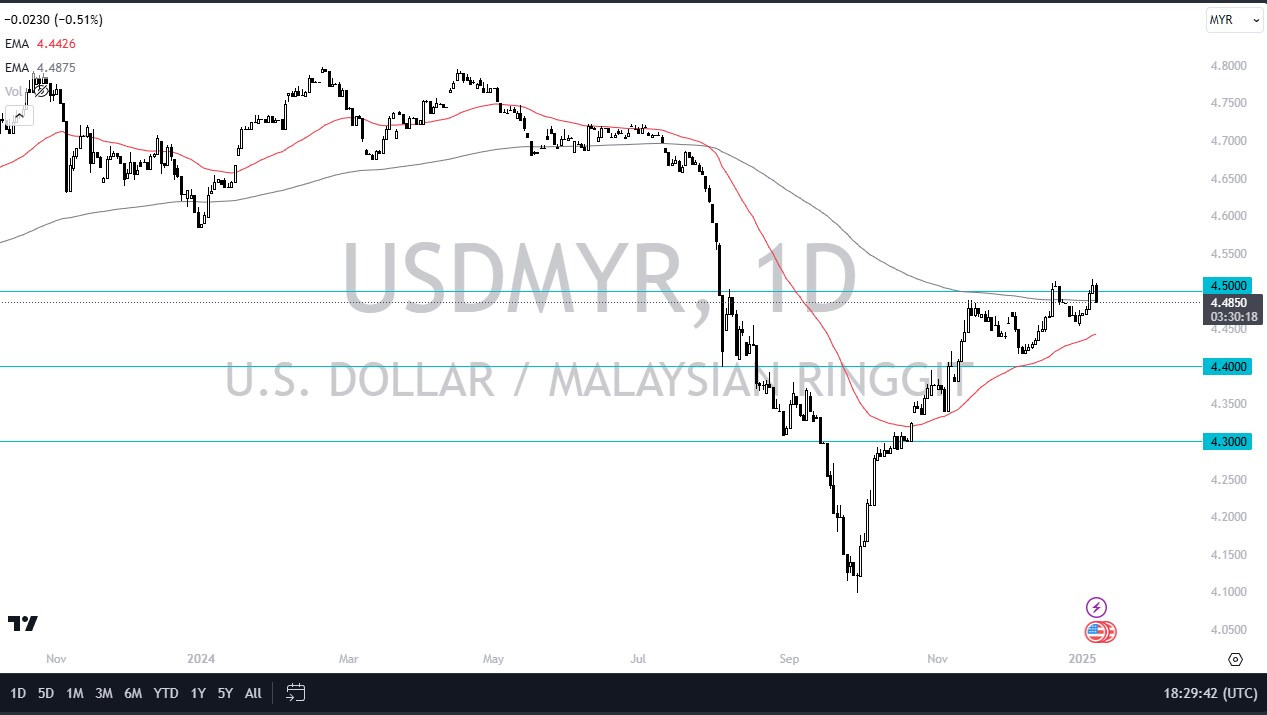

- I believe that a move above the 4.52 MYR level is a buying signal that I will be taking.

- I would have a stop loss at the 4.45 level and be aiming for 4.70 above.

During the trading session on Tuesday, we broke down pretty significantly in the USD/MYR pair, which is a bit of an outlier when it comes to the Forex world at the moment, as the US dollar has been extraordinarily strong. However, this sets up an interesting trading opportunity if we do in fact see it kick off. I think this pair will continue to be very noisy, and therefore I think you need to be cautious with your position sizing, but I also recognize that the Malaysian economy itself is a bit stronger than many of the other Asian ones.

Top Forex Brokers

Technical Analysis and the Breakout

At this point in time, the “double top” that we formed at the 4.52 level is now my trigger to start buying US dollars against the Malaysian ringgit. If that does in fact happen, then I think we have a situation where the market could very well go to the 4.70 MYR level. A pullback from here opens up plenty of buying opportunities all the way down to the 4.44 MYR level, where the 50 Day EMA currently resides.

I do believe that this is a market that continues to be very noisy but given enough time I think we’ve got a situation where buyers will come back into the situation and push the US dollar higher. After all, we have seen the US dollar demolished just about everything it has touched, and it’s probably worth noting that recently we had seen the Malaysian ringgit be one of those victims. I don’t think that changes, but I do think that it will more likely than not be a scenario where we might go sideways for little bit in order to digest a lot of the gains. Given enough time though, I think this is a scenario where traders will be more than willing to jump in and try to take advantage of “cheap US dollars” anytime they can.

Ready to trade our daily forex forecast? Here are the forex trading platforms in Malaysia to choose from.