- The US dollar has rallied a little bit during New Year's Eve as it looks like we are going to, in the year, on the right foot.

- All things being equal, it's worth noting that the US dollar will continue to be stronger than most other currencies and most certainly Canada as it has a failing government.

- The interest rate differential alone should continue to drive the US dollar higher against most currencies.

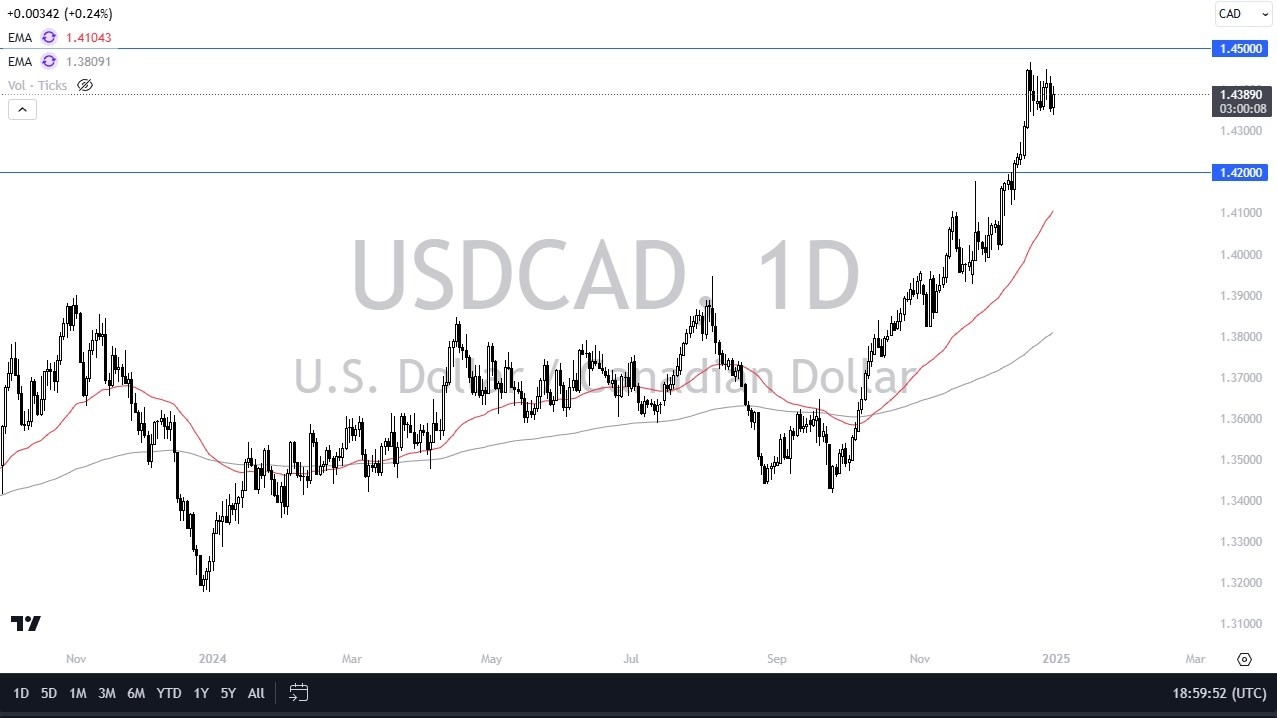

In Canada, we have a mess, so I think there's a really good shot that we continue to see this market break towards the 1.45 level. At this juncture, any short-term pullback will more likely than not end up offering buying opportunities, perhaps all the way down to the 1.42 level. The 1.42 level was an area of importance a couple of times, and now we have the 50-day EMA racing offering a little bit of support also. In this environment, I just don't have any interest in trying to get too cute here.

Top Forex Brokers

I think you've got a situation where every time we dip, it is going to end up being a bit of a buying opportunity. If we can break above that 1.45 level, then we go looking to the 1.4750 level. Keep in mind that non-farm payroll numbers in America don't come out until January 10.

In the Short Term

So, the next couple of days could be more or less a lot of sideways trading as most traders probably aren't putting money to work until Monday, the 6th at the earliest expect a few more quiet sessions, but the reasons the US dollar has been rallying have not changed. We have interest rates in America, flexing and muscles again. I just don't see that changing anytime soon, as the market continues to see a lot of questions about momentum, and the recent ceiling that we have seen form.

Ready to trade our Forex USD/CAD analysis and predictions? Here are the best Canadian online brokers to start trading with.