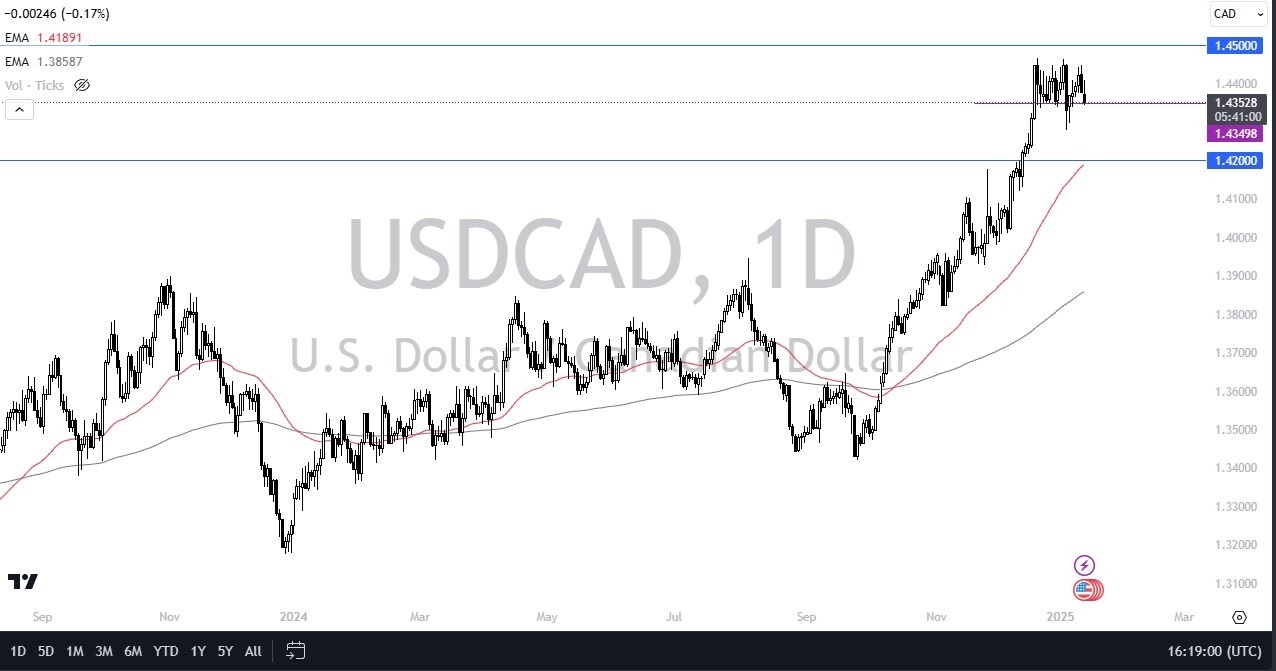

The US dollar initially rallied again against the Canadian dollar during the trading session on Tuesday, but it looks like we are testing the bottom of the small support level that we had been dancing around. Ultimately, I think we are still in the midst of consolidation, but there are a couple of things to look at here and try to determine whether or not the greenback continues its dominance. To begin with, we are most certainly still very much in an uptrend. So, I wouldn't get aggressively negative on the dollar anytime soon, especially against the Canadian dollar. Remember, the Canadian Parliament is essentially paused at the minute. And it is just a bad situation in Canada, as the US is about to have a transition in power to a president that has a lot of issues with Canadians and is willing to throw tariffs on the table.

Tensions Along the Border. Chaos in Parliament. Enter Donal Trump.

As the Canadians shoot themselves in the foot time and time again through their political process, it'll be interesting to see how this plays out. That being said, the 1.45 level above is a very difficult barrier to overcome. So, it's going to take quite a bit of effort. If we were to break down from here, then we could see this market go looking to the 1.43 level, followed by the 1.42 level, which was previously massive resistance and now features the 50 day EMA. So, it does make a certain amount of sense that we would see support there as well. On a breakdown from here, I think the 1.42 level is about where we end up. CPI numbers come out on Wednesday. That will have a major influence on the US dollar. and unless they are horrifically under what we are expecting, I anticipate that we continue to find buyers on dips in the US dollar against Canadian dollar pair.