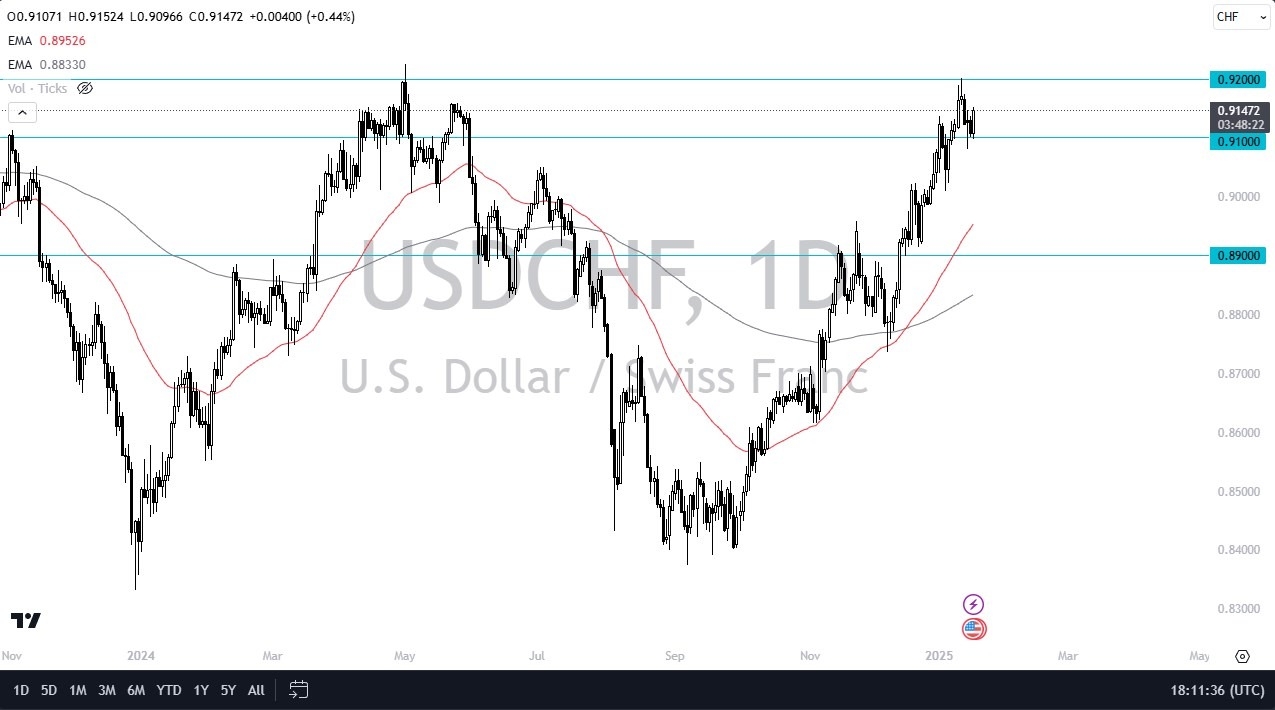

- The US dollar initially did dip a little bit against the Swiss franc, but the 0.91 level has offered enough support to turn things around. Ultimately, at this point in time, I think we have a situation where the market is going to try to reach the 0.92 level, an area that has had significant resistance.

- And when you look at the longer term charts, the 0.92 level is an area that you most certainly need to pay close attention to because once you break above there significantly, there's a big air bubble all the way to parity. That means an 800-pip move, and I am definitely watching this pair because of that. In fact, I believe that if the US dollar strength continues, this might be one of the more surprising pairs that forex traders deal with this year.

Support Below

On the other hand, if we were to break down below the 0.91 level, then it opens up and moves down to the 0.90 level, which the 50-day EMA currently is racing toward. All things being equal, I would expect a certain amount of choppy and noisy behavior, but I still favor the US dollar, mainly due to interest rate differential and the fact that unfortunately for Switzerland, it's surrounded by European Union countries.

In other words, it is a situation where their fate isn't necessarily in their own hands. And this was expressed by the Swiss National Bank cutting 50 basis points in a bit of a panic move at the last interest rate decision. So, with that being said, obviously, the Swiss see something they don't like, and therefore this all lines up. Now, that doesn't mean that it's going to be something that happens easily, nor does it mean it's something that's going to happen soon. But I do like the idea of buying this pair on a breakout or perhaps a potential pullback.Top Forex Brokers

Ready to trade our daily forex forecast? Here are the best online trading platforms in Switzerland to choose from