- During my daily analysis of major currency markets, the USD/JPY pair is one that captures my attention, because we are close to the precipice of breaking out.

- If we can break above a major resistance barrier just above, the market goes much higher.

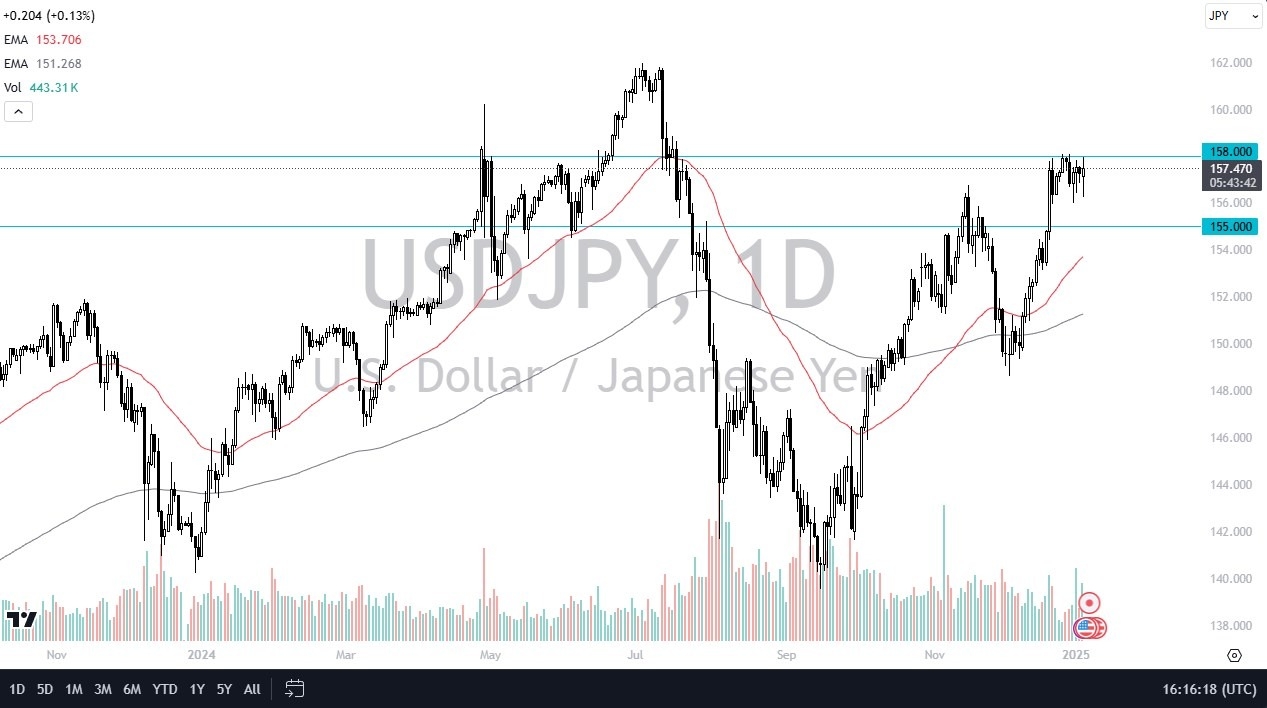

- If we can break above the ¥158 level, then it would be a major breach of resistance, and it is worth noting that we have tried to do that a few times over the last week or so. However, we just now have a significant amount of liquidity back in the market, so it’ll be interesting to see how this plays out.

Furthermore, you also have to keep in mind that the Nonfarm Payroll announcement comes out on Friday, and that has a major influence on where the US dollar is going overall, and that will most certainly be a major influence on what happens here. Furthermore, you also have to pay close attention to the interest rates markets, which of course have pulled back a little bit against the US on Monday, but overall, it is still an interest rate differential wide enough to drive a truck through when you are comparing the United States and Japan.

Top Forex Brokers

Technical Analysis

The US dollar is still very strong against the Japanese yen, as the market is threatening the ¥158 level. The ¥158 level has been important multiple times, and it is perhaps worth noting that the market is perhaps forming some type of bullish flag. If we can break above the ¥158 level, it’s very possible that we may see a ¥400 move to the upside, reaching toward the ¥162 level, which is essentially where we peaked previously.

On the downside, I see the ¥155 level offering significant support, especially with the 50 Day EMA reaching toward that as well. That’s an area that is not only a large, round, psychologically significant figure, but it is also an area where we’ve seen a lot of noise in the past. I am bullish of this market, but I have to keep this possibility in the back of my head.

Want to trade our USD/JPY forex analysis and predictions? Here's a list of forex brokers in Japan to check out.