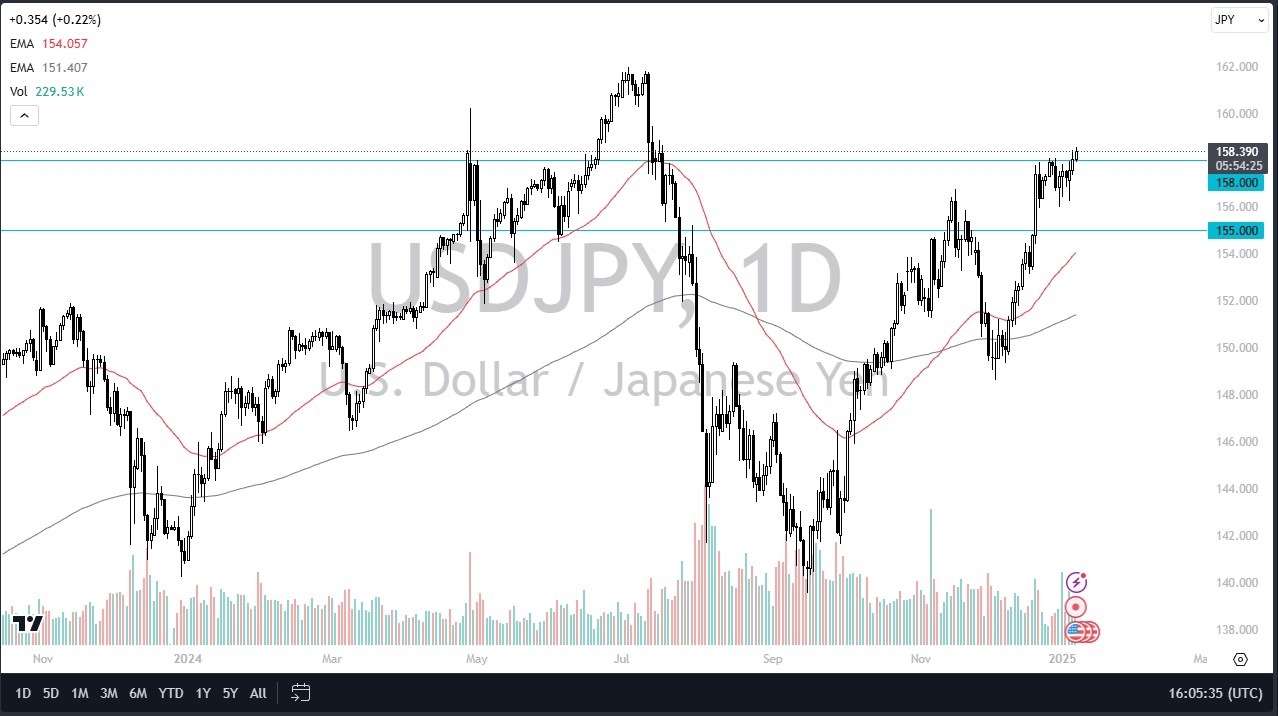

- The US dollar has rallied again during the trading session on Wednesday, as the Japanese yen has finally given away to the ¥158 level and the pressures being brought upon it.

- Because of this, the market is likely to continue to see a lot of upward momentum, but you should also keep in mind that Friday is a Non-Farm Payroll announcement, which obviously has a major influence on the bond market’s reaction to this.

Top Forex Brokers

After all, the interest rates in America are one of the biggest things pushing this market, as we have seen a massive amount of money flying into the US dollar as rates in America continue to climb quite drastically. With this, it’s worth noting that the market participants continue to look to America as one of the only places to put money to work, as the US dollar seems like an unstoppable force. Furthermore, it’s probably worth noting that we are in a major uptrend anyway.

Technical Analysis

The most obvious part of technical analysis worth paying attention to is the fact that the ¥158 level has finally been broken, which has been an area of major resistance previously. By breaking above that comment springboard’s this pair to higher levels from what I can see, but with the Non-Farm Payroll announcement coming out on Friday, it’s likely that we will continue to see a little bit of volatility. If those jobs numbers end up being higher than anticipated, we could see the US dollar really fly from here.

Even if we break down below the ¥158 level, it’s very likely that we could see the ¥157 level offer significant support. This is a market that has been very noisy as of late, but most certainly has an upward slant to it, and I think that continues to be the way you have to look at it, more of a grinding uptrend than anything else. In fact, I don’t have any interest in shorting this pair, at least not until we break down below the ¥154 level, something that isn’t going to happen anytime soon.

Want to trade our daily forex analysis and predictions? Here's a list of forex brokers in Japan to check out.