- During the trading session on Wednesday, we saw the US dollar drop fairly significantly against the Japanese yen, pressuring the pair to drop just below the ¥156 level. This was in direct reaction to the Core Consumer Price Index coming out at 0.23% month over month, under the expected 0.3% for that same period.

- That being said, it is worth noting that we have bounced a bit, and I do think that although the inflationary figures have dropped a little lower than anticipated, the reality is that we still have a long way to go before the Federal Reserve starts cutting rates. Quite frankly, this is a short-term reaction.

Technical Analysis

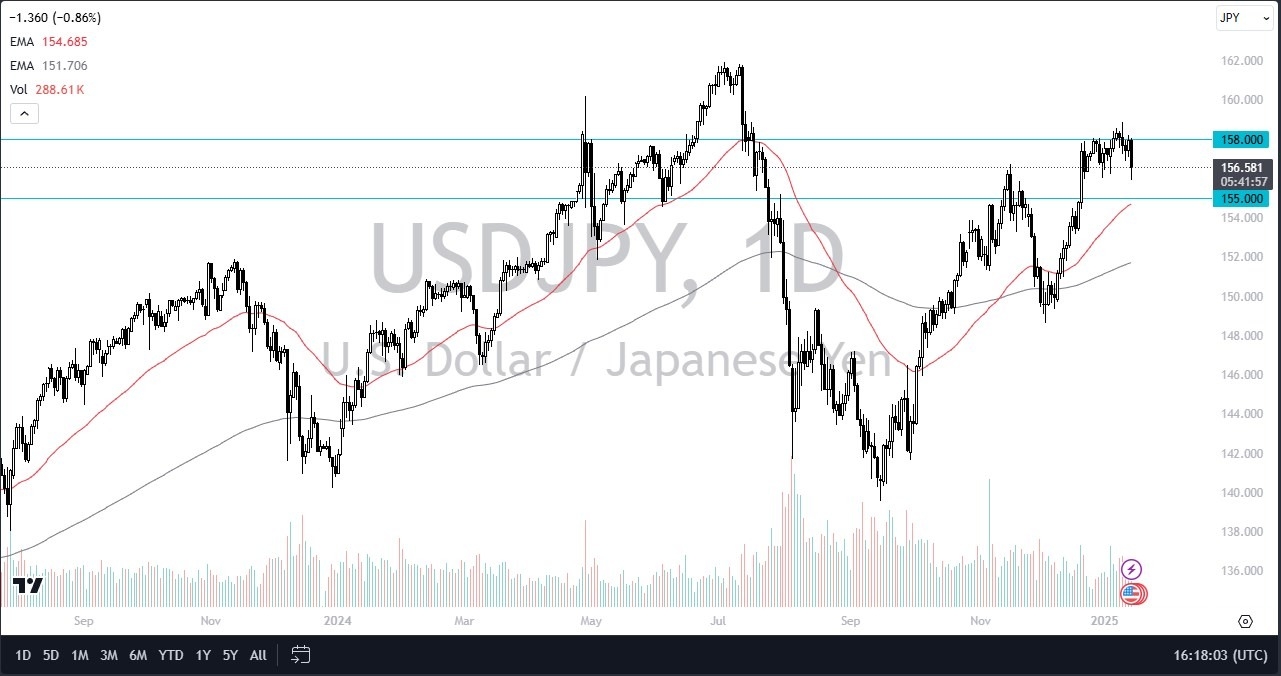

The technical analysis for this pair is still very strong, and it is probably worth noting that we have bounced enough to at least suggest that support should be held in this pair. If that’s going to be the case, then I suspect that we will find this pair reaching the ¥158 level much quicker than anticipated. With that being the case, I am still looking at this pair through the same prism that I was in the previous session, and I look at this as an opportunity to pick up “cheap US dollars”, at least until we were to break down below the ¥155 level.

It’s worth keeping in mind that the ¥155 level is also attracting the 50 Day EMA at the moment, which of course is a major technical indicator. With this, I think you have to look at the longer term trend and recognize that the markets have been bullish for some time. If we can break out above the ¥158 level, then I think it opens up the possibility of a move to the ¥160 level over the longer term. On the other hand, if we were to break down below the ¥155 level, then you might get a little bit more negative on this pair. However, you still get paid a swap at the end of every day, and that is something worth noting.

Top Forex Brokers

Want to trade our USD/JPY forex analysis and predictions? Here's a list of forex brokers in Japan to check out.