Signals for the Lira Against the US Dollar Today

Risk 0.50%.

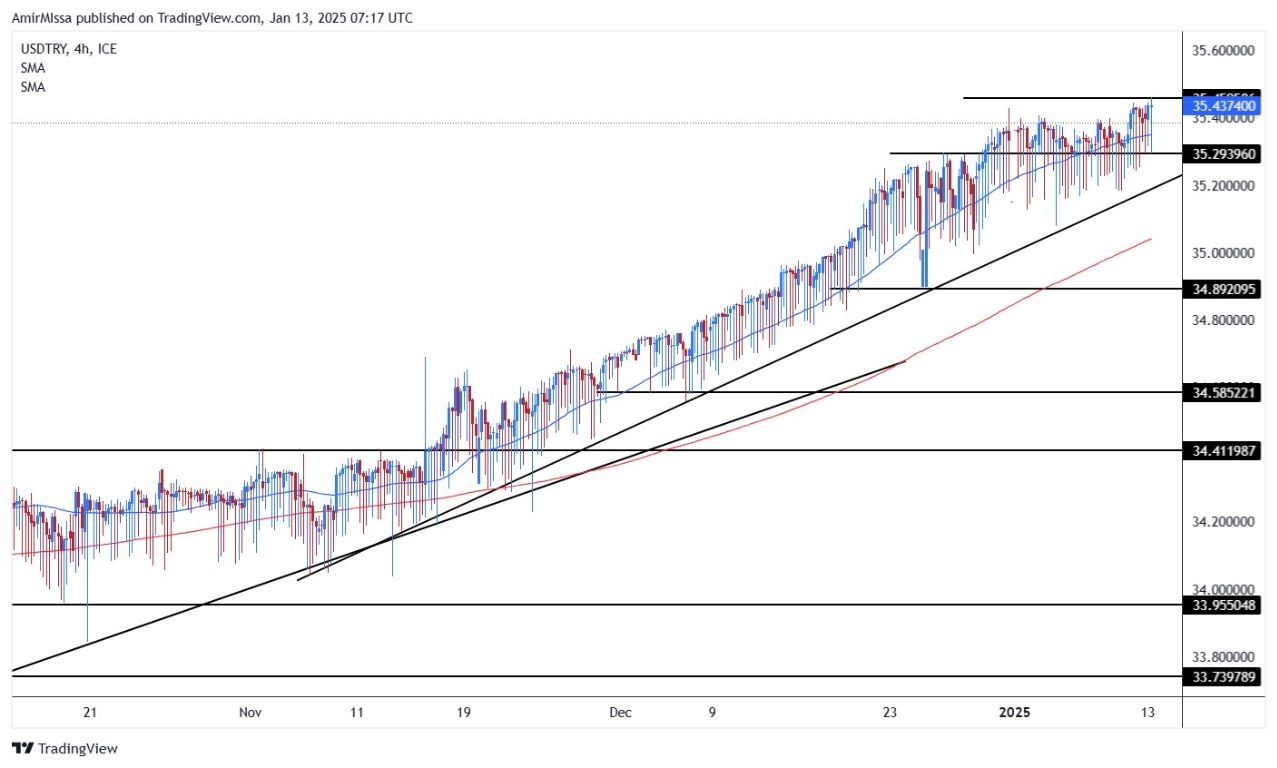

Bullish Entry Points:

- Open a buy order at 35.25.

- Set a stop-loss order below 35.05.

- Move the stop-loss to the entry point and follow the profit with a price movement of 50 pips.

- Close half the contracts at a profit of 70 pips and leave the rest until the strong resistance levels at 35.50.

Bearish Entry Points:

- Place a sell order for 35.50.

- Set a stop-loss order at or above 35.60.

- Move the stop loss to the entry point and follow the profit with a price movement of 50 pips.

- Close half the contracts at a profit of 70 pips and leave the rest until the support levels at 35.29.

Turkish lira Analysis:

The USD/TRY pair rose at the beginning of the week, surpassing the previous week's high. Meanwhile, US dollar reached a new peak at 35.4488 lira. Despite the current decline in the lira, a report published by Bloomberg revealed that Turkey is adopting a monetary strategy based on a "real appreciation" of the currency. Obviously, this is allowing the lira to weaken at a rate lower than inflation to reduce price pressures. Although the lira depreciated by 16% against the dollar in 2024, it achieved its largest gains since 2007 in terms of purchasing power, providing foreign investors with high returns on lira-denominated bonds, exceeding 50%.

The Turkish central bank affirmed that lira-denominated assets will continue to attract investors, with a focus on increasing purchasing power relative to inflation. The carry trade strategy, where investors borrow in low-interest-rate currencies and invest in Turkey, which offers higher interest rates, has been profitable, yielding over 15% in the past six months, making it a preferred option compared to other currencies.

Despite cutting interest rates in December 2024, the central bank is supporting the stability of the lira through direct support by injecting more dollars into the markets. Also, it is expected to follow a gradual reduction policy in 2025. However, the economy may face challenges such as increased demand for imported goods, which could affect the current account balance. Nevertheless, improving fundamental economic factors strengthen the outlook for lira stability.

In terms of data, Turkish retail sales data for November 2024 showed strong growth, with annual sales increasing by 16.4% compared to the same month last year, exceeding the growth rate of 15.0% in November 2023. On a monthly basis, retail sales increased by 1.9% compared to October 2024, compared to 0.2% in the same period last year.

Top Forex Brokers

TRYUSD Technical Analysis and Expectations Today:

On the technical front, the USD/TRY pair rose at the beginning of the week, breaking the top during the past week. Technically, the pair seems to be heading towards 35.50 levels as the Turkish lira price forecasts indicate that the dollar will continue to rise with the general upward trend dominating the dollar's performance against the lira. This is evident from the price moving above the upward trend line, as well as trading above the 50- and 200-day moving averages, respectively. If the pair breaks the recorded peak, it will target 35.50 and 35.75 levels, respectively.

Ready to trade our daily Forex forecast? Here’s a list of some of the top forex brokers in Turkey to check out.