Fundamental Analysis & Market Sentiment

I wrote on 5th January that the best trade opportunities for the week were likely to be:

- Short of the EUR/USD currency pair. This currency pair fell by 0.66% over the past week.

- Long of the USD/JPY currency pair. This currency pair rose by 0.24% over the past week.

The weekly profit of 0.90% equals 0.45% per asset.

Last week saw several key data releases, although the directional movement was average:

- US Average Hourly Earnings – as expected, showing a month-on-month increase of 0.3%.

- US FOMC Meeting Minutes – no real surprises, notable takeaway was warnings on inflation reaching 2% target.

- US Non-Farm Payrolls – there was a strong outperformance, with almost twice as many new jobs created than was expected.

- US JOLTS Job Openings – notably stronger than expected, mirroring the item above.

- US ISM Services PMI – a little better than expected.

- German Preliminary CPI (inflation) – slightly higher than expected.

- Australian CPI (inflation) – slightly higher than expected.

- Swiss CPI (inflation) – as expected.

- US Unemployment Claims – slightly lower than expected.

- US Unemployment Rate – an unexpected fall to 4.1%.

- Canadian Unemployment Rate – unexpectedly fell to 6.7% from 6.8%, when it was expected to rise to 6.9%.

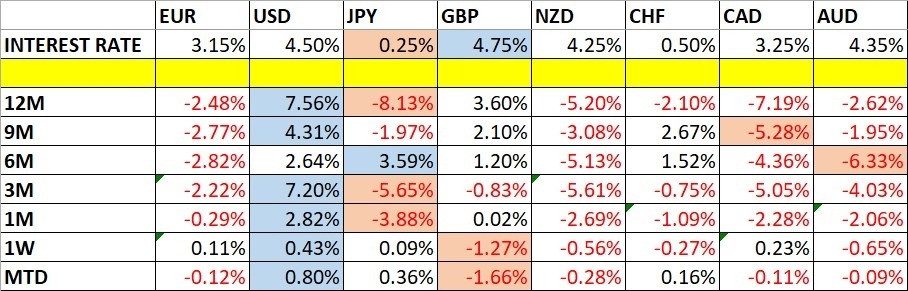

Last week saw continued risk-off sentiment, with particular fears of President-Elect Trump's recent tariff threats and of slowing growth data in many G20 nations. This was accompanied by an ongoing bullish focus on the US Dollar, with US treasury yields rising and the anticipated tariffs boosting the greenback and hitting other currencies, notably commodity currencies.

The British Pound and the Australian and New Zealand Dollars are notably weak in the Forex market, while the US Dollar and the Japanese Yen are strong.

The high-impact data last week showed that the US economy is still hot, which in turn boosts expectations of a slower pace of US interest rate cuts, and keeps the US Dollar advancing to new 2-year high prices.

Another standout issue last week was growing alarm at the state of the UK’s finances, with the new British government rapidly losing credibility in the market, which is sinking the British Pound. The British government is trying to weather the storm by stating its fiscal rules are “non-negotiable”.

The Week Ahead: 13th - 17th January

The coming week has an even more vital schedule of releases, so we are very likely to see increased market activity and volatility in the Forex market.

The coming week’s important data points are:

- US CPI (inflation)

- US PPI

- US Retail Sales

- UK CPI (inflation)

- UK GDP

- US Unemployment Claims

- UK Retail Sales

- Australian Unemployment Rate

Monday is a public holiday in Japan.

Monthly Forecast January 2025

For January, I forecasted that the USD/JPY currency pair would rise in value and that the EUR/USD currency pair would fall in value. The performance so far of this forecast is:

Weekly Forecast 12th January 2025

Last week, I made no weekly forecast as there were no unusually strong price movements in currency crosses, which is the basis of my trading strategy.

The US Dollar was the strongest major currency last week, while the British Pound was the weakest. Volatility was slightly lower last week, with 26% of the most important Forex currency pairs and crosses changing in value by more than 1%. It is likely to remain at a similar level over the coming week.

You can trade these forecasts in a real or demo Forex brokerage account.

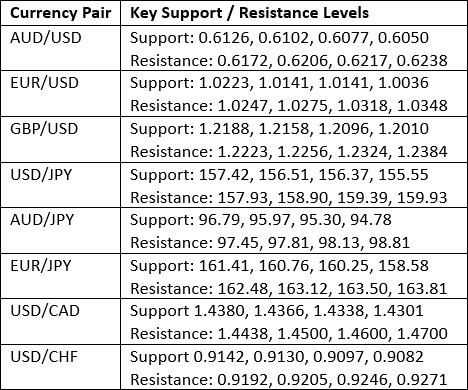

Key Support/Resistance Levels for Popular Pairs

Technical Analysis

US Dollar Index

Last week, the US Dollar Index again printed a bullish candlestick that continued the long-term bullish trend, again bullishly breaking out to make its highest close in more than 2 years. The price is above its price from three and six months ago, suggesting a healthy long-term bullish trend in the greenback that should be exploitable. The weekly candlestick has little upper wick and closed above the previous week’s high. These are bullish signs.

I have plenty of fundamental reasons to be bullish on the US Dollar after seeing the US unemployment rate unexpectedly fall to 4.1% after higher-than-expected non-farm payrolls data last week. We also seeing US 10-Year Treasury Yields rising to levels not seen in several months, currently above 4.75%, which is helping boost the greenback.

The Dollar is likely to rise over the coming week. The price has room to rise to at least the next resistance level at 110.00.

GBP/USD

The GBP/USD currency pair is in a valid long-term bearish trend. It fell strongly last week, with the weekly candlestick shown in the price chart below closing very near its low with little lower wick, suggesting bearish momentum. The price reached a 1-year low on unusually high volatility, which is another sign of momentum in this currency pair.

This pair was the biggest mover last week and is in focus because both currencies are newsworthy.

The US Dollar is advancing to new 2-year highs in a strong bullish trend, boosted by incoming President Trump’s policies and their likely momentary consequences of higher for longer interest rates. Rising US yields, especially 10-year yields, are pushing the greenback higher.

On the other hand, the British Pound has suddenly become very weak as the new British government becomes unpopular very quickly, with its fiscal projections and monetary policies beginning to be called into serious question by the capital markets. Bets against the British Pound using options have reached historically high levels.

I see this currency pair as an obvious sell.

Top Forex Brokers

EUR/USD

The EUR/USD currency pair is in a valid long-term bearish trend. After a period of consolidation within this trend, the price has begun to move lower with stronger bearish momentum. The price reached a new 2-year low last week but was ultimately held by the support level at $1.0223.

This currency pair often has very reliable trends, so I am interested in being short, especially as the price is now trading in “blue sky”.

The Euro is not especially weak, with the bearish momentum being driven mostly by a strong US Dollar which is advancing almost everywhere.

I see this currency pair as a sell, in fact, it is probably the most reliable trade right now in the entire Forex market, with the possible exception of the GBP/USD currency pair, which is probably dragging the price here lower.

USD/JPY

The USD/JPY currency pair was not impressive last week, as it was notable that the Japanese Yen was not willing to fall significantly against the very strong USD. This led to this currency pair being one of the few ones where the US Dollar made only a very small gain, ending the week quite a way off its highest daily close at ¥155.34.

I think this pair’s failure to seriously rise shows that the days of a weak Japanese Yen might really be coming to an end, even though this pair is technically in a long-term bullish trend. However, the weekly candlestick was not far from being a doji, showing indecision in the price action.

Another factor lowering my confidence in the bullish trend is that the Bank of Japan will eventually start implementing a more hawkish monetary policy. When that finally really starts to happen with the Bank of Japan's next rate hike, the price will be very likely to start moving down, so the trend is vulnerable to policy.

The Yen is also benefitting from the flow out of stock markets looking for a safe haven.

Technically, a daily close above ¥155.34 could be a good long trade entry signal, but I doubt it.

AUD/USD

Last week, the AUD/USD currency pair printed a very strongly bearish and large outside candlestick, closing right on its low, which was a new 4-year low. A look at the weekly chart below shows that the bearish momentum has been strong here since October, and the trend here has been stronger and clearer than any other trend in the Forex market, except maybe the one in the USD/CAD currency pair. It is difficult to image being more technically bearish. The linear regression analysis applied within the price chart below shows the strength and reliability of the trend over the past few months.

The story is really about US economic success and a more hawkish Fed boosting the greenback, while Australia is dealing with a weakening economy which will make more rate cuts a matter of necessity, and this will probably have to go increasingly deeper. Adding to the pressure on the Aussie is the fact that stock markets and other risky assets have been selling off, and the Aussie tends to perform poorly during periods of risk-off sentiment such as we have seen in recent days. On the other hand, the Aussie has been selling off even as several stock indices made record highs over recent months, so maybe this is not such a big factor.

This currency pair does not trend very reliably, so I don’t take long-term trades in it, but it certainly looks very weak. All the commodity currencies except maybe the Canadian Dollar are looking weak right now, so it might be an idea to use the AUD and the NZD together as the short component of any Forex trades you are making this week, or at least part of the short component by creating a basket. For example, if you were short two lots EUR/USD, you might also be one lot of AUD/USD long.

Natural Gas Futures

Last week, Natural Gas futures printed a strong and quite large bullish candlestick, which closed right on its high at a new 4-year high closing price, after it made a new 4-year high price the previous week before giving up some of its earlier gains.

Natural gas has been driven higher by strong demand due to cold weather in the USA and Europe. However, there are obviously deeper factors at work which are pushing the price to new highs and triggering a real bullish breakout last week.

Taking long trades when major commodities break out to new 6-month highs has historically been a very profitable trading strategy, which is the main reason that I want to get long here when the market opens on Monday. This bullish price pattern shown in the chart below is just starting to show an expansion of volatility, and we could see a very strong rise as the price has plenty of room to advance, especially once it clears the big round number at $4.

Micro futures in natural gas are available at the CME, so this commodity can be quite affordable to trade. There are also ETFs which hold natural gas such as UNG but note that the price of UNG is looking much less bullish than natural gas futures are, so it might not be a good idea to use that right now.

Corn Futures

Last Friday, Corn futures printed a strong and large bullish candlestick, which closed at a new 6-month high closing price. However, it is notable that the price has not cleared the inflection point at 475. I think once this is cleared, the price will look much more bullish, so more cautious traders might want to wait for the price to make a bullish breakout beyond 475.

Taking long trades when major commodities break out to new 6-month highs has historically been a very profitable trading strategy, which is the main reason that I want to get long here. However, I do not have as much faith in this trade as I do in the natural gas trade I outlined above.

Unfortunately, Corn futures are quite expensive and just too large for retail traders, but there is an ETF called CORN which can be used to participate in increases in the price of corn. Here, this ETF is outperforming the relevant futures, which puts a bit of a question mark above corn.

I think it will be wise to wait for a daily close above 475 in corn futures before going long.

Bottom Line

I see the best trading opportunities this week as:

- Short of the EUR/USD currency pair.

- Long of Natural Gas futures.

- Long of Corn futures following a daily close above 475 (CORN etf can also be used).

Ready to trade our weekly Forex forecast? Check out our list of the top 10 Forex brokers in the world.